After govt announces mega merger of banks, employees declare protest

Oriental Bank of Commerce (OBC) and United Bank (UB) will be merged with Punjab National Bank (PNB), Syndicate Bank will be merged with Canara Bank; Andhra Bank and Corporation Bank with Union Bank of India (UBI), Indian Bank with Allahabad Bank, making it the seventh largest state-owned bank.

The government on Friday (August 30) announced a major merger of 10 state-run banks in the country, in a bid to battle non-performing assets amid a serious slowdown affecting the economy.

Oriental Bank of Commerce (OBC) and United Bank (UB) will be merged with Punjab National Bank (PNB), Syndicate Bank will be merged with Canara Bank; Andhra Bank and Corporation Bank with Union Bank of India (UBI), Indian Bank with Allahabad Bank, making it the seventh largest state-owned bank.

Also read: India’s GDP growth hits seven-year low of 5% in April-June quarter

Announcing the mergers, Finance Minister Nirmala Sitharaman said this was done to make them global sized banks.

Bank unions announce protest on Saturday

Bank unions opposed the mega merger of 10 state-run banks into four saying the move is bereft of logic and lacks any rationale.

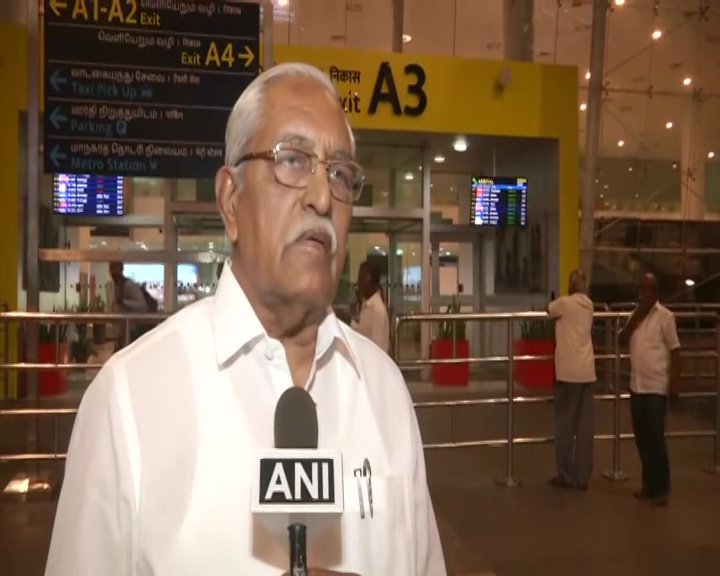

CH Venkatachalam, secretary of All India Bank Employees’ Association (AIBEA), said they will fight government’s decision.

“In India, we don’t need mega banks and mega mergers. We are a vast country and lakhs of villagers don’t have banking facility. Tomorrow we’re going to have massive protest all over the country by bank employees. We will fight,” he said

“The proposals which the government has moved are unmindful since it has no logic or rationale. Neither, it is the case that a weak bank is merged with a strong one nor geographically compatible banks are being merged,” AIBEA said in a statement.

The unions pointed out that United Bank, headquartered in Kolkata is being merged with the Delhi-based Punjab National Bank, while Syndicate Bank is being merged with Canara having network in same geographical areas.

The unions said the government has come out with merger proposals at a time when the economy is passing through a rough weather-as the announcements came an hour before the government reported that the economy slowed to the lowest level in 25 quarters in the April-June period clipping at a low 5 percent.

“At this point in time, when stability is the need of the hour, the government itself is attempting to destabilise the finance and economy,” the statement said.

The union said in the process of merger, SBI had closed over 1,000 branches and in case of Bank of Baroda, more than 500 branches are being closed.

“On one side the government wants to implement Jan Dhan, but how it is possible to implement the same by closing down the branches?” they wondered and announced that they will observe black day on Saturday and threatened to launch more protests go ahead.

From 27 state-run banks to 12 in 2 years

In January this year, the Union Cabinet had approved merger Dena Bank and Vijaya Bank with Bank of Baroda. The merger came in to effect from April 1.

With these mergers, the number of PSBs will come down from 27 in 2017 to 12 now.

Prior to this, the government had merged five associate banks of SBI and Bharatiya Mahila Bank with State Bank of India. These were State Bank of Patiala, State Bank of Bikaner and Jaipur, State Bank of Mysore, State Bank of Travancore and State Bank of Hyderabad and also Bharatiya Mahila Bank effective April 2017.

Sitharaman said the profitability of public sector banks has improved and total gross non-performing assets (GNPA) have come down to Rs 7.9 lakh crore at end-March 2019 from Rs 8.65 lakh crore at end-December 2018.

- 5th largest PSB with business of ₹14.59 lakh crore (2 times Union bank of India)

- 4th largest branch network in India, with 9,609 branches

- Business to become twice to 4 and 1/2 times existing bank business

- Large cost reduction potential due to network overlaps

- Cost savings and income opportunities for JVs and subsidiaries

- Same CBS platform (Finance) in all three banks to enable quick realisation of gains

In the amalgamation process, there has been no retrenchment so far and there is no chance of retrenchment. The benefits of employment and HR will improve. With the amalgamation, the best combination will be taken up, Finance Secretary Rajeev Kumar said.

Sitharaman also said liquidity support to NBFCs and housing finance companies has improved as the partial credit guarantee scheme has been executed. An infusion of Rs 3,300 crore has already been made and another Rs 30,000 crore is in the pipeline.

Also read: India needs structural reforms to fire up economy, say experts

Addressing her second press conference to announce steps to boost the economy, the finance minister said the reforms initiated in the public sector banks (PSBs) have started showing results as 14 of them posted a profit in the first quarter of the current fiscal. The minister also said that to avoid Nirav Modi like frauds in the PSBs, the SWIFT messaging system has now been linked with the core banking system.

The move comes a week after the government announced a slew of measures to boost growth, including revoking of levies on FPIs, easing of norms in FDI in retail, manufacturing and coal mining.