RBI keeps interests rates unchanged amid COVID-19 upsurge

The Reserve Bank of India (RBI) on Wednesday kept key interest rates unchanged at record lows while pledging to buy ₹1 lakh crore of government bonds this quarter to cap borrowing costs in a bid to support an economy facing a resurgence of the pandemic.

In the first monetary policy of the 2021-22 fiscal, the central bank stuck to its accommodative stance as long as necessary, amid concerns of rising infections that could derail the nascent economic recovery.

RBI’s key lending rate, the repo rate, which was cut by a total of 115 basis points last year to soften the blow from the pandemic, will stay at 4 per cent while the reverse repo rate or the central bank’s borrowing rate will be unchanged at 3.35 per cent.

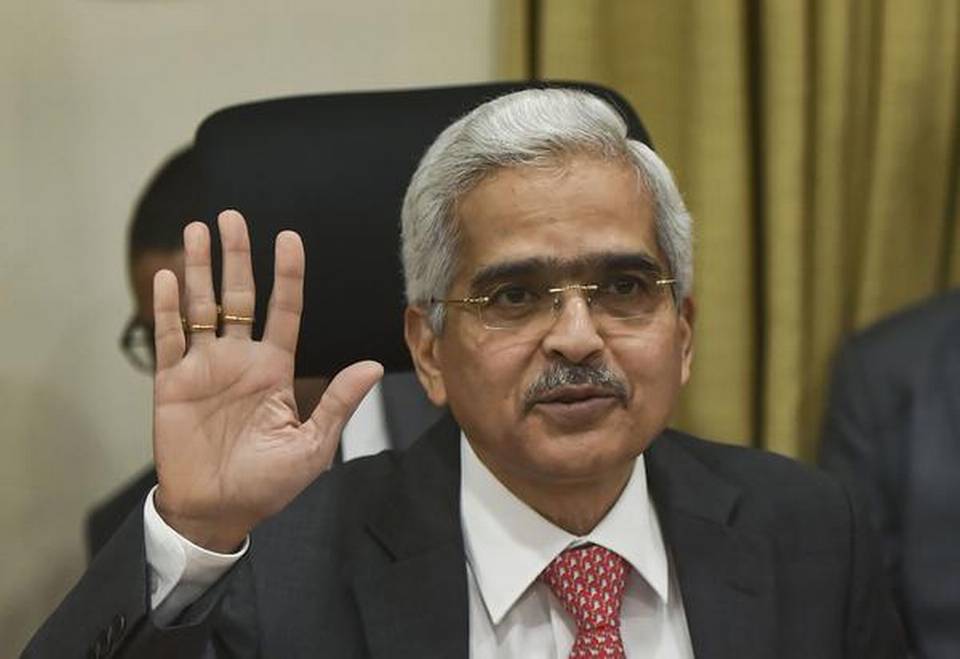

Governor Shaktikanta Das said the six-member monetary policy committee (MPC) voted unanimously “to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy while ensuring that inflation remains within the target going forward.”

Just as the economy started to recover after being pummelled by the pandemic and the lockdowns, India is witnessing a record jump in COVID-19 infections, threatening the nascent recovery.

“The recent surge in infections has, however, imparted greater uncertainty to the outlook and needs to be closely watched, especially as localised and regional lockdowns could dampen the recent improvement in demand conditions and delay the return of normalcy,” he said.

The Governor announced a second market G-sec acquisition programme or G-SAP 1.0 wherein RBI committed to open market purchase of government securities. In April-June, it is committed to buy ₹1 lakh crore bonds, with first debt purchases starting from April 15.

Opinion | Inflation? Growth? There’s much ado over ideal monetary policy target

RBI had bought ₹3 lakh crore of bonds in the last fiscal (2020-21) and planned similar or more spending in the financial year April 2021 to March 2022.

“We are now better prepared to meet the challenges posed by this resurgence in infections,” he added.

While retaining its GDP growth outlook for FY22 at 10.5 per cent after a 7.5 per cent contraction in 2020-21, RBI revised the outlook for inflation, with price rise seen at 5 per cent in the fourth quarter of last fiscal year. It is projected to rise to 5.2 per cent in the first half of the current fiscal.

Das reiterated that the banking system liquidity will continue to remain in surplus even after meeting all requirements of the financial market segments and productive sectors of the economy.

An accommodative stance implies a rate cut in the future if the need arises to support the economy.

This is the fifth time in a row that MPC has decided to keep the policy rate unchanged. RBI had last revised its policy rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting interest rates to a historic low.

Analysis | Remedy for low deposit rate? The name’s bond, inflation-indexed bond

He assured that RBI is committed to ensuring ample system liquidity in consonance with the accommodative stance of MPC.

“When I say ample liquidity, I mean a level of liquidity that would keep the system in surplus even after meeting the requirements of all financial market segments and the productive sectors of the economy,” he said.

The Reserve Bank will of course continue to do whatever it takes to preserve financial stability and to insulate domestic financial markets from global spillovers and the consequent volatility, Das added.

To provide additional liquidity to states, RBI has decided to accept the recommendations of an Advisory Committee constituted by it to review the Ways and Means Advance (WMA) limits for State Governments/UTs and other related issues.

Accordingly, it has been decided to enhance the aggregate WMA limit of states and UTs to ₹47,010 crore, an increase of about 46 per cent from the current limit of ₹32,225 crore which was fixed in February 2016.

Opinion | Does the government have any business to be in business?

“Further, it has also been decided to continue the enhanced interim WMA limit of ₹51,560 crore granted by RBI due to the pandemic for a further period of six months i.e. up to September 30, 2021,” he said.

Das further said that to nurture the still-nascent growth impulses, it is felt necessary to support the continued flow of credit to the real economy.

Accordingly, liquidity support of ₹50,000 crore for fresh lending during 2021-22 will be provided to All India Financial Institutions (AIFIs).

He announced that ₹25,000 crore will be provided to National Bank for Agriculture and Rural Development (NABARD), ₹10,000 crore to National Housing Bank (NHB) and ₹15,000 crore to Small Industries Development Bank of India (SIDBI).

It is to be mentioned here that special refinance facilities of ₹75,000 crore were provided to AIFIs during April-August 2020.

The central bank also announced relaxation in the period of parking of External Commercial Borrowing (ECB) proceeds in term deposits.