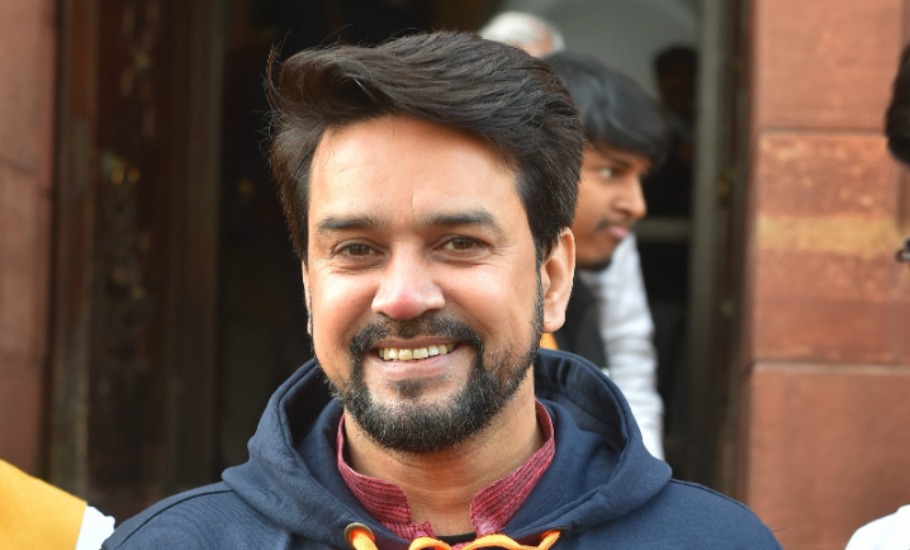

We believe in empowerment over doles: Anurag Thakur tells The Federal

The central government believes in empowering the citizens over doling out, the Union Minister of State for Finance, Anurag Thakur, says in an interview to The Federal, while justifying the move of taking the route to use monetary methods such as liquidity enhancement for interventions, instead of direct transfers to MSMEs.

The central government believes in empowering the citizens over doling out, the Union Minister of State for Finance, Anurag Thakur, says in an interview to The Federal, while justifying the move of taking the route to use monetary methods such as liquidity enhancement for interventions, instead of direct transfers to MSMEs.

“We believe in empowerment of citizens, over doling out. Our package was formulated after evaluating suggestions from various segments of society. We will continue to evaluate and do everything possible for citizens and industry,” the Union minister says in an emailed response.

Here’s the full text of the interview:

What will be the new revised Expenditure for 2020-21 post the stimulus package announcement?

The pandemic caused by COVID19 is not over, we are only in the second month of this financial year. It will be too early to arrive at any figure.

Will there be a lag in terms of the time taken to see the impact of the stimulus package on the ground? If so, what will be the time duration?

We are regularly evaluating the swift implementation of our announcements. Through the PM Garib Kalyan Yojana, we have disbursed more than ₹20,000 crores to over 20 crore women Jan Dhan account holders over two instalments. An amount of ₹18,000 crore was released as DBT cash transfers to farmers under PM-KISAN to nine crore beneficiaries. A total of around seven crore people have already taken free gas cylinders under Ujjwala scheme and a total of ₹9,000 crore has been transferred to bank accounts as DBT.

Regarding the announcements for MSMEs, the Cabinet has already approved three schemes and for the ₹3 lakh crore fund, the National Credit Guarantee Trust Company (NCGTC) has issued operating guidelines. Further, despite shortage of revenue for the Central Government, we have already transferred ₹92,077 crore to state governments under tax devolution and duties. Devolution of taxes was given fully as if Budget Estimates were valid.

A sum of ₹4,113 crore was released from Health Ministry for direct anti-covid activities, apart from ₹4,300 crore for essential items, testing lab and kits.

We are monitoring and evaluating the situation as we move ahead and will continue to support states and the people in every possible way.

How many DBT transactions have been executed by the government since the announcement of shutdown? What is the average amount transferred per transaction? What is the likely multiplier effect of these transactions?

DBTs are a transparent and swift way to reach intended beneficiaries, while developed nations struggled, India has shown the way through the use of JAM (Jan Dhan-Aadhaar-Mobile) trinity under Digital India.

The entire ‘AtmaNirbhar Bharat’ economic package is a little more than ₹20 lakh crore, coming at around 10% of India’s GDP. Over ₹20,000 crore was credited to more than 20 crore women Jan Dhan account holders over two instalments. Further, under NSAP, ₹2,807 crore has been disbursed to about 2.82 crore old-age persons, widows and physically-challenged persons in two instalments.

Related news: ₹20 lakh crore stimulus package by Centre: Here’s the break-up

Another tranche of ₹18,000 crore was front loaded towards payment of the first instalment of PM-KISAN to nine crore beneficiaries. A total of around seven crore people have already taken free gas cylinders under UJJWALA scheme and a total of ₹9,000 crore has been transferred to bank accounts as DBT. The Central government will pay EPF contribution of both the employee and employer’s 12%+12% for the next six months also extending further ₹2,500 crore benefit to people.

Over 2.20 crore Building & Construction workers received direct financial support amounting to ₹3,950.35 crore. The reduced 25% TDS and TCS rates for non-salaried sections will give an additional ₹50,000 crore liquidity. The Income-Tax Department has also issued income-tax refunds of ₹27,000 crore to 17 lakh assesses since April to make liquidity readily available.

According to the CEA, the fact that people haven’t withdrawn money during the lockdown from their PM JDY accounts shows there is no real distress as assumed to be. Does the Hon’ble Minister agree with this assessment?

With this pandemic, the scenario keeps on evolving with each passing day. The Jan Dhan Yojana beneficiaries can withdraw the money whenever they desire. The banks and ATMs remain open plus the PSBs have appointed Bank Mitras too to ensure that no citizen faces any issue.

Since there is no way of escaping from a breach in our deficit does the government (Hon’ble Minister) think this is an appropriate time to monetise our deficits? If so, what steps can be taken? Have there been discussions with the RBI on this issue during the current juncture?

We announced the entire Aatma Nirbhar Bharat package over a period of five days and the implementation of the same is being carefully monitored. We had discussed various options and strategies and decided to carry on with what we announced. We will evaluate the situation as we move ahead in the weeks to come.

Why has the route to use monetary methods such as liquidity enhancement for interventions instead of direct transfers for MSMEs been preferred? Is there any policy research to back this choice of method?

We believe in empowerment of citizens, over doling out. Our package was formulated after evaluating suggestions from various segments of society. We will continue to evaluate and do everything possible for citizens and industry.

The PM Garib Kalyan package has provided DBTs to those sections such as farmers, widows, senior citizens and divyangs through various schemes to support them during this crisis.

With regards to MSME, the sector is the backbone of the Indian economy, it provides employment to 120 million people and contributes around 45% to the overall exports from India. After due consultations in the fund of ₹3 lakh crore for MSMEs, the Central Government has provided 100% credit guarantee, collateral-free cover to banks and NBFCs.

Related news: FM announces ₹3 lakh crore automatic loan for businesses, MSMEs

Further, the suspension of Section 7, 9 and 10 of the Insolvency and Bankruptcy Code for a year will benefit the MSMEs too. In order to provide more funds at the disposal of the middle class, the rates of TDS have been reduced by 25%.

This ensures induction of ₹50,000 crore liquidity into the market and this reduction is available till March 31, 2021. This form of hand holding will help them to pay wages, purchase raw materials and get on the road to recovery.