- Home

- India

- World

- Premium

- THE FEDERAL SPECIAL

- Analysis

- States

- Perspective

- Videos

- Sports

- Education

- Entertainment

- Elections

- Features

- Health

- Business

- Series

- Bishnoi's Men

- NEET TANGLE

- Economy Series

- Earth Day

- Kashmir’s Frozen Turbulence

- India@75

- The legend of Ramjanmabhoomi

- Liberalisation@30

- How to tame a dragon

- Celebrating biodiversity

- Farm Matters

- 50 days of solitude

- Bringing Migrants Home

- Budget 2020

- Jharkhand Votes

- The Federal Investigates

- The Federal Impact

- Vanishing Sand

- Gandhi @ 150

- Andhra Today

- Field report

- Operation Gulmarg

- Pandemic @1 Mn in India

- The Federal Year-End

- The Zero Year

- Science

- Brand studio

- Newsletter

- Elections 2024

- Events

- Home

- IndiaIndia

- World

- Analysis

- StatesStates

- PerspectivePerspective

- VideosVideos

- Sports

- Education

- Entertainment

- ElectionsElections

- Features

- Health

- BusinessBusiness

- Premium

- Loading...

Premium - Events

Digital currencies: Why design is all that matters

The global fintech sector is witnessing a large number of innovations and is driven by entities within and outside the conventional banking system. Wallets owned and managed by private fintech firms and cryptocurrencies are changing the way we think about and interact with money. Left to play the catchup game for a very long time, the central banks are getting ready to lead the charge through...

The global fintech sector is witnessing a large number of innovations and is driven by entities within and outside the conventional banking system. Wallets owned and managed by private fintech firms and cryptocurrencies are changing the way we think about and interact with money. Left to play the catchup game for a very long time, the central banks are getting ready to lead the charge through the introduction of central bank digital currencies (CBDCs).

What is CBDC

There is no agreement on what CBDC exactly is because the term is used to denote different concepts. According to a 2020 report by Brookings Institution, a CBDC is the legal tender issued by a central bank in a digital form.

Put simply, CBDCs are cash we hold in our wallets, except it exists in digital form. They are legal tenders issued by central banks in a digital form. For example, having 100 Indian rupees of CBDC is exactly like having a 100 INR of physical cash except that the 100 rupees of CBDC will be digitally stored. In other words, CBDCs are digital forms of the existing currency of a country and constitute m0 (total currency in circulation) of a country’s money supply. While CBDC is a new idea, central banks have been issuing digital currencies exclusively for limited users such as commercial banks. What is really novel about CBDCs is their potential to be used by retail users.

According to a late 2020 survey conducted by the Bank for International Settlement, “Central banks collectively representing a fifth of world population are likely to issue a general purpose CBDC in the next three years.”

