- Home

- India

- World

- Premium

- THE FEDERAL SPECIAL

- Analysis

- States

- Perspective

- Videos

- Sports

- Education

- Entertainment

- Elections

- Features

- Health

- Business

- Series

- Bishnoi's Men

- NEET TANGLE

- Economy Series

- Earth Day

- Kashmir’s Frozen Turbulence

- India@75

- The legend of Ramjanmabhoomi

- Liberalisation@30

- How to tame a dragon

- Celebrating biodiversity

- Farm Matters

- 50 days of solitude

- Bringing Migrants Home

- Budget 2020

- Jharkhand Votes

- The Federal Investigates

- The Federal Impact

- Vanishing Sand

- Gandhi @ 150

- Andhra Today

- Field report

- Operation Gulmarg

- Pandemic @1 Mn in India

- The Federal Year-End

- The Zero Year

- Science

- Brand studio

- Newsletter

- Elections 2024

- Events

- Home

- IndiaIndia

- World

- Analysis

- StatesStates

- PerspectivePerspective

- VideosVideos

- Sports

- Education

- Entertainment

- ElectionsElections

- Features

- Health

- BusinessBusiness

- Premium

- Loading...

Premium - Events

In the world of IPO, Class of 2021 breaks all records

The world at large would term 2020 the Year of the Pandemic, and 2021 the Year of the Vaccine, but Wall Street would fondly recall this year for its IPO stardust. As of early December 2021, over 950 companies listed their shares in the US to raise over $301 billion. The proceeds doubled from the $146 billion raised by 399 IPOs last year. With the global adoption of Web 3.0, the US IPO...

The world at large would term 2020 the Year of the Pandemic, and 2021 the Year of the Vaccine, but Wall Street would fondly recall this year for its IPO stardust.

The world at large would term 2020 the Year of the Pandemic, and 2021 the Year of the Vaccine, but Wall Street would fondly recall this year for its IPO stardust.

As of early December 2021, over 950 companies listed their shares in the US to raise over $301 billion. The proceeds doubled from the $146 billion raised by 399 IPOs last year. With the global adoption of Web 3.0, the US IPO frenzy surpassed the dotcom boom of 1996, when 848 companies raised $79 billion and set a benchmark for the decades to come.

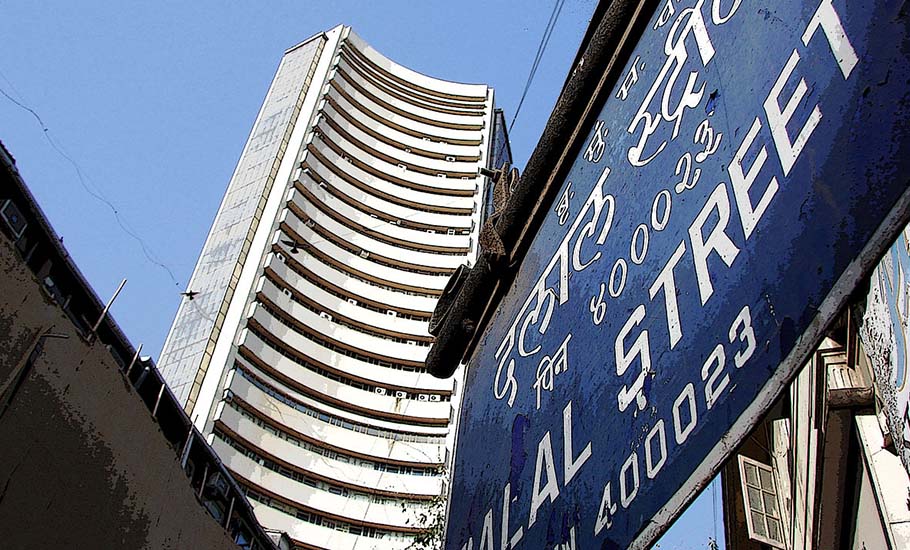

India has run on a parallel track in the IPO race. In one of its best years for IPOs, Dalal Street saw over 55 companies raise around ₹1.20 lakh-crore till date, with nearly 40 of them bringing home listing gains. This is thanks largely to an overall buoyant stock market that’s hospitable to maiden issues, as well as investors keen to want in on the IPO boom.

