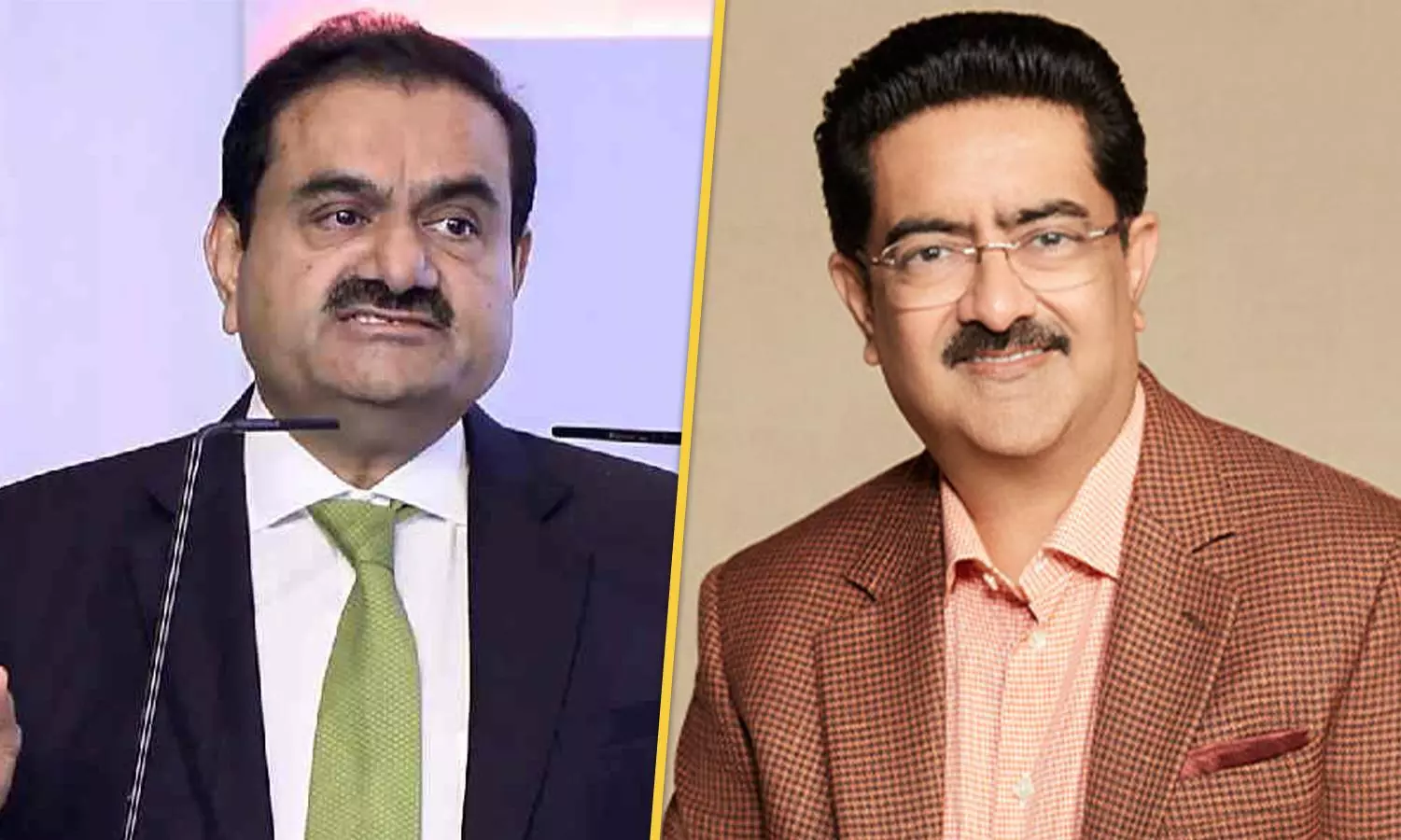

India Cements deal | Who will win the cement war? Aditya Birla or Adani?

The ultimate winner will be the one who not only has the money power to outbid the other but also can quickly react to the industry's ever-changing dynamics

Corporate India has witnessed fierce battles, from Nirma versus Hindustan Unilever to Airtel versus Reliance Jio. The stage is set for a new epic showdown: Adani Group versus Aditya Birla Group in the quest to dominate the cement sector.

The race to the top became fierce this week with the Aditya Birla Group’s acquisition of a controlling stake in India Cements, South India’s major cement manufacturer. Both conglomerates are vying for supremacy in this crucial industry, each employing distinct strategies and leveraging their unique strengths.

The stakes are high, and the competition is fierce. With the acquisition of a controlling stake in Chennai-based India Cements for Rs 3,954 crore, the Aditya Birla Group’s flagship company, UltraTech, will now have a total capacity of 165.6 MTPA compared with Adani Group’s 77.4 MTPA.

