Kerala Masala Bonds case: Why ED needs to do solid homework before quizzing Thomas Isaac

Before making headway into the case, ED also has to understand that KIIFB had the approval of the RBI to issue Masala Bonds.

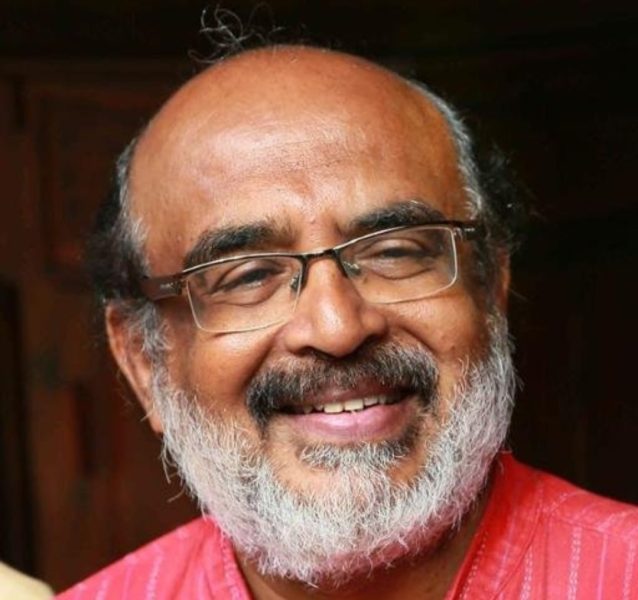

The Enforcement Directorate (ED) has quite a bit of legal research and homework to do before interrogating Kerala’s former finance minister Dr Thomas Issac, whom the agency has summoned in the Kerala Infrastructure Investment Fund Board (KIIFB) ‘Masala bond’ case.

The ED has alleged that the KIIFB has violated the provisions of Foreign Exchange Management Act (FEMA) by issuing Masala bonds (rupee-denominated bonds). Dr Issac was sent summons for questioning in the case on July 18, and has been asked to appear with ‘account books.’

“I have not understood which account books they are referring to. However I replied that I was not free on the day as I had to deliver a few lectures at EMS Academy,” Dr Issac told The Federal.

Lessons ED should learn from gold smuggling case

However, experts say, it would be good for ED officials to have a clear understanding of the KIIFB before its officials sit down with Issac. The agency’s poor research and understanding of the KIIFB reflected in its investigation into the gold smuggling case.

The ED on August 9, 2020 had interrogated chartered accountant P Venugopal, who had helped accused Swapna Suresh open and maintain a locker at the SBI City branch in Thiruvananthapuram, at its Kochi office. The National Investigation Agency had seized ₹64 lakh and 983 grams of gold from the locker. Venugopal was summoned to furnish the details of the operation of the locker and the source of money and gold deposited in it.

But as per the transcript of the interrogation produced in the PMLA court, of which The Federal has a copy, the ED had asked Venugopal questions which were not only unrelated but also ill-researched. Here’s a sample:

- ‘Do you have any high profile clients such as bureaucrats, politicians and businessmen?

- PR Chandran IPS, K M Abraham, the present chairman of KIFFB and Sivasankar IAS are some of my clients.

- Do any of your clients have investment in KIIFB?

- No

- Have you ever visited KIIFB office?

- Yes.

The excerpts of the interrogation show that the ED has to primarily learn that KIIFB is neither a ‘Swiss bank’ which helps a person hoard black money nor a private company in which one can make an investment.

What is KIIFB?

KIIFB is a statutory body established in 1999 under the Kerala Infrastructure Investment Fund Act as the principal funding arm of the state government.

By the drastic amendments introduced by the previous LDF government in 2016, KIIFB was enabled to mobilise funds for infrastructure development projects using financial instruments approved by Securities & Exchange Board of India (SEBI) and Reserve Bank of India (RBI). According to the KIIFB website, the board has so far approved funding for projects worth ₹60,102 crore, covering all vital sectors like healthcare, education, transportation, information technology, sanitation and energy among others.

Has it violated laws? Experts say no

Now the question is whether KIIFB has violated FEMA by issuing Masala bonds. The ED’s case is based on the findings of the Comptroller and Auditor General of India (CAG) which says that the KIIFB mobilised funds from the international market by issuing Masala bonds without the consent of the Centre.

The additional report published by the CAG last year (yet to be approved by the Legislative Assembly) said that external borrowing done by KIIFB was unconstitutional because Entry 37 of List 1 of the Seventh Schedule under Article 246 of the Constitution only empowers the Union government to raise foreign loans.

Experts say the CAG’s contention is a misreading of the Constitution. Article 246 refers to the subject matter of laws to be made by the Parliament as well as state government. The Seventh Schedule defines the allocation of powers between states and Centre as ‘Union List,’ ‘State List’ and ‘Concurrent List’. The power to make legislation rests only with the Union government for the areas referred to in List 1.

“Foreign loans is the 37th entry in the Union List. It means that only the Union government has the power to make laws regarding foreign borrowings and not that it only it has the absolute power to take foreign loans,” explains M Gopakumar, former secretary to Dr Thomas Issac, who has been currently working as a fellow at CSES- Centre for Socio-economic and Environmental Studies at Kochi.

FEMA is the rule made by the Parliament by invoking the power entrusted by entry 37 of List 1 under article 246. “The CAG has misinterpreted this provision to arrive at the conclusion that only the Centre is authorised to avail foreign loan and the ED is investigating a non-existing issue,” says Gopakumar.

KIIFB’s Masala bonds had RBI stamp

Before making headway into the case, ED also has to understand that KIIFB had the approval of the RBI to issue Masala Bonds. Section 6 of the FEMA empowers RBI to prohibit, restrict or regulate foreign borrowings. Under Section 6(3) (d) of FEMA, RBI is entrusted with the powers to regulate “any borrowing or lending in foreign exchange in whatever form or by whatever name called.”

By invoking these powers, the RBI issued a circular on the issuing of rupee-denominated bonds overseas (Masala bonds). According to this circular, any corporate or body corporate is eligible to issue such bonds. Section 4(2) of the Kerala Infrastructure Investment Fund Act – the statute under which KIIFB is formed – defines KIIFB as a body corporate which mobilised ₹2,150 crore by issuing Masala bonds.

Interestingly, KIIFB is not the first of its kind that issued rupee-denominated bonds to mobilise foreign fund. National Highways Authority (NHAI) of India is a similar body corporate by statute which had mobilised ₹5,000 crore by issuing Masala bonds with the approval of RBI.

“How is it possible that NHAI’s Masala bond is legal and KIIB’s is not?” asks Gopakumar.

The last thing that ED officials have to learn before interrogating Dr Issac is that, even the Parliament has cleared KIIFB’s issuance of Masala bond.

While answering a question on the legal validity of Masala bonds in the Lok Sabha on March 22, 2021, Anurag Singh Thakur, Minister of State in the Ministry of Finance said that the RBI had given ‘no objection’ from the angle of FEMA for raising rupee-denominated bonds.