Also, unlike in the US, where bear rallies led to sharp declines in the prices of newly listed stocks, India’s debutantes mostly sustained their performance—41 of the stocks were trading above their offer prices, as of December first week.

Blazing new trails on Wall Street

In the first nine months of this year, 953 companies went public in the US, vis-à-vis 555 last year and 664 for all of 1996, the previous record holder, reveal data from digital financial media firm TheStreet.

While a simplistic view would brush it off as a bubble created by investor greed wanting a share of the tech boom, and Corporate America’s haste to tap into it, several factors are steadily driving the significant rise in IPO numbers.

First, a good number of the IPO candidates are tech firms that need capital to scale—be it technology, skilled manpower or marketing. Once they outgrow the various stages of institutional funding, from incubation to angel to venture capital to private equity, they turn to the market to raise capital that’s critical to their future plans.

Second, to address COVID-related stress, the US Federal Reserve introduced low interest rates and stimulus packages. Flush with funds, investors are eager to invest in the capital markets. As the stocks that are already performing well are expensive, IPOs offer a low-cost way to invest in firms that show promise. Thanks to social media and numerous tech journals, most investors are familiar with the tech start-ups that are doing well, and feel at ease investing in them when the opportunity arises.

The quick-fix SPAC space

The third and vital driver are SPACs (special purpose acquisition companies), which have grown in numbers and girth this year. These are blank-cheque firms that raise money through an IPO and then acquire a company.

The SPAC immediately gets a fully operational, revenue generating business, while the target gets access to capital markets without the bother of an IPO. In 2021, around 60% of the US IPOs were made by SPACs, reveal data. Today, SPACs are mainstream, with several big names in the game—both entrepreneurs who float them and companies that have used the route to ‘soft launch’ in the stock markets. While the US Securities and Exchange Commission (SEC) is tightening SPAC norms to deter misuse of investor funds, the entry of respected names into the field has lent it credibility.

Indian start-ups are among favourite SPAC targets. For instance, in July 2021, StoneBridge Acquisition Corp, an India-focussed SPAC sponsored by GSS Infotech CEO Bhargav Marepally and Sett & Lucas co-founder Prabhu Antony, raised $200 million through a Nasdaq IPO.

Sri Lankan-born Canadian venture capitalist Chamath Palihapitiya, whom Bloomberg labelled ‘King of SPACs’, had a big hand in popularising SPACs. Among the corporate majors he took public via blank-cheque companies are Virgin Galactic, Opendoor Technologies and Clover Health.

Among other celebrities who’ve entered the SPAC space are retired US politician Paul Ryan, basketball star Shaquille O’Neal, tennis champion Serena Williams, football player and civil rights activist Colin Kaepernick, and LinkedIn co-founder Reid Hoffman.

America’s star IPO performers

Dating app Bumble, alternative milk company Oatly, gaming platform Roblox, cryptocurrency firm Coinbase, online brokerage Robinhood, online payments company Affirm, and EV maker Rivian were some of the high-profile IPOs of 2021.

Data from PitchBook suggest that Rivian’s blockbuster IPO took the total exit value (net realizable value of an asset) for US IPOs this year beyond $1 trillion — yet another record. This is more than twice last year’s levels.

The EV newbie priced its share price at $78 apiece, taking its valuation to $77 billion. Today, its market cap stands at $101.43 billion, against GM’s $84.39 billion and Ford Motor’s $79.58 billion. Never mind that Rivian is yet to sell a car, while the Detroit giants have sold millions down the century.

A more sustained boom in India

American firms that launched IPOs this year have had their ups and downs. Just two weeks back, Rivian, Affirm and Roblox plummeted as the Nasdaq sank. However, back home, the IPO euphoria had a longer run, with many of the scrips continuing to do well. As of the first week of December, around 41 of the 55 that had gone public were trading above their offer prices.