Strategic acquisitions

UltraTech's growth trajectory has been marked by strategic acquisitions. Notable among these is the acquisition of Jaypee Group’s cement assets for $2.4 billion in 2017, which significantly expanded its footprint in the northern and central regions of India. Furthermore, the acquisition of Binani Cement in 2018 for $1.1 billion after a protracted legal battle with Dalmia Bharat provided a stronghold in the Western market and enhanced its export capabilities.

Following these acquisitions, the $8.4 billion UltraTech is now India's largest manufacturer of grey cement and ready-to-mix and white cement. It is also the third-largest cement company globally, excluding China.

The cement majors have increased their market share and added capacities through acquisitions. The increased consolidation in the cement industry is poised to boost the market share of the leading players significantly. According to Antique Stock Broking, UltraTech Cement and the Adani Group are projected to dominate the sector, collectively accounting for 50 per cent of the industry's volume by FY27-28.

The war escalates

UltraTech has a robust expansion plan that includes organic growth and strategic acquisitions. The company aims to reach a capacity of 199.6 MTPA by FY2028, focusing on regions with high demand, such as Tamil Nadu and Andhra Pradesh. It has also consistently maintained high capacity utilisation rates (85 per cent for FY24) and has invested heavily in modernising its facilities to improve cost efficiency. The company’s EBITDA per tonne is projected to improve as it integrates India Cements' operations.

The Adani Group, traditionally known for its dominance in infrastructure, energy and logistics, has made a formidable entry into the cement sector. In 2022, it acquired Ambuja Cements and ACC Ltd from Holcim Group for $10.5 billion, instantly catapulting it to a prominent position with a combined capacity of over 70 MTPA.

Adani’s strategy revolves around leveraging its existing strengths in logistics and energy to achieve cost efficiencies and synergies. Integrating cement production with its ports and logistics operations aims to streamline supply chains, reduce costs and enhance distribution networks.

Expanding geographical footprint

The Adani Group has announced significant investments to expand its cement capacity, aiming to become the most significant player in India.

The group’s focus on state-of-the-art technology and automation is expected to enhance operational efficiency and product quality, setting new benchmarks in the industry. It aims to have around 140 MTPA by FY28, doubling its capacity within the next four years and has earmarked an investment of $3 billion to reach the target.

Both groups are keenly focused on expanding their geographical footprint. While UltraTech continues consolidating its position in key markets and exploring international opportunities, Adani is aggressively expanding in underserved regions, aiming to capture market share from local players.

Price wars and court battles

The tussle between these two conglomerates has led to intense competition, often manifesting in aggressive pricing strategies. For instance, in 2023, Adani’s decision to reduce cement prices in key markets by 10 per cent to gain market share forced UltraTech to follow suit, triggering a price war that squeezed margins across the industry.

One of the most intriguing episodes in this rivalry was the battle for Binani Cement. UltraTech initially faced competition from Dalmia Bharat but ultimately emerged victorious after offering a higher bid and securing approval from the National Company Law Tribunal. This acquisition expanded UltraTech’s capacity and demonstrated its resilience and strategic acumen.

Adani’s acquisition of Ambuja Cements and ACC from Holcim Group was a game-changer. This move, financed through debt and equity, showcased Adani’s financial muscle and strategic intent to dominate the cement industry.

The acquisition provided Adani with an extensive distribution network and a strong brand presence, significantly altering the competitive landscape.

Who will win?

According to analysts, the ultimate winner between the two giants will be the one who not only has the money power to outbid the other but also can quickly react to the industry's ever-changing dynamics.

For example, the cement industry operates under stringent environmental regulations that vary by region. Compliance with these regulations can increase operational costs and necessitate investments in cleaner technologies.

The cement industry is responsible for approximately 6 per cent of global greenhouse gas emissions, making it one of the largest industrial sources of carbon emissions. This has led to increasing pressure from governments and environmental groups to adopt more sustainable practices and reduce carbon footprints.

Issues of cement industry

Transitioning to a carbon-neutral model is essential, which involves adopting alternative fuels, carbon capture technologies, and innovative production methods. However, the lack of mature, cost-effective decarbonisation technologies presents a significant hurdle.

The cement industry is also highly sensitive to economic cycles. Recent years have seen fluctuations in demand due to factors such as the Covid-19 pandemic, geopolitical tensions and inflationary pressures. For instance, global cement demand fell by 1.2 per cent in 2023, following a decline in previous years.

While both conglomerates possess unique strengths and competitive advantages, the Aditya Birla Group, with its established market presence, proven track record in strategic acquisitions and commitment to sustainability appears slightly better positioned to sustain long-term leadership in the cement industry. However, the Adani Group’s financial muscle and aggressive expansion could disrupt the market, making the ultimate outcome uncertain and dependent on future strategic moves and market conditions.