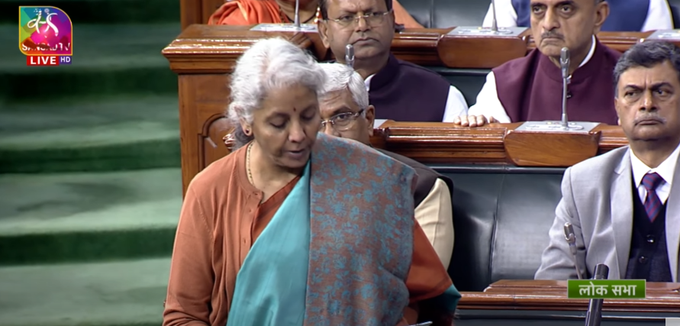

Economic Survey: India's FY24 GDP growth estimated at 6.5%

Growth to be driven by private consumption, higher capex, strengthening corporate balance sheets, credit growth to small businesses and the return of migrant workers to cities

Economic Survey Highlights:

The services sector witnessed a swift rebound in FY22, growing Year-on-Year (YoY) at 8.4% compared to a contraction of 7.8% in the previous financial year.#EconomicSurvey #EconomicSurvey2023 pic.twitter.com/iJ7Bw1ZA8N

— Prasar Bharati News Services & Digital Platform (@PBNS_India) January 31, 2023

India will remain the fastest growing major economy in the world, said the Economic Survey. The growth will be driven by private consumption, higher capex, strengthening corporate balance sheets, credit growth to small businesses and the return of migrant workers to cities.

The survey further said India is the third largest economy in PPP (purchasing power parity) terms, and the fifth largest in terms of exchange rate. The economy has nearly “recouped” what was lost, “renewed” what had paused, and “renerengised” what had slowed during the pandemic and since the conflict in Europe, it said.

Real GDP growth is expected to be in the range of 6-6.8 per cent next fiscal, depending on global economic, political developments. GDP in nominal terms will be 11% next fiscal, it is esitmated.

‘Quick recovery from pandemic’

The annual survey said India’s recovery from the pandemic was relatively quick. As a result, the growth next fiscal is likely to be supported by solid domestic demand and a pick-up in capital investment.

The Reserve Bank of India’s (RBI) projection of 6.8% inflation this fiscal is outside the upper target limit, and not high enough to deter private consumption, said the survey, adding that it is also not too low to weaken inducement to invest.

The borrowing cost may remain higher for longer, and entrenched inflation may prolong the tightening cycle, it cautioned.

The challenge to rupee depreciation persists with the likelihood of further interest rate hikes by the US Fed, said the survey. The CAD (current account deficit) may continue to widen as global commodity prices remain elevated; however, the economic growth momentum stays strong, it said. If the CAD widens further, the rupee may come under depreciation pressure.

However, the survey indicated that the overall external situation will remain manageable. India has sufficient forex reserves to finance CAD and intervene in the forex market to manage rupee volatility, it said.

There are elevated downside risks to the global economic outlook as inflation persists in advanced economies and there are hints of further rate hikes by central banks, it observed.

India’s inflation did not “creep too far above” tolerance range compared to several advanced nations, the document noted.

Growth in exports has moderated in the second half of current fiscal. The surge in growth rate in FY22 and the first half of FY23 led to production processes shifting gears from mild acceleration to cruise mode. Slowing world growth and shrinking global trade led to loss of export stimulus in the second half of the current year, the survey conceded.

Poverty alleviation schemes

Schemes like PM KISAN and PM Garib Kalyan Yojana significantly contributed to lessening impoverishment, the Economic Survey said. Credit disbursal, capital investment cycle, expansion of public digital platforms and schemes like PLI (Production Linked Incentive), National Logistics Policy and PM Gati Shakti will further drive economic growth, it added.

Bank credit growth will likely be brisk in FY24 on the back of benign inflation and moderate credit cost, said the survey. Credit growth to small businesses was remarkably high at over 30.5% in January-November, 2022, it added.

Housing prices firming up after release of pent-up demand and a decline in inventories.

The Union government’s capex grew 63.4% in April-November, 2022. India withstood an extraordinary set of challenges better than most economies, it added.

Global challenges

India’s economic resilience has helped it withstand the challenge of mitigating external imbalances caused by the Russia-Ukraine conflict without losing growth momentum, it said.

The stock market gave positive returns in calendar year 2022 unfazed by FPI withdrawal, said the survey.

After a dip in FY21, GST paid by small businesses has been rising and now crossed pre-pandemic levels reflecting the effectiveness of targeted government intervention. Private consumption, capital formation led economic growth in the current fiscal has helped generate employment, said the survey. Urban employment rate declined, while Employee Provident Fund registration rose, it added.

Expert comment

Lakshmi Iyer, CEO-Investment Advisory, Kotak Investment Advisors Ltd, said in a statement that the projected FY24 growth of 6-6.8 per cent seems a tad stretched “given the fact that there is a global slowdown, specifically in global exports”. “It also comes at a time when domestic demand is slowing down initially,” said Iyer. “We need to be fiscally prudent, especially after almost three years of the fiscal breach (globally too) due to the pandemic phase. The survey also alludes to the fact that the tightening cycle may remain prolonged, which means higher interest rates for a longer period of time. All eyes are now on the budget, which could determine the trajectory of growth as also the direction of interest rates given the borrowing programme that will be announced tomorrow. The key to watch will be the gross borrowing numbers, which we estimate that it should be Rs 16 lakh crore.”

Sanjiv Bajaj, President of CII, said the survey has eluded that the government is on track to achieve its fiscal deficit target for the year despite budgetary pressures. “This would help maintain credibility and macroeconomic stability and create the space for increasing capex significantly, especially in the infrastructure sector, to drive the economic growth engine in the current year and beyond,” said Bajaj.

“CII has been advocating that spending priorities should not come in the way of achieving the fiscal deficit targets for the year and has called for a roadmap for gradually reducing the fiscal deficit to achieve the goalpost of 4.5% by FY26,” he added.