The three elephants in the RBI Governor’s office

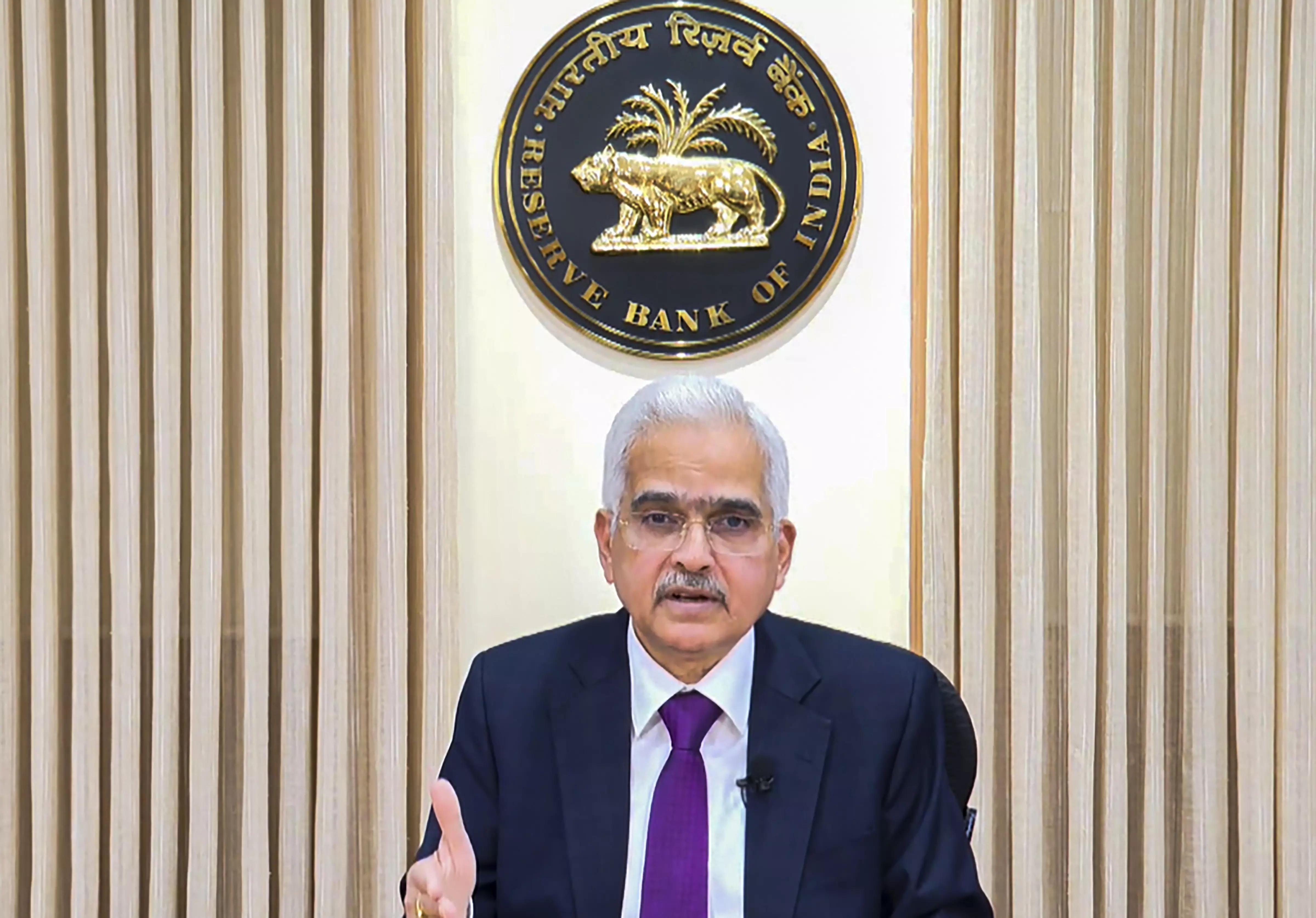

RBI Governor Shaktikanta Das, making his monetary policy statement, said inflation – the elephant in the room – is under control. Has he ignored the other elephants in his office - lagging pvt investment, structural rigidities in the economy, real growth rate?

Making his monetary policy statement on April 5, Reserve Bank of India Governor Shaktikanta Das said that just two years ago, the elephant in the room had been inflation, but the elephant has since gone for a walk. Inflation had been 7.8 per cent in April 2022, and has now been forecast to come down to 4.5 per cent in 2024-25. The governor’s vision was not perhaps very clear, probably because he was looking at the past. In any case, he ignored the herd of elephants still shuffling their feet inside his office on Mint Street.

RBI’s obsession with containing CPI

From the outside, we can spot at least three of these indoor pachyderms. One is the continued obsession of the RBI with containing the consumer price index. CPI inflation, after all, is just one - and that, too, partial - measure of inflation. The most comprehensive measure is economywide inflation, which is captured as the difference between the growth rate of GDP in current prices (the nominal rate of growth) and the rate of growth of the economy at constant prices (the real growth rate).

