A step-by-step explanation of the National Herald case

At the heart of the case is a publication, a company that controlled it, called AJL, and one that bought it later, Young Indian; between these and Rahul and Sonia Gandhi, a decades-long case involving hundreds of crores of rupees has evolved

If Netflix documented the National Herald case, it would run to 12 seasons of 20 episodes each. The action-packed series would span almost a century, beginning in the era of India’s freedom struggle and traversing through high courts and the Supreme Court, and various government offices including that of the Enforcement Directorate (ED). It would have a parallel track covering a media trial, and a social media trial, of the protagonists, the Gandhis.

On terra firma, the ED, probing allegations of money laundering against Congress leaders Sonia Gandhi and Rahul Gandhi, has completed its interrogation of the latter. Rahul faced five days of quizzing of around 11 hours each. Sonia, down with COVID earlier this month, is likely to be interrogated in mid-July.

The Congress describes the ED probe as vendetta politics. The ruling BJP believes this is a crackdown on ‘corruption’ and accuses the Gandhis of trying to pressurise the investigating agencies and prevent them from doing their job.

Watch: The Federal News Sense Episode 3 | National Herald under 30 mins

In February 2016, the Supreme Court had directed the Gandhis to face criminal proceedings in the case, but exempted them from personal appearances. The court also expunged the Delhi High Court’s remarks that prematurely pinned criminal intent on the Gandhis.

While facing the charges in the law courts, Sonia and Rahul are simultaneously trying to politically fight it out in the streets, calling for a ‘satyagraha’. The case is now a battle of wits between the Gandhis and the BJP.

