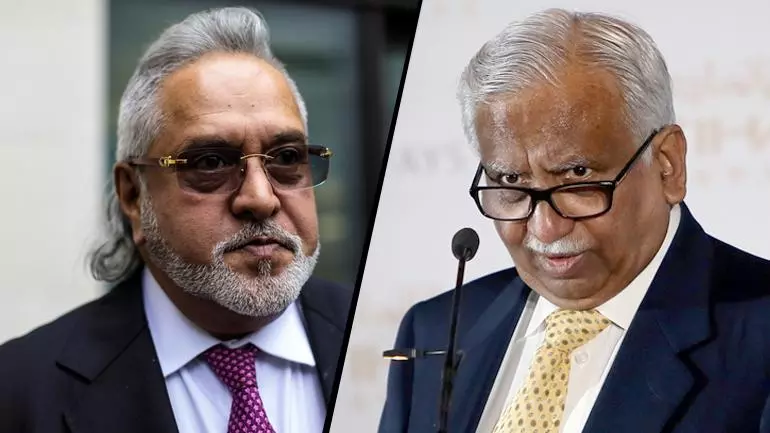

How Mallya, Goyal’s failed leadership led to collapse of India’s aviation titans

Both their airlines were victims of poorly executed takeovers of other airlines

With the arrest of Jet Airways founder Naresh Goyal in a money laundering case on Friday (September 1) night, the spotlight is back on the several challenges and controversies that plagued the now-defunct airline.

In many ways, there are several similarities between Goyal and Vijay Mallya, the founder and chairman of the now-defunct Kingfisher Airways. Even when both airlines were floundering, Goyal and Mallya held on to the reins even though allowing professionals to run their respective airlines would have been prudent.

Both their airlines were victims of poorly executed takeovers of other airlines. While Jet Airways bought Sahara Airlines, Kingfisher acquired Air Deccan and these acquisitions, according to market analysts, were the main reasons for the downfall of both airlines.

Goyal was never able to turn around Sahara, even after renaming it as Jet Lite. At the same time, Mallya could not lend a distinct identity to Air Deccan, first renaming it as Kingfisher Red and later merging it with Kingfisher. In their hurry to fly international routes, both owners needed to understand the dynamics of competing with foreign airlines. It needed a different approach and perhaps a separate identity, but too much interference from them was their undoing. Their stubbornness to realise their limitations might have prevented several suitors, including Etihad and Tata Sons, from taking a stake in their respective airlines.

Jet Airways saga

Founded in April 1993, Jet Airways was a paragon of India's civil aviation sector. However, by April 2019, the airline had grounded its fleet, leaving thousands of employees jobless and shaking the confidence of investors and consumers in the aviation industry. The collapse is a tale of mismanagement, financial woes, and failed leadership, encapsulated most vividly in its founder and then-chairman, Naresh Goyal.

As of early 2019, Jet Airways had reportedly accumulated a debt of around $1.2 billion. The airline found it increasingly difficult to service this huge debt due to declining revenues and poor cash flow. High debt levels acted as a barrier for the airline to secure additional financing or restructure existing debts.

A significant portion of the airline’s operating costs comprised aircraft leases, fuel, and salaries. Fuel expenses alone are notorious for their volatility, and fluctuations in oil prices frequently left the airline grappling with high operating costs. Complicating matters further was the depreciating Indian rupee, which made foreign currency expenses, such as aircraft leases and fuel, increasingly unmanageable. Inadequate risk hedging against fuel price volatility and foreign exchange rate fluctuations added to the airline’s financial stress.

Vendors demanding cash payments and the threat of aircraft repossession exacerbated cash flow problems. The airline’s issues in revenue management, such as sub-optimal pricing and poor route selection, also eroded its financial base.

Reluctance to cede control

Goyal’s centralised decision-making and reluctance to relinquish control were identified as key hindrances to potential financial rescue plans. His governance style made it difficult to bring in fresh investment or embark on aggressive restructuring. Goyal’s unwillingness to cede control was a stumbling block for prospective investors like Tata Sons and Etihad, eventually leading to failed negotiations.

Low-cost airlines like IndiGo and SpiceJet provided stiff competition, offering no-frills services at lower prices. Jet Airways, as a full-service carrier, had higher operating costs, making it difficult to match the ticket prices of these budget airlines.

Jet Airways found itself under regulatory scrutiny, facing investigations for alleged financial irregularities and governance issues. This scrutiny dented the airline’s public image and eroded consumer confidence, thereby reducing bookings and worsening its financial situation.

Financial irregularities

Goyal’s arrest came after CBI registered an FIR against Jet Airways, Naresh Goyal, and several other key figures over allegations from Canara Bank of a financial fraud amounting to ₹538 crore. The bank claimed that out of credit facilities totaling ₹848.86 crores, ₹538.62 crores remained unpaid. Acting on the FIR, the Enforcement Directorate (ED) officials are learnt to have taken Goyal for questioning at their office in Mumbai. Following this, the ED officials arrested Goyal on charges of money laundering.

Investigations revealed suspicious transactions totaling ₹197.57 crore involving entities associated with the airline, with further discrepancies in expenses amounting to ₹420.43 crore, according to several media reports.