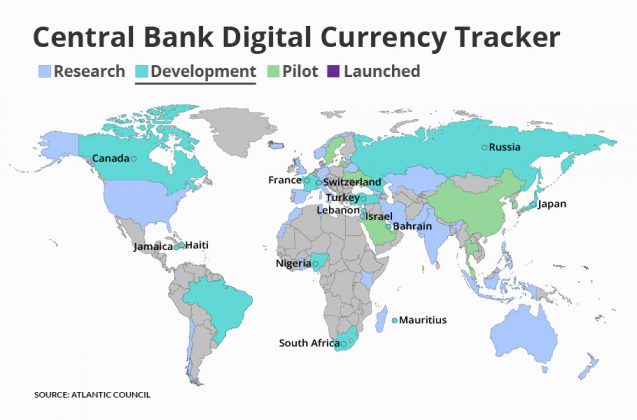

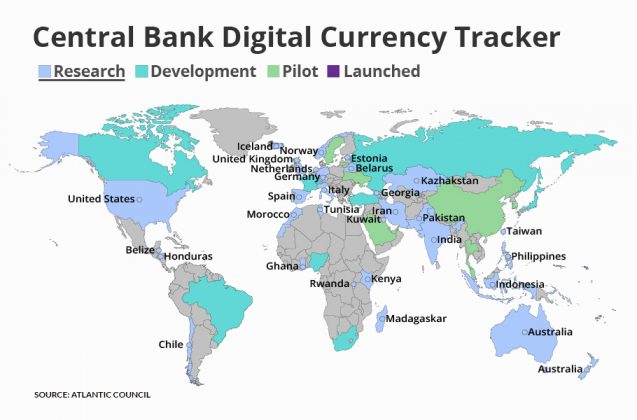

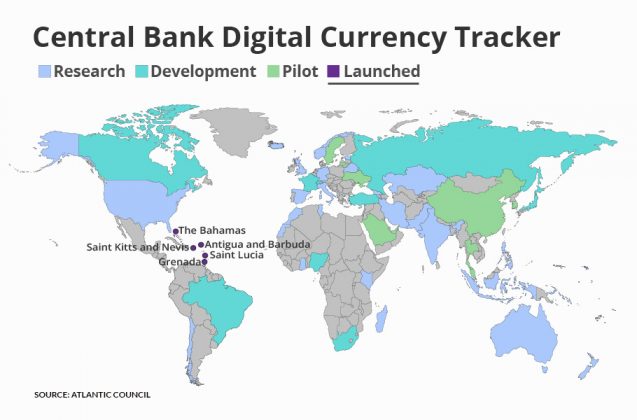

The Atlantic Council, a US-based think tank, monitors 83 countries and currency unions on the status of CBDC progress worldwide. It says 81 countries (representing over 90 per cent of global GDP) are now exploring CBDCs. Five countries – The Bahamas, Saint Kitts and Nevis, Antigua and Barbuda, Lithuania, Saint Lucia and Grenada – have already launched CBDC.

The Atlantic Council report on CBDC says China is mulling to allow foreign visitors to use digital yuan if they provide passport information to the People’s Bank of China during the upcoming Winter Olympics. While The Bahamas became the first country to launch a live CBDC, People’s Bank of China has already conducted trials for its digital currency for electronics payment (DC/EP).

Solution in search of a problem

Central banks are moving from a conceptual stage to more practical experimentation and CBDC trials. The governor of Reserve Bank of India Shaktikanta Das informed that the country could start testing a CBDC by December 2021. CBDCs are gaining wide traction from central banks and policy makers, yet there is no unanimity or clarity with regard to their use. Most use cases of CBDCs are fulfilled by the existing payment solutions. This was underlined by Federal Reserve governor Christopher J Waller when he described CBDC as “a solution in search of a problem”. For example, in India, the existing payment solutions such as UPI are well-equipped to process speedy payments using devices with limited technical capabilities.

On the other hand, central banks and supporters of CBDCs exalt multiple of its virtues including implementing monetary policy through nominal negative interest rate, creation of particular non-fungible currency, and the ability to create a panoramic view of the national economy. These possibilities have encouraged central banks to invest in CBDCs. While there is much brouhaha about CBDCs from most central banks including that of India’s, its actual use and effect will depend on the design. As we shall see, the design choice each central bank makes is not merely a technical choice but deeply political and social.

Choosing the right design

As India plans the test for CBDCs, there is a need to think critically about the design and place it in the larger social milieu.

There is no existing ready-made design configuration available to central bankers for implementing CBDCs. Two projects which have influenced the CBDC discussions are digital yuan (DC/EP) and Libra. While many of the design choices of the former are not in public domain, the latter is a stable-coin and not technically a CBDC. This means that central banks will have to structure CBDC in novel ways suiting the needs of the respective societies.

According to Richard Turrin, the author of Cashless: China’s Digital Currency Revolution, there are four fundamental design choices for a CBDC. The first choice is between a single-tier and two-tier CBDC system. In the single-tier CBDC, central bank distributes CBDC to retail customers directly. In the two-tier system, central banks rely on intermediaries that are retail banks or other financial institutions for distributing CBDC and conducting KYC. Most central banks prefer a two-tier system as they do not result in disintermediation and subsequent disruption in existing financial institutional structure.