National Herald Case — the background

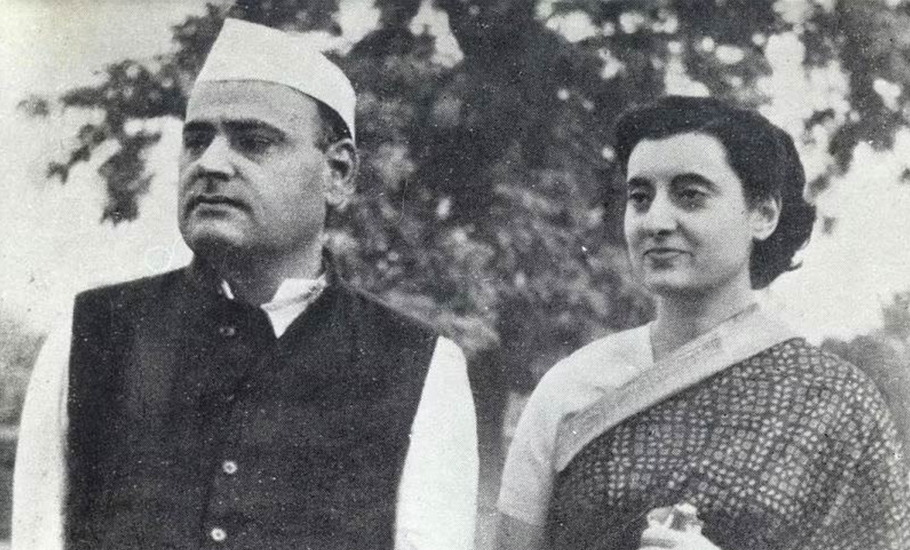

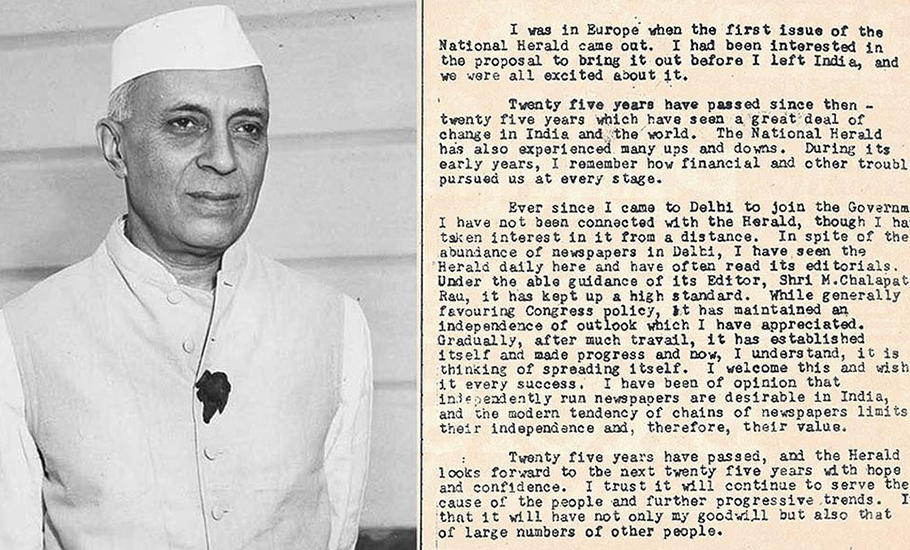

Like many controversies, the story dates back to Jawaharlal Nehru, the favourite whipping boy of the current regime. In 1937, Nehru floated a company called Associated Journals Ltd (AJL) with 5,000 freedom fighters as its donors. Therefore, there was no particular owner to that company. AJL launched three newspapers — in English, Hindi and Urdu.

Nehru was the international correspondent for National Herald, the English language newspaper that was a powerful mouthpiece of the Congress party. He continued to voice his opinions in the daily even after he became the Prime Minister. His son-in-law Feroze Gandhi was the managing director of AJL between 1946 and 1950.

Also read: National Herald case: ED postpones Sonia’s questioning for 4 weeks

Nehru would have little imagined that decades later his grandson’s wife Sonia and her children Rahul and Priyanka would find themselves embroiled in criminal investigations following a case filed by their bete noire Subramanian Swamy and two others.

The case involves three entities, all controlled by the Gandhis — the All India Congress Committee (AICC); AJL, the owner of National Herald and other publications; and Young Indian.

Swamy and two others have accused Sonia and Rahul of hatching a “criminal conspiracy to defraud the Congress party and AJL by dubiously forming the Young Indian company”. He estimated the value of AJL assets at ₹5,000 crore. The Congress pleaded that Swamy has no locus standi in the case, but that was rejected by the courts that said public money was involved.

The alleged conspiracy

AJL closed printing National Herald in 2008. It was left with no money and owed a debt of ₹90 crore to the Congress. The debt was a sum of interest- free loans extended by the Congress to AJL from time to time so that the newspaper could pay its employees and continue its operations. The allegation here was that the Gandhis had no real interest in the newspaper, and they were actually eying AJL’s real assets.

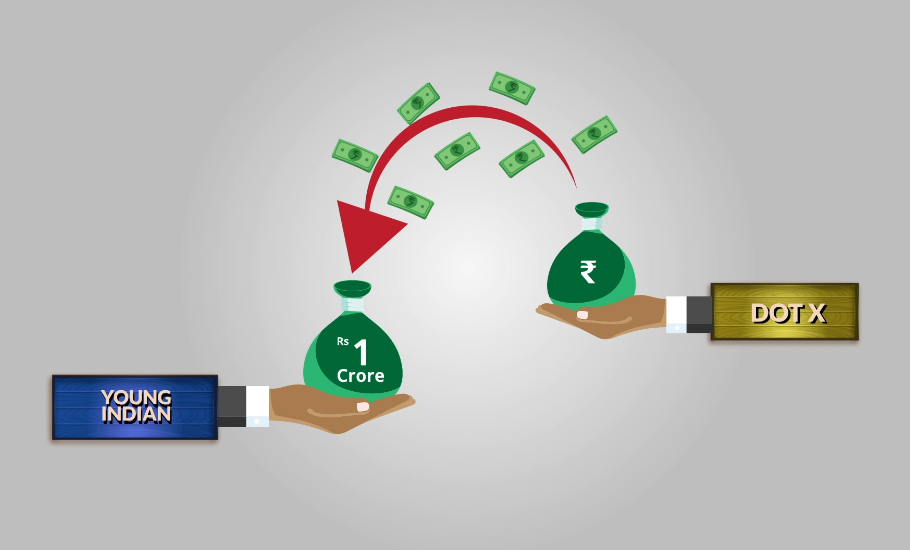

In November 2010, the family floated a company called Young Indian and bought the outstanding loan of ₹90 crore from AICC by merely paying ₹50 lakh. The debt that AJL owed to the Congress now stood transferred to Young Indian.

A month later, in December 2010, AJL expanded its equity pool and allotted a large chunk of shares to Young Indian, making it a majority shareholder. Young Indian, too, had no funds. To acquire AJL, it borrowed ₹1 crore from a Kolkata-based company called Dotex. Of this, ₹50 lakh was paid to the Congress to purchase the ₹90 crore debt.

