Trump hikes steel, aluminium tariffs, may make exception for Australia

Trump says tax hikes on the people and companies buying foreign-made products will ultimately strengthen domestic manufacturing

US President Donald Trump has removed the exceptions and exemptions from his 2018 tariffs on steel, so that all steel imports to the US will now be taxed at 25 per cent at least. Trump has also hiked his 2018 aluminium tariffs to 25 per cent from 10 per cent.

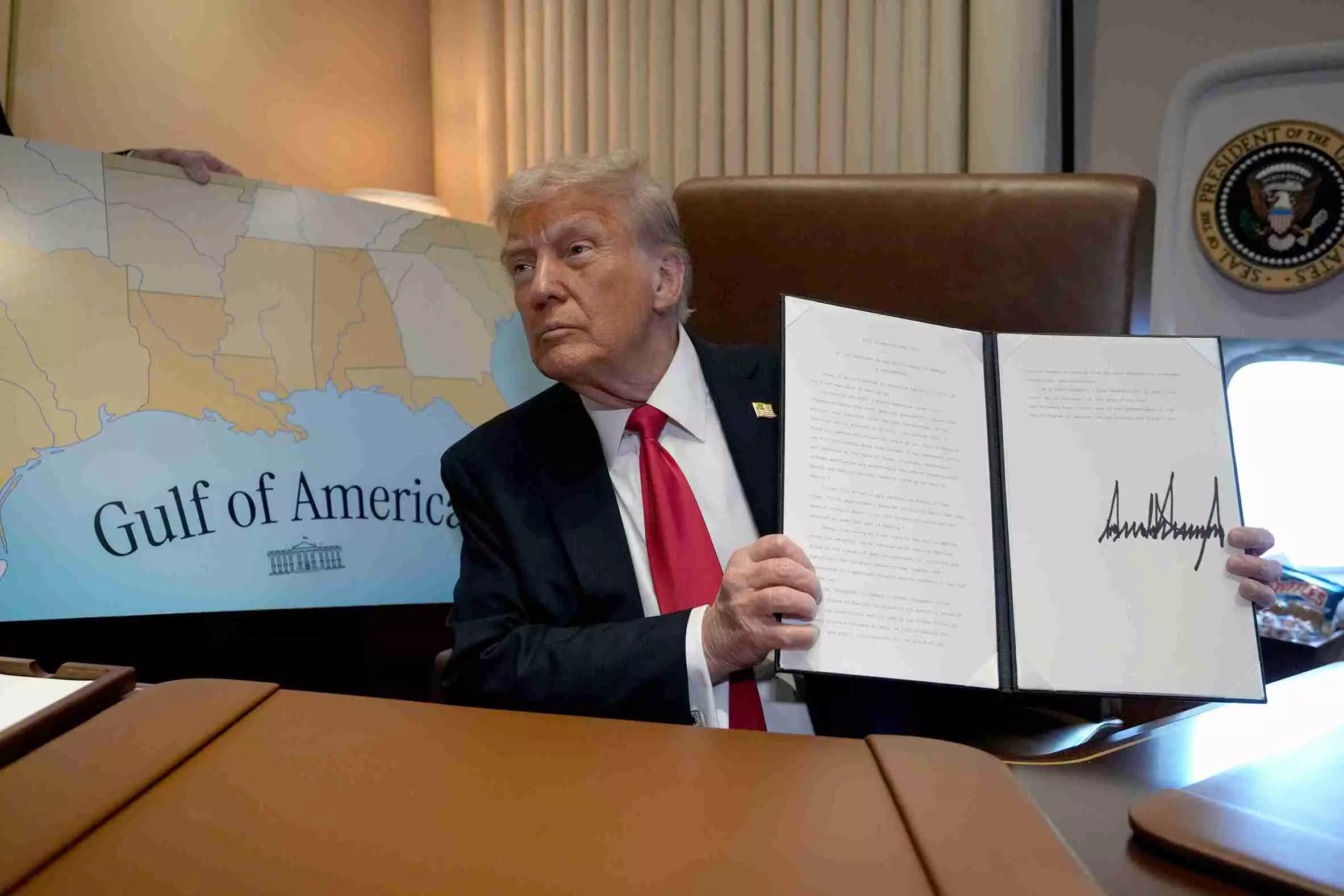

“We were being pummelled by both friend and foe alike,” Trump said as he signed two proclamations, changing his orders during his first term, that go into effect on March 4. “It’s time for our great industries to come back to America,” he said.

