Patanjali Foods gets set for new FPO even as bourses freeze promoters' shares

With stock exchanges freezing shares of its promoters, Patanjali Foods on Thursday said the move will not impact the companys operation and it will start the process of launching a Follow-On Public Offering (FPO) in April to increase the public shareholding to 25 per cent.

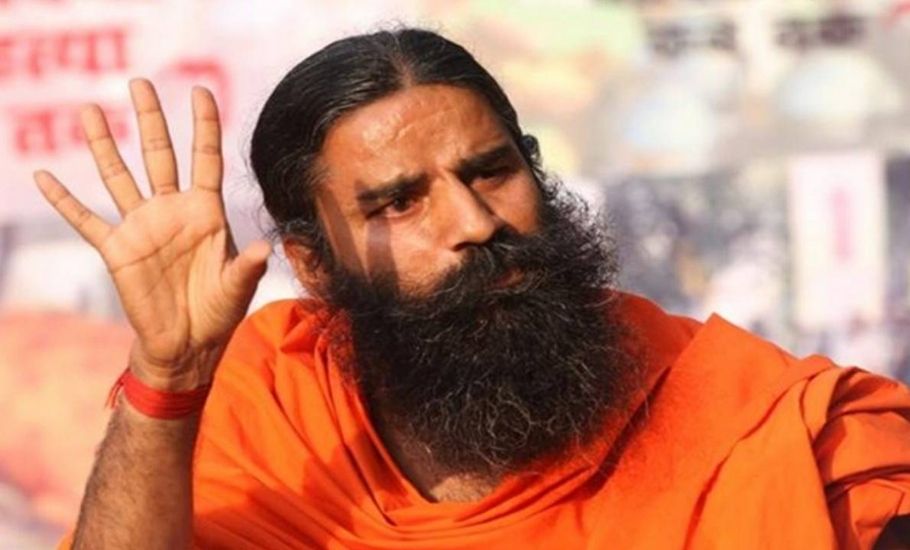

Stock exchanges NSE and BSE have frozen the shares of promoters of Baba Ramdev-led Patanjali Group firm Patanjali Foods, which is a major edible oil player.

Patanjali Foods Ltd, erstwhile Ruchi Soya Industries, on Thursday said the freezing of its promoters shareholding in the company “will not have any impact” on its financial position and functioning of the company.

On Thursday, Patanjali Foods Ltd (PFL) informed that leading bourses BSE and NSE had frozen shares of its 21 promoter entities, including Patanjali Ayurved for failing to meet minimum public shareholding norms. Rule 19A(5) of the Securities Contracts (Regulation) Rules, 1957 mandates a listed entity to have a minimum public shareholding (MPS) of 25 per cent.

In a filing, PFL said its promoters are “fully committed” to achieving the minimum public shareholding and discussions are going on for this. “We have received a communication from our promoters that they are fully committed to the mandatory compliance of achieving minimum public shareholding. They have been discussing various modes best suited for increasing public shareholding.

(Except for the headline, this story has not been edited by The Federal staff and is auto-published from a syndicated feed.)