The Income Tax Department raised a red flag over the Dotex deal. According to it, Dotex was in the business of providing “accommodation entries,” which means the company accepted cash and issued cheques of equivalent amounts. In other words, it was a hawala company.

The Gandhis deny this, saying it was an RPG Group company with which they had struck an agreement. The company, among other things, manufactures CEAT brand automobile tyres.

On deal and paper deals

Meanwhile, the enforcement agencies alleged that since 2008, AJL was not publishing any newspapers and was only collecting rent from its tenants, therefore it was a real estate company. This was denied by the Gandhis, who said the newspaper publication was only temporarily suspended and not closed. The lease agreements allow renting. They gave examples of how all other newspaper companies were involved in similar practices.

The probe agencies were unwilling to believe that the Congress actually extended money to AJL. Rather, they said, AJL’s takeover was based on fraudulent transactions; the ₹90 crore loan from AICC to AJL was “non-existent’ and just a paper entry, they claimed. The loan from Dotex too was a simple book entry, according to the agencies. The counsel for the Gandhis denied the charges and said the payments were made and received in cheques and records submitted.

In October 2017, the IT Department ordered Young Indian to pay ₹249 crore as tax for acquiring AJL assets for a transaction that it valued at ₹413 crore. The Gandhis appealed against the order saying there was no transaction, but this was dismissed on March 31, 2022 by the Income Tax Appellate Tribunal.

Meanwhile, the Land Development Office, Delhi moved to cancel the lease granted to Herald House at Bahadurshah Zafar Marg. The order was stayed by the Supreme Court.

The case has now travelled back and forth for over a decade with arguments and counter arguments flying thick and fast in local courts, high courts and the Supreme Court. The enforcement agencies such as IT Department and ED have been probing the case. The Income Tax Appellate Tribunal too has heard the case and passed its judgment.

To get a better understanding of the issue this writer has gleaned out the allegations and replies made in the courts respectively by the two sides. This article is only a glimpse of the case and not a comprehensive account of the entire proceedings. Most of the charges and responses are taken out of an IT order on Young Indian that runs into 570 pages.

The case: Owning shares, owning assets

The crux of the argument is that AJL was once a company owned by 5,000 shareholders, of which only 1,057 are around today. Following the takeover, there’s just one owner — Young Indian, 76 per cent of whose shareholding is with Sonia and Rahul.

The counsel for the family argued that AJL was a Chapter 8 company and Young Indian was a Section 25 company, which means the shareholders in no way can take out the assets of the two companies or benefit from their proceeds, issue dividends, etc.

All properties owned by AJL remain under its ownership. The company is a legal entity and shareholders of the company (read Sonia and Rahul) do not own the properties owned by the company. To put it simply — when someone buys shares in the company, the person as a shareholder cannot claim any rights over the properties owned by the company.

Besides, a Section 25 company (Young Indian in this case) cannot do anything without the permission of the Union government.

All these facts are being challenged threadbare in the courts. The investigating agencies have challenged the Section 8 and Section 25 licences, tax exemption permits, sequence followed while concluding the deal among the three entities, and so on.Some of these issues are being discussed here in the form of charges made by the investigating agencies on the one hand and the responses by the Gandhis on the other.

Charges and responses

Charge 1: The investigators say the loan of ₹90.21 crore, which AICC says it gave AJL to run the newspaper business, was non-existent, bogus and deliberately created as a step to acquire the shares of AJL by Young Indian. It was not an actual loan but a paper entry aimed at the takeover of AJL.

