RBI keeps repo rate unchanged at 6.5%, projects 7% growth for next fiscal

This is the sixth time in a row that the central bank has decided to keep the repo rate unchanged, mainly due to concerns over inflation

The Reserve Bank of India (RBI) on Thursday (February 8) kept the repo rate unchanged at 6.5 per cent. This is the sixth time in a row that the Monetary Policy Committee (MPC) has decided to keep the repo rate unchanged, mainly due to concerns over inflation.

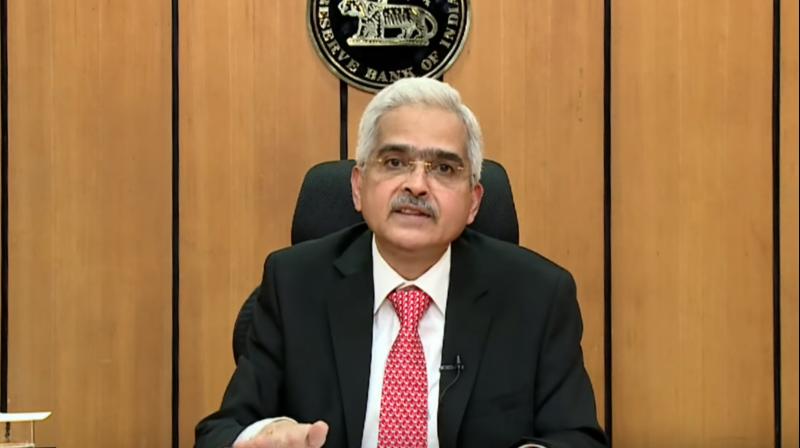

Announcing the bi-monthly monetary policy, RBI Governor Shaktikanta Das said central bank has decided to maintain the monetary policy stance as ‘withdrawal of accommodation’.

The bank also projected a GDP growth of 7 per cent for 2024-25 financial year, lower than the 7.3 per cent expansion estimated for the current fiscal.

Das said the economy is witnessing an accelerated growth which has outpaced the forecast of most analysts.

Rural demand continues to gather pace, urban consumption remains strong and investment cycle is gaining steam on the back of increased capex, he said, adding that there are signs of revival in private investments too.

The real GDP for 2024-25 is projected to grow at 7 per cent, with June and September quarters growth at 7.2 per cent and 6.8 per cent, respectively.

The growth in December and March quarters is projected at 7 per cent and 6.9, per cent, respectively.

Das said domestic economic activity remains strong and growth in the current fiscal as per estimates by the NSO is 7.3 per cent.

"The momentum of 2023-24 is expected to continue in 2024-25 fiscal," he said.

For a year, RBI has kept the short-term lending rate or repo rate stable at 6.5 per cent. The benchmark interest rate was last raised in February 2023 to 6.5 per cent from 6.25 per cent to contain inflation driven mainly by global developments.

The retail inflation in the current financial year has declined after touching a peak of 7.44 per cent in July 2023, it is still high and was 5.69 per cent in December 2023, though within the Reserve Bank's comfort zone of 4-6 per cent.

Governor Das-headed MPC started its three deliberations on Tuesday.

The government has mandated the central bank to ensure the retail inflation based on the Consumer Price Index (CPI) remains at 4 per cent with a margin of 2 per cent on either side.

The MPC is entrusted with the responsibility of deciding the policy repo rate to achieve the inflation target, keeping in mind the objective of growth.

In an off-cycle meeting in May 2022, the MPC raised the policy rate by 40 basis points and it was followed by rate hikes of varying sizes, in each of the five subsequent meetings till February 2023. The repo rate was raised by 250 basis points cumulatively between May 2022 and February 2023.

The MPC consists of three external members and three officials of the RBI.

The external members of the panel are Shashanka Bhide, Ashima Goyal, and Jayanth R Varma. Besides Governor Das, the other RBI officials in MPC are Rajiv Ranjan (Executive Director) and Michael Debabrata Patra (Deputy Governor).

(With inputs from agencies)