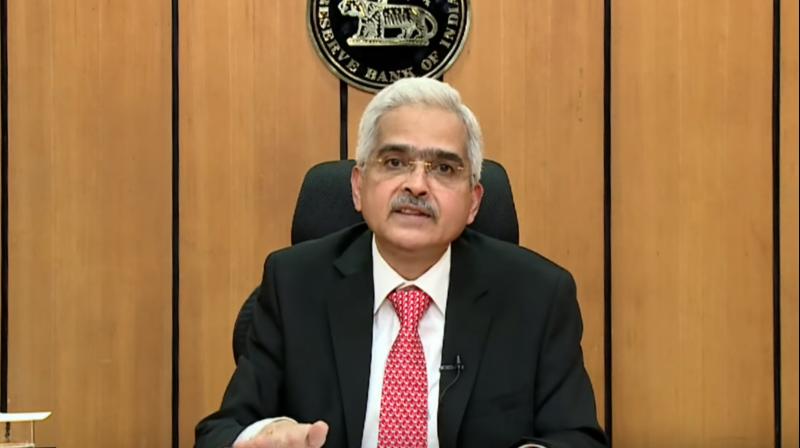

Inflation check: RBI's report to govt won't be made public, says Shaktikanta Das

Ahead of its additional meeting of the Monetary Policy Committee (MPC) on Thursday (November 3), the Reserve Bank of India (RBI) said it will not immediately make public its report to the government on its failure to keep the retail inflation rate below 6%.

For the first time since the implementation of the monetary policy framework in 2016, the RBI will submit a report to the government on its failure to keep the retail inflation rate below 6% for three consecutive quarters beginning January 2022.

Also read: Inflation, slow business push service sector PMI to six-month low

“It is a report sent under a law. I don’t have the privilege, the authority, or the luxury to release a letter like this which is written under the law, as per the legal requirement. I don’t have the privilege, authority, or the luxury to release it to the media even before the addressee (government) gets it. There is so much communication which goes on between the Reserve Bank and the government, both ways. We don’t share each and every letter,” RBI Governor Shaktikanta Das said on Wednesday (November 2).

He added that the report will be available in the public domain at some point. “But that is not to assume the contents of this letter and the report are perennially under wraps. They will be available in public domain at some point.”

Also read: Inflation check: What RBI’s Nov 3 special meeting of MPC is all about

The monetary policy framework, which came into effect about six years ago, mandates the RBI to maintain retail inflation at 4% with a margin of 2% on either side.

In case of failure to maintain the inflation target for three consecutive quarters, the central bank, under section 45ZN of the RBI Act, is required to submit a report to the government explaining the reasons and spelling out the remedial actions it would be taking to check the price rise.

The central bank has called a special meeting of the MPC to prepare its report on missing inflation targets to the government. The six-member rate-setting panel is headed by Das.

Amid flak faced by the RBI for missing inflation target, Das defended its policies saying the economy would have taken a “complete downward turn” if it had started to tighten rates earlier.

Das said the Indian economy is being looked at as a story of resilience and optimism by the world and the inflation is now expected to moderate.

Acknowledging that the central bank has missed its primary target as inflation has consistently overshot, Das said there is a need for appreciating the counterfactual aspect as well and think about the impact of premature tightening which would have hurt the recovery.

“It (tightening earlier) would have been very costly for the economy. It would have been very costly for the citizens of this country. We would have paid a high cost,” he said.

“We prevented a complete downward turn of our economy,” Das said, adding that RBI did not want to upset the recovery process and was guiding the economy towards a safe landing.

(With agency inputs)