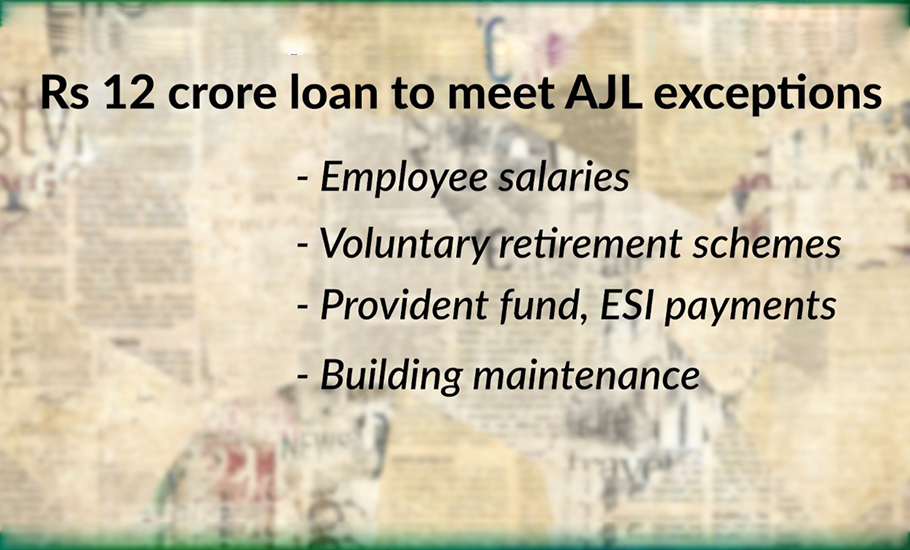

Response: The AICC responded that it started advancing loans from April 7, 2002 to AJL in fractions of ₹2 lakh, ₹3 lakh and once even ₹12 crore for meeting AJL’s expenses such as employees’ salaries, VRS, PF, ESI, other statutory taxes, besides paying buildings maintenance charges etc. These amounts disbursed through cheques between 2002 and 2011 aggregated to ₹90.21 crore.

Further, the advocates for the family pointed out that the annual report of AJL for the year ending March 31, 2010 showed total unsecured loans of ₹89.67 crore. The details of the lenders were on the ledger accounts.

Also read: What’s National Herald case that haunts the Congress

Charge 2: The investigating agencies accused Young Indian of hiding its transactions with AJL as, according to them, Young Indian’s financial statements for FY 2010-11 do not state the purchase of shares from AJL.

Response: Young Indian in its reply stated that the information was provided in the notes of accounts. All the transactions of assignment of AICC loans to Young Indian and conversion of loan into equity by AJL were disclosed in the audited financial statement of Young Indian for the year ended March 31, 2011, it said.

In the Appellate Tribunal’s view, the reply wasn’t satisfactory. The IT authorities would rather believe the Assessment Officer as the entire fact of acquisition of shares and the manner in which the whole transaction was made was not mentioned anywhere.

Charge 3: There was no loan from Dotex; it was a money laundering exercise, said the probe agencies.

Response: Dotex is an RPG company. The annual accounts of RPG Life Sciences and CEAT for FY 2010-11 show the balance sheet of Dotex as on March 31, 2011, were submitted.

Charge 4: Why would Dotex give an unsecured interest free loan of ₹1 crore? Also, there is no reasonable explanation why Dotex did not demand the loan repayment within the stipulated one-year period, the probe agencies observed.

Response: Young Indian said it had made a provision of ₹1,76,603 as interest to Dotex and deposited TDS for the year ended March 31, 2011. Besides, the loan was renewed from time totime and repaid on April 24, 2015.

Tribunal: The tribunal in its order asked the Assessing Officer to review the issue once again.

Charge 5: To take over 100 per cent shares of AJL, Sonia, Rahul and Priyanka Gandhi Vadra purchased additional shares through Rattan Deep Trust and Janhit Nidhi Trust, the agencies said.

Response: The two were public trusts and together they held a 33.16 per cent stake in AJL. Janhit acquired 28.16 per cent and Ratan 5.10 per cent in the 1950s and 1970s, respectively. Rahul became a trustee only in 2010.

Both Rahul and Priyanka resigned from these trusts in 2013. Hence, none of the Gandhi family members holds any share in AJL in their individual capacity.

Charge 6: The objective of AJL was never recasted before 2016. The allegation was that though the original objective of AJL was publishing, it began to indulge in real estate business and therefore before takeover by Young Indian, a-not-for-profit company, the objectives of the two companies should have aligned.

Response: The memorandum of agreement or MoA of AJL was amended in 2011 to include the objectives of Young Indian. Another amendment in 2016 ensured that the profits of AJL could not be distributed to the shareholder either as dividend or proceeds in the event of the winding up of the company.

Tribunal: The Tribunal in its 2011 ruling said that the amendment was of no consequence because till 2016 no such activity was carried out by Young Indian through AJL.

Charge 7: In 2012, the Election Commission received a petition seeking derecognition of AICC under the EC Symbols order, saying the loan of ₹90 crore to AJL was a violation of its guidelines.

