EMIs set to go up as RBI’s Monetary Policy Committee hikes repo rate to 6.25%

The Monetary Policy Committe decided to hike the benchmark lending rate by a majority of five members out of six; the rate hike is aimed to tame inflation, which continues to stay above the RBI's tolerance band

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RB), has decided to hike the repo rate by 35 basis points (bps) to 6.25 per cent, with immediate effect. The MPC has been holding its latest bi-monthly meeting from December 5-7.

‘Repo rate’ refers to the interest rate at which the RBI lends money to commercial banks. Among other things, the repo rate hike will lead to higher EMIs (equated monthly installments) for people.

The rate hike is aimed to tame inflation, which continues to stay above the RBI’s tolerance band.

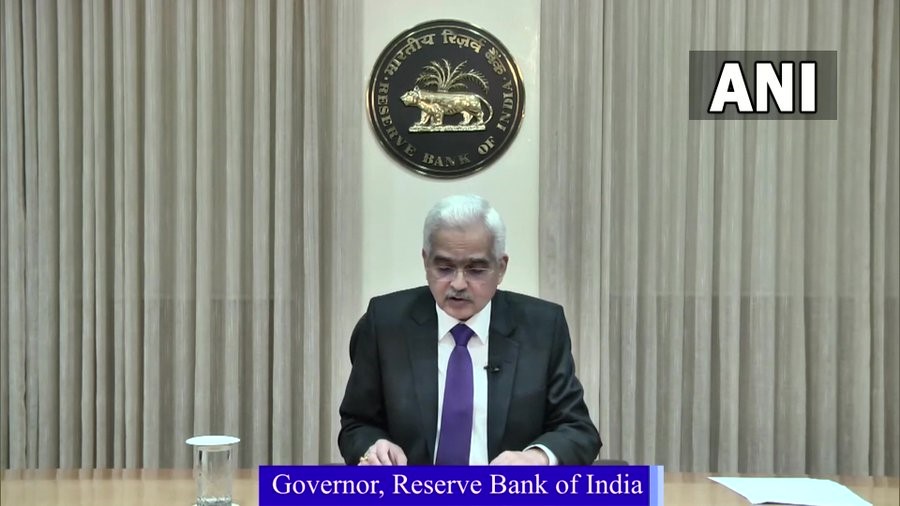

Statement by Shri Shaktikanta Das, RBI Governor – December 07, 2022 https://t.co/n8XlBguWt0

— ReserveBankOfIndia (@RBI) December 7, 2022

RBI Governor Shaktikanta Das said the decision was based on an assessment of the macroeconomic situation and its outlook. The MPC decided the rate hike by a majority of five members out of six.

Watch: RBI’s repo rate hike: What does it mean for us?

“MPC was of the view that further caliberated monetary policy action is warranted to keep inflation expectations anchored, break core inflation persistence and contain second round effects…,” said Das. The central bank would continue the withdrawal of accommodation, he added.

The RBI had last raised the rate by 50 basis points on September 30. With the latest hiket, the repo rate has been raised by 225 bps since April 2022.

Also read: RBI pares FY23 GDP growth forecast to 6.8%, cites geopolitical tensions