In line with Mukesh's grand plan, Reliance is debt-free ahead of deadline

Bucking the trend, where companies are finding it difficult to raise funds during the COVID-19 pandemic, Reliance Industries have gone ahead and announced itself as net debt-free.

Bucking the trend, where companies are finding it difficult to raise funds during the COVID-19 pandemic, Reliance Industries have gone ahead and announced itself as net debt-free.

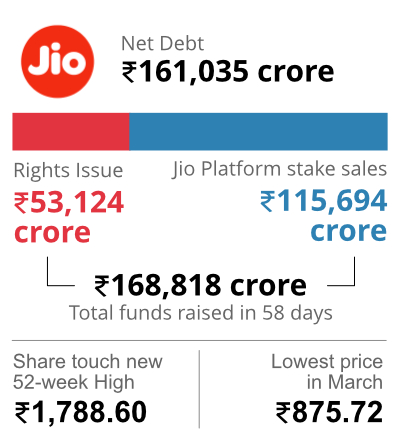

The conglomerate that had a net debt of ₹1.61 trillion in March, has raised ₹1.68 trillion in two months since April and fast-tracked a promise made by its Chairman Mukesh Ambani to his shareholders on August 12, 2019.

The original schedule for going debt-free was March 31, 2021. Ambani, Asia’s richest man, promised his shareholders that Reliance Industries, in its ‘golden decade’, will set even more grandiose growth goals and achieve them.

“Exceeding the expectations of our shareholders and all other stakeholders, again and yet again, is in the very DNA of Reliance,” Ambani said, remembering his father who always rewarded his shareholders.

The ‘net debt-free’ status means that Reliance is less risky from an investor’s point of view, since in the worst-case scenario, it has enough cash in its hands to pay off its debt. This would also now make it an attractive investment option to certain groups of portfolio investors who, in the past, might have been concerned with the high amount of leverage in its business.

Reliance has raised a capital of ₹53,124 crore through a rights issue and ₹1,15,694 crore by diluting its equity in Jio platforms to a combination of Private Equity Funds, Sovereign Funds, Financial Investors, and strategic foreign tech giants, such as Facebook. The gains in stock prices of Reliance Industries have outpaced the NIFTY since it announced the first of 11 fund-raises.

Ambani said that over the past few weeks, he was “overwhelmed by the phenomenal interest of the global financial investor community in partnering with Jio.”

Jio is arguably India’s largest telecom operator with nearly 400 million users. It is now looking to monetize its user base by leveraging partnerships with global businesses like Facebook. These companies provide a gateway into an exploding digital economy and an e-commerce ecosystem that includes retail, services, payments, education, and health care sectors.

Since there is strong investor interest in Reliance’s consumer businesses, Jio Platforms, and Reliance Retail, they are likely to go for public listings in the next five years. Reliance’s retail unit runs 12,000 cash and carry and wholesale stores across India. In a move aimed at competing with global e-commerce giants such as Amazon, Walmart, and Flipkart, the company last month launched an online grocery service called JioMart.

It is believed that Reliance Industries would wrap up the bulk of its fundraising initiatives for Jio platforms by the third quarter of 2020. It is also exploring public listing in the United States by 2021, according to a Reuters report.

Modi, Modi, and Modigliani

A key rainmaker who was a part of these deals for Reliance Industries is believed to be Manoj Modi, who has in the past been a part of every big move RIL makes. Sources claim he has ‘a say’ in each of its businesses. Currently, there is no designated CEO as such at Reliance Industries, but if there were to be one, it would be Manoj Modi—55, a Chemical Engineering classmate of Mukesh from UDCT (University Department of Chemical Technology) Matunga, Mumbai.

While Reliance’s recent mega capital-raising spree has been the focus, the company, over the years, has been on a shopping spree. It has been acquiring smaller firms in order to build domain expertise in newer technologies that range from artificial intelligence to distributed computing and blockchain. The idea is to create a digital business, “a super app” that powers everything from online retail to streaming entertainment and internet payments. Manoj Modi is believed to have been the driving force behind these initiatives.

The company’s patriarch, the late Dhirubhai Ambani was among those who spotted early the organizational capabilities of Prime Minister Narendra Modi even when he was a ‘karyakartha’ in Gujarat in 2001 and was carrying out earthquake relief works. He had then requested the industrialist for a helicopter.

In 2019, when Modi was sworn in as the Prime Minister for a second time, Mukesh Ambani was seated in the front row. Steel magnate LN Mittal, and port conglomerate owner Gautam Adani were sitting next to him. All three again featured when US President Donald Trump visited India in February 2020.

Mukesh Ambani’s road map of going debt-free by 2021 had hit a few road blocks due to government regulations. The Centre had moved a petition in the court to halt a proposed stake sale by Reliance Industries to Saudi Arabian Oil Company, threatening a key source of funds needed to reduce its liabilities.

The ‘pivot’ by Reliance from the Aramco deal to the new Jio deals has in fact enhanced the upside for Reliance Industries as and when the court cases get settled amicably. (A pivot occurs when a company shifts its business strategy to accommodate changes in its industry, customer preferences, or any other factor that impacts its bottom line)

The stimulus package announced during the pandemic in May 2020, which included a number of supply side reforms, is likely to help the overall expansion strategy of Jio. Modi’s Digital India program too is tied to Mukesh Ambani’s success in his telecom and IT infrastructure investments. If India were to move towards the ambitious $5 trillion economy, much of it could be on the back of productivity gains driven by disruptive services such as Jio. This is the opportunity that Jio could leverage and the timing could not be more appropriate.

The Modigliani and Miller Theorem

What is the underlying rationale behind such an expansive idea? It has a solid foundation in corporate finance in the form of Modigliani-Miller theorem. The theorem provides conditions under which a firm’s financial decision does not affect its value.

Since the value of the firm depends neither on its dividend policy nor its decision to raise capital by issuing stock or selling debt, the Modigliani–Miller theorem is often called the capital structure irrelevance principle. The key Modigliani-Miller theorem was developed in a world without taxes. In the present context, there is a tax element available which can be knocked off against the interest on debt that is to be paid and also gives the conglomerate the free cash in hand in large amounts.

Reliance, on becoming ‘net debt-free’, can pay all of its debts if they were due, immediately. Net debt shows how much debt a company has on its balance sheet compared to its liquid assets. It also shows how much cash would remain if all debts were paid off and if a company has enough liquidity to meet its debt obligations.

This means Reliance is less risky from an investor’s point of view since in the worst-case scenario it has the cash in its hands to pay off its debt but at the same time does have debts on its books which can be leveraged towards favorable tax breaks.

This is a new thing for Reliance, as historically, the company has been known to deploy a ‘high debt, high cash’ strategy. This has helped the group in keeping its options open. Reliance might not choose to pay off all its creditors and become “zero debt”. On the other hand, it could end up retaining a large part of the cash from future asset dilutions.

The timing of the deals during pandemic stands out, bucking global trends where mergers & acquisitions (M&A) markets have tanked. Going against the grain is perhaps Reliance’s nature as it has sailed through, raising billions of dollars in investments during one of the toughest business periods.

We at the Federal spoke to Senthilnathan, Director and AVP, Investments at Crest Wealth Management about this move of Reliance Industries and what it means forward for both the conglomerate as well as its investors.

(The author or his immediate family does not directly hold any equity shares in Reliance Industries or its subsidiaries.)