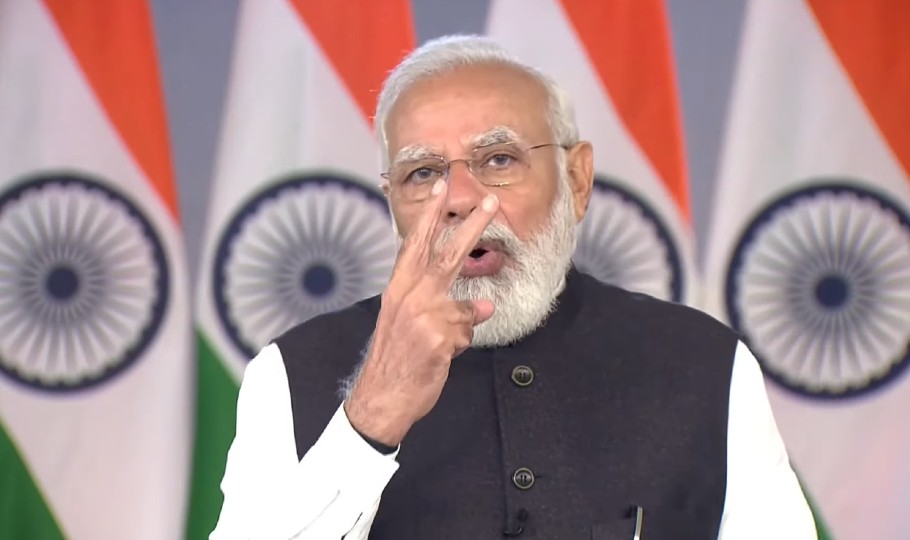

No need for fund managers, says PM Modi launching 2 RBI schemes

Two RBI schemes—RBI Retail Direct Scheme and RBI-Integrated Ombudsman Scheme—will change the way investors can generate wealth in India, with even the common man being able to invest directly in government bonds and securities, without the need of fund managers.

Two RBI schemes—RBI Retail Direct Scheme and RBI-Integrated Ombudsman Scheme—will change the way investors can generate wealth in India, with even the common man being able to invest directly in government bonds and securities, without the need of fund managers, according to Prime Minister Narendra Modi.

“RBI Retail Direct scheme provides small investors a simple and safe medium to invest in government securities. Similarly, under the Integrated Ombudsman Scheme, ‘One Nation, One Ombudsman’ system for the banking sector in the country has taken shape today,” Modi said on Friday (November 12) launching the schemes.

“A large section of our country would now be able to directly invest in government securities and participate in the creation of national wealth. Government securities have the provision of guaranteed settlement, this gives assurance of safety to the small investor,” he said.

“The Retail Direct Scheme will boost the spirit of promoting everyone’s participation in the economy. The middle class, employees, small businessmen and senior citizens with small savings will now be able to directly and securely invest in government securities,” he said about the two RBI schemes.

“Financial inclusion tries to include even the last person of this country in the process. Under Retail Direct Scheme, there will be no need for fund managers. Retail direct guild (RDG) account can be opened online & securities can be purchased or sold online.”

Modi also appreciated the RBI, banks and other financial institutions for their “admirable” work during the Covid-19 pandemic.

Also read: Indian economy’s fundamentals strong; private investment picking up: Panagariya

He also recalled how his government has been working in a transparent manner towards resolution of various non-performing assets.

“In the last seven years, non-performing assets were recognised with transparency and public sector banks were recapitalised. To further strengthen this sector, co-operative banks were brought under the purview of the RBI.”

The Prime Minister also said that we need to continuously strengthen the faith of investors in India as an investor-friendly destination.

“We should continuously strengthen the faith of the investors. I am fully confident that the RBI will continue to strengthen India’s new identity as a sensitive and investor-friendly destination,” PM Modi remarked.