According to EY data, India’s tech sector continued to grab a big share of the IPO pie, followed by healthcare, industrials and consumer products. The Covid crisis gave a strong impetus to the healthcare sector, reflecting in a high number of IPOs from that segment.

In India, too, the IPO boom was largely fuelled by the need for companies to tap the market for funds to push growth despite the Covid challenges, and the investor appetite for new equity investment options. There were other factors also at play—green-shoots in the economy after the pandemic crisis, buoyant secondary markets, low interest rates leading to ample liquidity, and strong corporate earnings quarter after quarter that boosted investor sentiment. There was also the dearth of other asset classes—the bank FD rates were unattractive, and real estate was dull.

The investor enthusiasm for IPOs often spilled over into listing day. Data suggest that five companies saw over 100 per cent listing gains. In November, the Sigachi Industries scrip rose 270 per cent on its listing day, as against its IPO price. As of mid-December, over 15 of the newly listed firms — such as Stove Kraft, EasyTrip, Nazara Technologies, Barbeque Nation and Latent View Analytics — were trading at 100 per cent gains from their issue price, thereby doubling their investors’ wealth.

Toppers and also-rans

The ‘tech-superstar’ IPOs—the ones running popular consumer apps—were the attention grabbers in the IPO sphere. But companies from traditional sectors such as manufacturing and engineering proved equally strong.

As of December 17, the top five companies by gains till date (the gain or loss a stock has made from its listing till the last trading day) are Paras Defence and Space Technologies (defence products), MTAR Technologies (precision engineering), Nureca (medical devices), Laxmi Organic Industries (specialty chemicals) and Easy Trip Planners (online travel aggregator). Of these, only Easy Trip is a tech firm; the rest belong to traditional industries.

On the other hand, the bottom five are Suryoday Small Finance Bank (banking), CarTrade Tech (used cars aggregator), Windlas Biotech (biotech), One97 Communication (payments platform) and Fino Payments Bank (banking). Two of these are tech firms, and Paytm’s parent One97 being at the bottom would perhaps be the shocker IPO of 2021.

The company launched what was billed as India’s biggest-ever IPO, at ₹18,300 crore, with great fanfare. However, the investor enthusiasm was lacklustre. After faltering for a few days, the offer scraped through on the final day; in all, it was subscribed just 1.89 times. Stock market experts linked Paytm’s dull debut to investor scepticism over its high valuation. A Macquarie Research note said there are flaws in the ‘focus and direction’ of the fintech platform’s revenue model, and that Patym is a ‘cash guzzler’.

However, the other top tech IPOs more or less performed well. Online beauty start-up Nykaa had a blockbuster IPO, making its founder Falguni Nayar India’s richest self-made woman billionaire. Among the other star performers were food delivery firm Zomato, Indigo Paint, MTAR Technologies, insure-tech firm PolicyBazaar, footwear maker Metro Brands and women’s bottom wear brand Go Fashion.

A busy IPO calendar for 2022

For 2022, the Indian IPO pipeline looks rather strong, with the queue including payments app MobiKwik, travel portal Ixigo, cab hailing app Ola, edtech giant Byju’s, furniture etailer Pepperfry and logistics platform Delhivery. The most awaited IPO—and the most controversial—would be Life Insurance Corporation (LIC), where the government plans to dilute a 5-10 per cent stake.

Yet, in a sign that the nation’s primary market still has much scope for growth, India’s IPOs in the first eight months of 2021 accounted for just 3 per cent of the worldwide total in terms of proceeds, as per EY data. Further, in terms of number of IPOs, Indian indices ranked far below their peers in the US, China, Hong Kong and elsewhere. Market experts have observed that the Paytm debacle may make both corporates and investors a little wary.

Several domestic firms including Byju’s are said to be looking at a marketing listing through a SPAC. However, the SPAC segment in India is still at a nascent stage. The taxation is not investor-friendly, and the regulatory regime is ambiguous; these need to be fixed before Indian companies can fully tap the opportunity.