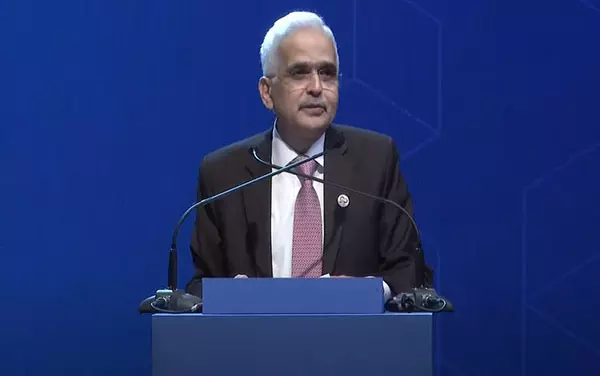

RBI Governor Shaktikanta Das was giving the keynote address at the Future of Finance Forum 2024 organised by the Bretton Woods Committee in Singapore. Photo: X | @ani_digital

RBI Governor Das: Inflation has moderated, but we still have some distance to cover

He said that monetary policy management by central banks has to be prudent and supply-side measures by governments have to be proactive

Inflation in India has moderated but still there is a distance to cover, Reserve Bank Governor Shaktikanta Das said on Friday (September 13).

India's retail inflation based on movement in consumer price index (CPI) was at 3.65 per cent in August, making it the second consecutive month of sub-4 per cent inflation. The government has tasked the RBI to ensure that inflation remains at 4 per cent with a margin of 2 per cent on either side.

"Inflation has moderated from its peak of 7.8 per cent in April 2022 into the tolerance band of +/- 2 per cent around the target of 4 per cent, but we still have a distance to cover and cannot afford to look the other way," said Das in a keynote address at the Future of Finance Forum 2024 organised by the Bretton Woods Committee in Singapore.

The RBI's projections indicate that inflation is likely to ease from 5.4 per cent in 2023-24 to 4.5 per cent in 2024-25 and 4.1 per cent in 2025-26.

‘Financial stability risks’

The Governor further said while global economic activity and trade have largely withstood downside risks, the last mile of disinflation has proved to be challenging, giving rise to financial stability risks.

"The momentum of global disinflation is slowing, warranting caution in easing monetary policy," Das said, adding that monetary policy management by central banks has to be prudent and supply-side measures by governments have to be proactive.

Das noted that market expectations of rate cuts are now regaining momentum, especially after indications of a policy pivot from the US Fed, but the adverse spillovers from the ‘higher-for-longer’ interest rate scenario remains a contingent risk.

On the other hand, there are central banks which naturally and justifiably remain averse to premature loosening of policy before inflation has been durably reined in in their countries, he said.

Central banks in these countries need to remain watchful of their domestic inflation-growth balance and make policy choices, the RBI Governor added.

(With agency inputs)