Start early, stay consistent: A millennial’s guide to wealth creation

Investments can be daunting, especially to the untrained mind. Whether you’re a millennial laying out an investment plan, a Gen Z looking to dabble in the markets or a boomer taking control of finances, a few vanilla investing strategies is all you need to achieve your goals.

Investors all over the world, from superstar fund managers to you and I, have one simple goal – to earn the highest return while taking the lowest possible risk. Though we might disagree on what “risk” constitutes or what “high return” means, this basic principle stays true. This article aims to deconstruct this simple enough principal and help you make better investment decisions.

If you take away nothing else from this article, just remember to start early, stay consistent, stay invested and find the right asset allocation. Without further ado, lets dive deeper.

To truly appreciate what starting early and staying consistently invested can do for wealth creation, it is imperative that we understand the often-overlooked concept of Compounding.

If leveraged correctly, compounding allows you to earn returns not just on your initial principal but also on the returns you’ve earned on your principal, which makes wealth grow exponentially, not linearly.

Start early, stay consistent

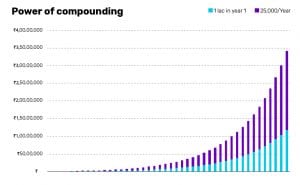

Every 20-year-old is a Crorepati. Just not when they’re 20. ₹1 lakh, and not a single penny more, invested at 10% for 50 years would grow to ₹1 crore. ₹25,000 invested every year (a little more than ₹2000 per month) at 10% would grow to a crore in 40 years (right in time to throw a lavish retirement party, eh?).

As evident from the above illustration, even a modest amount of consistent, long term investing can create a substantial corpus over time. Easier said than done.

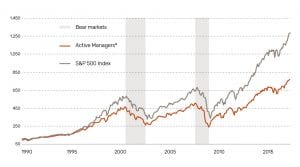

The 1 lakh or 25 thousand per year principal, the discipline to invest consistently and the patience to stay invested are completely in your hands. But the 10% isn’t. This 10% expected return is the holy grail of investments. The best minds in finance (and everyone else) are constantly trying to exploit opportunities that can earn higher, if not similar returns. Let’s be honest, few are capable of earning market-beating returns consistently over long periods of time. And those who can are professionals who do this for a living.

The best we as individual investors can do to earn sufficient returns is to find the right asset allocation, rebalance it periodically and avoid getting swayed by the market. As simple as that.

You should be focussing your energy on whatever it is that you do best: design, engineering, sports, medicine etc., and let the market work for you. Trying to pick stocks by cramming research on the weekends is surely a losing proposition for most of us, and that time is better spent elsewhere.

Focus on the Percentage, Not the Amount

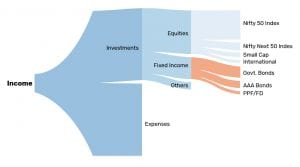

Expenses plus investment equals income. This equation looks simple enough, doesn’t it? Well, it depends on your interpretation. A vast majority of people, failing to grasp a crucial point, invest what’s left after expenses rather than spending what’s left after investing. The former prioritizes expenses whereas the latter prioritises investments. Additionally, it works best if you think of investment allocation as a percentage of your income rather than as an absolute figure. This allows your investments to grow proportional to your income.

Implementing this simple but golden strategy is easier for someone who’s just entering the work force, for the simple reason that they can calibrate the scale right at the beginning. A fresh graduate earning ₹10 lakh per annum can quite easily direct 50% of their income towards investments and adopt a lifestyle as allowed by the remaining 50%. Others need to recalibrate their scale, revaluate their expenses and accordingly modify their lifestyles.

Although aversion to change might keep some from adopting this strategy, it is in their best interest to make the switch as soon as possible.

Asset Allocation & Diversification

Choosing the right asset class is the foundation of any sound investment process. Although the spread at a buffet is the same for every diner, hardly any two of us would choose to eat the same items in the same proportion. Everyone has their own preference and constraints (health, appetite or otherwise). Similarly, the assortment of asset classes is pretty much common for every investor on the planet, but each of us have different financial goals, investment horizons and risk appetites. A fresh graduate has very different constraints than a mid-40s professional with his kid’s college education to worry about.

Ideally, you should be invested in a well-diversified basket of assets that have low correlations with each other. Such a portfolio will not only earn the average return but will also come with less than the average risk (as measured by price volatility). When one of the asset tanks, others come to the rescue.

Broadly speaking, the major asset classes are Equity, Fixed Income and Commodities. Real estate can be thought of as a combination of equity and fixed income. You own a part of or the entire property (equity) and you receive predictable rental income from it (fixed income).

Returns must always be viewed in conjunction with risk for it is possible to earn substantial returns by taking substantial risks, for example, using high leverage. All of these asset classes have different risk-return profiles. Historically, equities have delivered consistently superior risk adjusted returns compared to others mentioned above, in spite of their high volatility.

Equities have also had low correlation with fixed income and commodities. This is evident even from the current market scenario: equities have fallen considerably from last year while gold is at an all-time high. An investor with 50% in equities and 50% in gold would have performed much better than one holding only equities.

Other Factors to Consider

High inflation is the first enemy for any investor. In an environment where inflation is 10%, a portfolio earning 10% is not creating any real wealth.

Interest rates prevalent in the economy play a crucial role in determining future returns. In a low interest rate environment, money is cheap, liquidity is aplenty and asset prices are inflated thereby reducing the future expected returns. When interest rates are high, asset prices get deflated and push up future expected returns. Over extended intervals, effects of interest rates aren’t significant enough to alter our basic strategy.

For a DIY investor, passive investing (through index funds and ETFs) has proven to be much more successful than picking the right mutual funds, primarily because of low fees and the time involved in identifying the right funds. Sensible long-term passive investing, as described above, can help you avoid frictional costs like tax, management fees, transactional fees and brokerages, which silently eat into returns.

The longer you stay invested in the market, the longer compounding has to work its magic and grow your corpus. Equities tend to move up over long periods of time, and that’s a fact. The longer your investment horizon, the higher the risk you can afford to take. Hence for someone with decades of investing ahead, especially millennials and Gen Z, higher equity allocations can do wonders for the portfolio.

In summary

Do what you do best, let the market work for you. Start your investment journey early with a fixed percentage of your income, however small the amount. Based on your financial goals and risk appetite, decide on a suitable asset allocation and stick to your principals through ups and downs of the market, all while rebalancing the portfolio periodically to avoid deviation from the target allocation. Assuming the past to be representative of the future, allocate higher percentage to equities to earn the highest risk adjusted returns. In order to realize the full potential of compounding reduce the portfolio costs by avoiding expensive funds and frequent trades. The easiest path to great wealth is the simplest one: a well-diversified passive portfolio invested for long horizons. Keep it simple (and mundane), silly!