The moves are part of an aggressive push by the president to reset global trade, with Trump saying that tax hikes on the people and companies buying foreign-made products will ultimately strengthen domestic manufacturing.

But the tariffs would hit allies, as the four biggest sources of steel imports are Canada, Brazil, Mexico and South Korea, according to the American Iron and Steel Institute.

Also read: US tariffs on Indian steel: Limited blow, but dumping fears loom large

Exception for Australia

However, Trump has agreed to consider a tariff exemption on Australian steel and aluminium imports after a telephone call with Australia’s prime minister.

Prime Minister Anthony Albanese argued for an exemption during the call, which was scheduled before Trump announced tariffs on steel and aluminium imports on Monday.

Trump said the United States trade surplus with Australia was one of the reasons he was considering an exemption from the tariffs.

“We actually have a surplus,” Trump told reporters in the Oval Office about trade with Australia. “It’s one of the only countries which we do. And I told (Albanese) that that’s something that we’ll give great consideration to.”

Also read: Trump to announce 25% tariffs on steel and aluminium, 'reciprocal duties'

Australia had exemption during Trump 1.0 too

Albanese had told reporters earlier in Canberra that he made Australia’s case for an exemption, and that both leaders agreed on wording to say publicly, “which is that the US president agreed that an exemption was under consideration in the interests of both of our countries.”

Australia had an exemption from such tariffs during Trump’s first administration too.

Australia’s arguments include that the country has run a trade deficit with the US since the mid-20th century and Australian steelmaker BlueScope employs thousands of workers in the US. Australia has only a minor share of the US markets.

“Our steel and aluminium are both key inputs for the US-Australia defence industries in both of our countries,” Albanese said.

Taxes to be reset

Trump also intends this week to reset US taxes on all imports to match the same levels charged by other countries. All of that comes on top of the 10 per cent tariffs he already put on China, China’s retaliatory tariffs that started Monday, and the US tariffs planned for Canada and Mexico that have been suspended until March 1.

Also read: China imposes 15% tariffs on coal, LNG in response to Trump's tariffs

Monday’s tariffs almost immediately drew criticism from Canada, the largest source of steel imports. Candace Laing, president and CEO of the Canadian Chamber of Commerce, said that Trump was a destabilizing force in the global economy.

“Today’s news makes it clear that perpetual uncertainty is here to stay,” said Laing.

Inflation risks

The tariffs carry inflation risks at a moment when voters are already weary of high prices and fearful that price increases will eclipse any income gains. Trump maintains that the tariffs will level the playing field in international trade and make US factories more competitive, such that any pain felt by consumers and businesses would eventually be worthwhile.

“‘Fairness’ is in the eye of the beholder, but the more fundamental question is whether the US actually benefits from such new tariffs,” Benn Steil, director of international economics at the Council on Foreign Relations, a New York-based nonpartisan think tank, said in an email.

“The costs to the US will include higher prices to US consumers, retaliatory tariffs abroad, and the loss of US jobs and competitiveness in firms hit by higher input costs.”

Impact uncertain

Of the roughly 29 million net tons of steel imported into the United States last year, a little under 2 per cent came from China. But the White House maintains that exemptions to the tariffs provided over the previous four years by the Joe Biden administration enabled steel and aluminium from China and Russia to go through other nations to reach the US.

Also read: EU leaders scramble to avoid friction with US under Trump and avoid 'stupid tariff war'

While the tariffs could help the finances of US steel mills and aluminium smelters, they could also increase costs for the manufacturers that use the metals as raw materials to make autos, appliances and other products. The stock prices of steel companies climbed sharply on Monday as investors assumed the tariffs would increase their profits.

The US government’s inflation report scheduled to be released on Wednesday is expected by economists to show consumer prices rising at 2.8%, which would suggest that the public sees tariffs as a major risk to their financial wellbeing.

(With agency inputs)