'India grappling with inflation': RBI hikes repo rate to above pre-COVID level

But Governor Shaktikanta Das remains upbeat on economy; RBI retains growth projection at 7.2 per cent for the current fiscal as it sees improvement in urban demand and gradual recovery in rural India aided by normal monsoon

The Reserve Bank of India (RBI) on Friday raised the benchmark lending rate by 50 basis points (bps) to 5.40 per cent to tame inflation. With the latest hike, the repo rate, or the short-term lending rate at which banks borrow, has crossed the pre-pandemic level of 5.15 per cent.

This is the third consecutive rate hike after a 40 basis points in May and 50 basis points increase in June. In all, the RBI has raised the benchmark rate by 1.40 per cent since May this year.

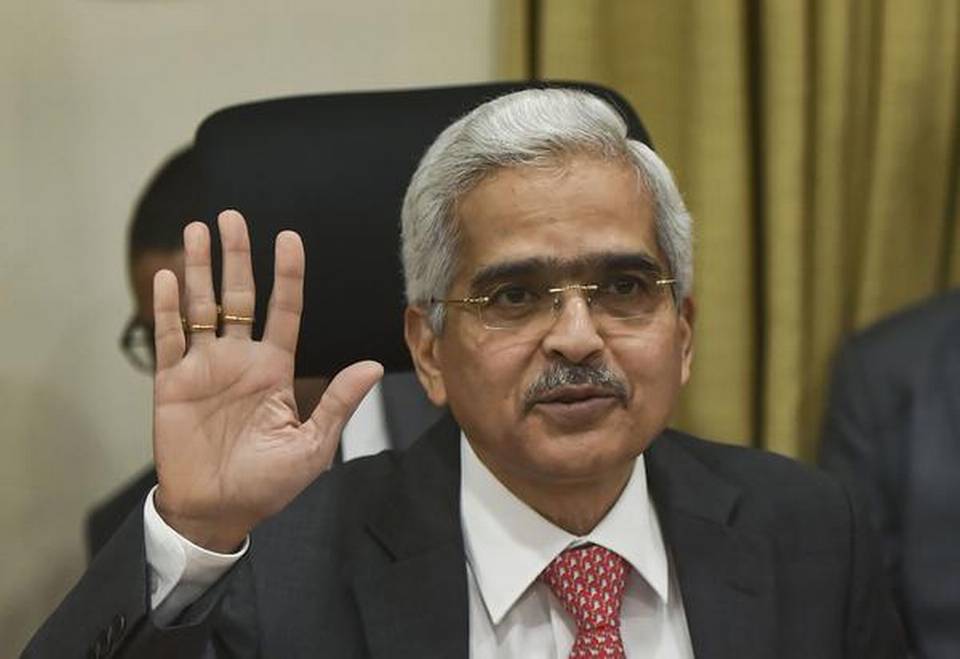

All the six members of the Monetary Policy Committee (MPC), headed by RBI Governor Shaktikanta Das, unanimously voted for the rate hike. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth, said an RBI statement.

“MPC decided to focus on withdrawal of accommodation to keep inflation within target while supporting growth,” said Das while announcing the rate hike. “India is grappling with inflation.”

“However, the financial sector remains will capitalised, and India’s forex reserves provide insurance against global spillovers,” said Das.

Inflation spiralling

The Consumer Price Index (CPI)-based inflation, which the RBI factors in while fixing its benchmark rate, stood at 7.01 per cent in June. Retail inflation has been ruling above the RBI’s comfort level of 6 per cent since January this year.

Inflation based on the Wholesale Price Index (WPI) remained in double-digit for 15 months in a row. The WPI reading was at 15.18 per cent in June.

The latest RBI action follows the Bank of England raising rate by 50 basis points, the biggest hike in 27 years, to 1.75 per cent. Last month, the US Federal Reserve effected its second consecutive 0.75 percentage point interest rate increase, taking its benchmark rate to a range of 2.25-2.5 per cent.

Growth projection

The RBI, however, retained its growth projection at 7.2 per cent for the current fiscal as it sees improvement in urban demand and gradual recovery in rural India aided by normal monsoon.

Das said the central bank remains committed to price stability to put the country on the sustained path of growth. The RBI expects growth in the first quarter of the current fiscal at 16.2 per cent, which will taper to 4 per cent by the fourth quarter. He, however, cautioned that there are risks from the ongoing Russia-Ukraine war.

“Since the MPC’s meeting in June 2022, the global economic and financial environment has deteriorated with the combined impact of monetary policy tightening across the world and the persisting war in Europe heightening risks of recession,” said the RBI statement.

“Gripped by risk aversion, global financial markets have experienced surges of volatility and large sell-offs. The US dollar index soared to a two-decade high in July. Both advanced economies (AEs) and emerging market economies (EMEs) witnessed weakening of their currencies against the US dollar. EMEs are experiencing capital outflows and reserve losses which are exacerbating risks to their growth and financial stability.”

However, the RBI remained optimistic on the domestic scenario. “Domestic economic activity remains resilient,” said the statement. As on August 4, 2022, the southwest monsoon rainfall was 6 per cent above the long period average (LPA). Kharif sowing is picking up. High frequency indicators of activity in the industrial and services sectors are holding up. Urban demand is strengthening while rural demand is gradually catching up. Merchandise exports recorded a growth of 24.5 per cent during April-June 2022, with some moderation in July. Non-oil non-gold imports were robust, indicating strengthening domestic demand,” it added.

The central bank in April slashed the GDP growth projection for 2022-23 to 7.2 per cent from its earlier forecast of 7.8 per cent.