Response: The EC dismissed the petition saying Section 29B/C of the Representation of People Act, 1951 provides for the manner in which the political parties may raise funds and there is no provision in the Act prescribing the manner in which these parties may use these funds.

Charge 8: AJL borrowed about ₹90 crore from the Congress and it had no other liability. If the assets of AJL were to be liquidated, hundreds of its shareholders would have received back sums equivalent to several thousand times the amount invested by them originally and even the Congress would have gotten back the loan with interest. But, instead of adopting such a transparent course, the Gandhis misappropriated AJL assets by gaining effective control over the company. Original shareholders of AJL as well as the supporters/donors of the Congress were thus cheated by the family, said the probe agencies.

Response: Young Indian claimed that the lease or allotment conditions of AJL properties in Mumbai, Delhi, Panchkula and Patna (with the exception of Lucknow) clearly showed that these were allotments with several restrictive covenants and therefore not freely marketable properties. Thus, the assumption of the Income Tax department that the properties could defray the loan liability is incorrect.

Further citing the deed assignment of the loan by AICC to Young Indian, the lawyers argued that AICC was satisfied with the objectives for which Young Indian was set up. To support these objectives and also keeping in mind that AJL was not in a position to repay the ₹90 crore loans, it had agreed to assign them to Young Indian for ₹50 lakh, said the defendants.

Besides, though AJL owned real estate properties, it was never the intention of the company to liquidate these assets. These were acquired only for the publication business. It had no substantial loan and the reserves of the company were negative of ₹72.5 crore and the loan from AICC helped its publication business.

Charge 9: Young Indian did not have any money to pay even the consideration amount of ₹50 lakh to the Congress.

Response: Young Indian entered into an agreement with Dotex on December 24, 2010, for a ₹1 crore loan and, on the same day, it got the money in the form of a cheque. It could not be encashed because Young Indian had not opened a bank account yet. The deed of assignment between AICC and Young Indian was entered into only on December 28, 2010. So it is incorrect that Young Indian entered into an agreement without money.

Charge 10: Young Indian has benefitted from the assets of AJL following its takeover, said the agencies. Now it owns all the properties of AJL. The facts and circumstances, when viewed in totality, go to indicate that the whole purpose of incorporation of Young Indian was to get hold of the prime properties of AJL.

Response: Young Indian has not acquired any assets of AJL. Young Indian being a Section 25 company, any alleged gain cannot be distributed as dividend. Same is the case with AJL, which is a Section 8 company. It can’t sell or dispose of its assets. With restrictions on its usage, there is no benefit, monetary or otherwise, received by Young Indian.

Tribunal: Though claims are being made about AJL being a Section 8 company, this permission was not granted by the Registrar of Companies (RoC).

Charge 11: The AJL stopped publishing newspapers in 2008 and it subsequently turned into a real estate company.

Response: AJL is not a real estate company. It continues to be in the newspaper business. It had only temporarily suspended its publications because of financial difficulties in 2008. In the past too the company had suspended and later resumed operations.

While providing details of its efforts to restart the paper, Young Indian said that in 2014 it got the name of its web portal registered. It had also sent a letter to the registrar of newspapers, sharing its intent to restart the papers. Two years later, in 2016, the website started functioning. In the same year, National Herald appointed a new editor. It also provided minutes of meetings where monthly expenditures were discussed.

The counsel for the family argued that renting a portion of built-up property is a normal practice in newspaper business. Such renting does not make it a real estate company.

Tribunal: The tribunal in its final order issued on March 31, 2022, said that Young Indian benefitted from the AJL takeover. In its words, such benefit constitutes profits and gains of the business within the meaning of Section 28(iv) of the IT Act. The benefit is in the form of fair market value of the properties of ₹413.41 crore and therefore it must pay a tax of ₹249 crore.

The tribunal’s final order rests among other things on two major arguments. One: There was no publication of the paper for five years between 2012 and 2017 and therefore exemptions and concessions claimed under IT Act cannot be granted. Two, it was a fit case where the theory of “lifting of the corporate veil” must be applied. This means the courts could disregard a corporate personality and look straight to the owner or owners for accountability — in this case the largest shareholders Sonia Gandhi and Rahul Gandhi.

The case is likely to go through its motions before reaching a logical conclusion.