The Central Statistics Office had forecast the advance estimate of real growth in 2023-24 to be 7.6 per cent, when the nominal growth rate came in at 9.6 per cent, by setting economywide inflation at 2 per cent. The average consumer price inflation for the first 11 months has been at a little over 5.1 per cent, so CPI inflation for the whole year can be expected to be at least 2.5 times the rate of economy-wide price rise.

Accuracy of real growth rate

The inflation that pinches ordinary people is the rise in the price of food and fuel, a largish chunk of the basket of goods and services used to track CPI inflation. These cannot be tackled by monetary policy, except by creating extreme distress, and have to be addressed by supply-boosting measures. The measure that captures the result of excess demand, caused, for example, by a runaway fiscal deficit or frenetic investment that exhausts available domestic savings and sucks in global savings via a current account deficit, is economywide inflation. That is, by official pronouncement, down to 2 per cent.

Why does the RBI still obsess over CPI inflation, and refuse to cut rates? Could it be that the RBI has the teeniest bit of doubt about the reliability of the figure the Central Statistics Office has trotted out for economywide inflation? In which case, is the 7.6 per cent real growth rate really accurate? No wonder, this particular elephant has a puzzled expression on its face.

Lagging private investment

The second elephant that escaped Mr Das’s attention is lagging private investment. Capacity utilisation of the manufacturing sector, he noted, has been improving. But the footnote that detailed the numbers shows that capacity utilisation in the third quarter improved from 74 per cent in the previous quarter to 74.7 per cent. For this microscopic improvement to warm the cockles of his heart, this particular elephant must be unusually cold-blooded in the normal course.

When one-fourth of the available capacity has been unutilised for ages, and when interest rates are still high, and should be expected to be coming down, given official projections of economywide inflation plummeting to 2 per cent, which manufacturer is rushing to expand capacity? Low-capacity utilisation means that the private sector does not have much scope to raise its level of investment - except in the infrastructure sector.

No policy framework for PPP

But private investment in infrastructure, other than in real estate and in some favoured sectors like renewable energy, is hobbled by two factors. One is the absence of a policy framework for public-private-partnership (PPP). The present political leadership came to power by identifying the previous United Progressive Alliance government’s PPP initiatives as sites of corruption, and that propaganda is sustained by official claims that all that governments did before 2014 was to loot the people. This has tarnished PPP.

While those economists who relish dredging the data to see how PPP projects have fared have come to the conclusion that more than 60 per cent of PPP projects were successful. The Delhi and Mumbai airports are shining examples of such success. However, there were significant failures, which contributed to the twin balance-sheet problem identified by Raghuram Rajan, when he was RBI governor: companies had loans they could not service on their books and banks had loans they could not recover on theirs.

Absence of vibrant corporate debt market

This NPA problem has been sorted out, even by writing off the bad loans and recapitalising the banks out of taxpayer funds, but the wholly irrational reliance of most private players on bank finance, even for long-term projects, rather than on the corporate debt market remains. For the failure of a vibrant debt market to emerge, the RBI cannot duck responsibility.

NBFCs that lend to infrastructure – endangered species

Elephants are not an endangered species. But non-banking finance companies are, especially those that lend to infrastructure. IL&FS self-destructed by colluding in a scheme of circular lending by a bunch of banks and NBFCs, who kept lending ever larger amounts to one another to repay/service earlier loans, even as assorted individuals related to these lending institutions siphoned the loan amounts to their own private fortunes.

The financial sector regulators’ failure to spot such circular lending in time not only led to the problem growing to a scale where it led to the collapse of the likes of Yes Bank and DHFL but also to the RBI burning its regulatory fingers. A cat that falls into boiling water will be scared of cold water too, says an old Malayalam saying. The RBI has since taken a sledgehammer to NBFCs that probably called for a couple of tiny taps with a chisel.

Kolkata-based SREI, for example, could not service its loans to the banks, as its clients, to whom it had on-lent the money, had to stop work during Covid. While the government mandated refinancing of most loans during the Covid years, lenders like SREI were left out. That guaranteed that these would turn sick. Instead of giving such institutions time and funding to enable their clients to complete their projects and repay their loans, regulation let them malinger and descend into insolvency. Net result - no NBFC capable of lending to infrastructure, and missing private investment in infrastructure.

This elephant looks set to crowd Mr Das’s office for some time.

Structural rigidities in the economy

The third elephant Mr Das chose not to notice is the lack of political will to address structural rigidities in the economy. India’s farm sector continues to be a mess, with farmers addicted to crops of which India produces a surplus, like rice and wheat, or are ill-suited for the agro-climatic conditions in which they are grown, such as sugarcane. This untreated addiction burdens the exchequer with runaway subsidies, pushes up the RBI’s favourite measure of inflation, and keeps interest rates higher than they ought to be. It also pre-empts investment that could increase productivity and enhance and expand storage and agro-processing that could together remove the seasonal shortages of onions and tomatoes that afflict the economy.

Should the RBI hire an elephant whisperer at a rank senior enough to be present in the Governor’s room most of the time?