The second choice is between an account-based CBDC and token-based CBDC system. While the end-users cannot often distinguish between a token-based and an account-based CBDC, the two technologies are vastly different. Physical cash works more or less like a digital token. We transact in physical cash after verifying its authenticity and tokens as well as cash convey ownership. The key difference between a physical token like cash and a tokenised CBDC is that in the latter, the verification takes place on a network using some digital means. While token-based technologies have gained much traction, the Bank for International Settlement in a recent paper assumes CBDCs to be account-based as accounts are linked to identity.

The third choice is about whether to use blockchain or not. This question is related to the question of how centralised or decentralised the CBDC system should be. Blockchain technology became popular due to its use in crypto currencies and many believe it to be a natural choice for CBDC. However, its high demand for computational resources coupled with the fact that it can be expensive makes it a design question for central bankers.

The last design question is with regard to the interest bearing capacity of CBDC. If CBDCs are indeed like physical cash, they should not be interest bearing. However, many central bankers see the possibility of using CBDCs as a tool for monetary policy by instituting nominal interest rate. They also see the possibility of enforcing some fee on converting other forms of money to CBDC in order to regulate the use of CBDC.

It is important to note that outlined above are only the basic design choices. One can think of different configurations and certain hybrid variations of these configurations. For example, there are many non-blockchain based distributed ledger technologies which could be used for a CBDC.

From technocratic to social conversation on design

The conversations surrounding the design choices of CBDC often ignore the political nature of the design choices and the larger social milieu undergirding these choices. Seemingly technical design choices are in reality largely determined by social and political factors. Like all other markets engineered by economists, CBDC design is both engineering and politics. All engineering choices are essentially trade-offs, creating winners and losers. In other words, all engineering involves implicit politics. The choice between a single-tier and two-tier, or between a centralised and decentralised CBDC system is inherently political as each design will create a different set of winners and losers. The same is with regard to the privilege each entity has in managing the CBDC which are determined by the rules underlying the system.

Each rule embedded in technology will serve the interest of a set of entities and adversely impact a different set of entities. If a CBDC system is to allow private payment companies to own and manage data at the cost of commercial banks, the former will find themselves playing a major role in the financial sector.

The social influence on design is an equally important consideration which needs to become a part of our conversation. While there is an objective element of risk in each CBDC design choice, risk and trust are highly dependent on societal values. Because individuals are never in a position to identify and measure risk entirely, there is always an element of social construction in perception about risk. Trust towards both governments as well as financial technologies differ from society to society.

What is the level of privacy that a CBDC system should ensure?

Should CBDC ensure both identity privacy and transaction privacy? These are questions which involve social preferences regarding privacy. As the Brookings Institution report notes, a design choice whether user data is to be entrusted with central banks, private banks or any other entity should not solely be based on technical grounds but should have sufficient legal and social grounds. In a similar vein, who has the right to manage nodes or edit the ledger in a CBDC depends on the trust that society places on each entity.

A group of central banks in a recent paper identified the future usefulness and acceptance by merchants to be key factors which will determine the adoption of CBDC. For example, in India, CBDC while having the advantage of a central bank currency, will have to compete with the traditional digital payment methods.

While traditional digital payment methods are representation of the physical money stored elsewhere, CBDCs are replacement for physical notes. This means that Reserve Bank of India can design CBDC as a low-cost efficient payment solution with better privacy and offline capabilities. However, with the level of market penetration achieved by some of the private companies offering traditional digital payment solutions, CBDC will coexist with the former.

Going ahead, the adoption of CBDCs will depend on their ability to meet unfulfilled user needs, achieve network effects (that is, CBDC being accepted by most parties in an economy) and the ability of CBDC to work on existing infrastructure. Such adoption strategies will have to become a part of CBDC design, else it runs the risk of becoming one among many payment options available for users. As we shall see, the design choice each central bank makes is not merely a technical choice but deeply political and social.

The strength of any monetary system is the trust bestowed on it by citizens. As India embarks on a CBDC trial, there is a need for wide and open conversation about the various design choices. For the reasons already noted, this conversation should begin with the understanding that seemingly technical choices are both political and social. Only such a conversation can arrive at a socially relevant and politically feasible design choice for CBDC.

(Writer is a Fulbright fellow in the Department of Economics, University of Massachusetts, Amherst and PhD candidate in the Department of Humanities and Social Sciences at the Indian Institute of Technology, Mumbai.)