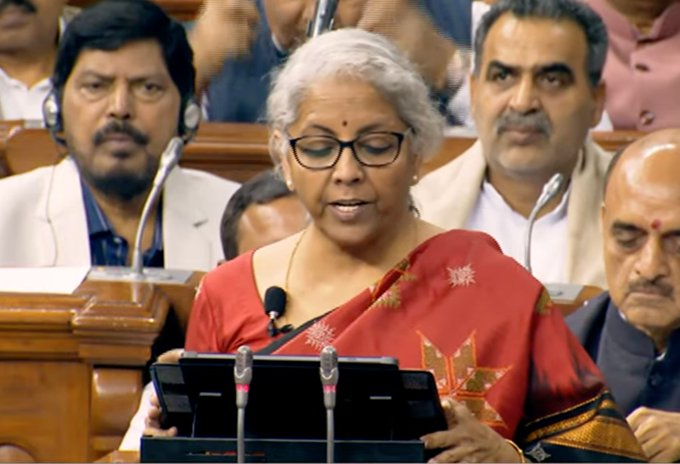

Finance Bill passed in Lok Sabha amid ruckus by Opposition over Adani issue

Lok Sabha on Friday passed The Finance Bill 2023 with 64 official amendments, including the one that seeks withdrawal of long-term tax benefits on certain categories of debt mutual funds and another for setting up the GST Appelate Tribunal.

The Finance Bill that gives effect to tax proposals for fiscal year starting April 1 was passed without a discussion amid ruckus by Opposition members demanding a JPC (Joint Parliamentary Committee) probe into the allegations against the Adani group of companies.

Panel to look into pension issues

While moving the Bill for passage and consideration, Union Finance Minister Nirmala Sitharaman also announced the setting up of a committee under finance secretary to look into pension issues of government employees. She also said the Reserve Bank of India will look into the payments made through credit cards for foreign tours which escape tax at source.

Also read: Worst message from parliamentary democracy is approval to Budget without discussion: Chidambaram

Sitharaman introduced 64 official amendments to the Finance Bill which was tabled in Parliament on February 1 along with the Budget proposals. The Budget was passed on Thursday. At that time too, no discussion could take place because of the protest. Following amendments, 20 new sections have been added to the Bill. The Finance Bill will now be sent to the Rajya Sabha.

“I propose to set up a committee under the finance secretary to look into the issue of pensions and evolve an approach which addresses the needs of employees while maintaining fiscal prudence to protect common citizens,” she said. “The approach will be designed for adoption by both the central government and state governments.”

The move comes in the backdrop of several non-BJP states deciding to revert to the DA-linked Old Pension Scheme (OPS) and also employee organisations in some other states raising demand for the same.

The state governments of Rajasthan, Chhattisgarh, Jharkhand, Punjab and Himachal Pradesh have informed the Centre about their decision to revert to the Old Pension Scheme and have requested a refund of corpus accumulated under the NPS.

Tax on mutual fund investments

The amendments will now go to Rajya Sabha and will become law once the President gives assent. From April 1, investments in debt mutual funds will be taxed as short-term capital gains, stripping investors of the long-term tax benefits that made such investments popular.

Also read: Govt to scrap long-term tax benefit for debt mutual funds investing less than 35% assets in equity

Currently, investors in debt funds pay income tax on capital gains according to the income tax slab for a holding period of three years. After three years these funds pay either 20 per cent with indexation benefits or 10 per cent without indexation.

After the amendment, such gains from transfer of units of specified mutual funds will be treated as short term and taxed at slab rates. This is in addition to taxation of market linked debenture proposed in the original bill.

Specified mutual funds have been defined to include funds where not more than 35 per cent of proceeds is invested in shares of domestic companies. This may include debt mutual funds and gold ETFs where investment in domestic companies is less than 35 per cent of proceeds of the fund.

The move will bring taxation of such mutual funds on par with bank deposits which are taxed at slab rates. Finance secretary T V Somanathan said the move was aimed at bringing parity with instruments which are of a similar nature.

(With Agency inputs)