Cheque bounce cases need out-of-box thinking, not special courts

As the example of Debt Recovery Tribunals shows, the sheer volume of pending cases will render the special court system inefficient; the way forward would be to restrict cheque usage

In May 2022, the Supreme Court ordered the setting up of special courts to deal with the cheque bounce cases pending in large numbers. These courts will be headed by retired judges in the five states with the most pending cases.

A three-judge bench of Justices L Nageswara Rao, BR Gavai and S Ravindra Bhat, in this suo moto case, said the special courts would be set up from September 1 in Delhi, Gujarat, Maharashtra, Rajasthan and Uttar Pradesh. They will hear such cases under Section 138 of the Negotiable Instruments (NI) Act (cheque dishonour).

“We have incorporated the suggestions of the amicus curiae (friend of the court) concerning the setting up of pilot courts in five districts in each of the five states and we have given the timelines also,” the bench said.

The report submitted by the amicus curiae had read: “It is suggested that the high courts utilise the services of retired judicial officers for this purpose. This scheme could be tested on a pilot basis in five states with the highest pendency.”

Increase in pendency

The amicus curiae had further reported on May 1 that there had been an increase in pendency of 7,37,124 cheque dishonour cases in just five months. Pending cases increased from 26,07,166 in November 2021 to 33,44,290 as of April 13, 2022.

The states with the highest pendency of cases were Rajasthan (4,79,774), Gujarat (4,37,979), Delhi (4,08,992), and Uttar Pradesh (2,66,777).

A former judge opined that retired judges have the legal acumen to head special courts and handle the stakeholders in the case. The victim and the other party — the one who has issued the cheque — have a right to a fair trial, and they will benefit from the establishment of these courts.

The former judge also said that with the establishment of the special courts, India’s image as an attractive destination — where commercial disputes are decided promptly — would improve.

Specialised training

On the issue of training, the Supreme Court said the identified judicial officers, who are to preside over the special courts, would be imparted specialised modules.

A four-week training programme by the state judicial academies on topics of substantive, procedure and evidence law related to the offences under the NI Act shall be conducted for them.

Though one can be satisfied that the highest court has taken recognition of the large number of pending cases on account of cheque bounce, the remedy suggested may not actually provide a solution to the problem. What it calls for, instead, is an out-of-the-box solution.

Cheque returns as criminal offence

Until 1989, failure to discharge the liability of a payment through cheque was only a civil liability and failure to discharge was a civil wrong. Section 138 of the Negotiable Instruments Act, 1881, was introduced to make it a criminal liability.

The objective of Section 138 was to encourage the culture of use of cheques (as against cash) and to enhance the credibility of the instrument. It was meant to inculcate faith in the efficacy of the banking operations and to enhance the acceptability of cheques in the settlement of liabilities by making the issuer of cheques liable to penalties in case of bouncing of cheques. Due care was also taken to prevent the harassment of honest cheque drawers.

Prior to this, the drawer of a dishonoured cheque could only be criminally prosecuted under Section 420 of the Indian Penal Code (for offence of cheating). Section 138 of the NI Act is better than prosecution under IPC for the aggrieved.

To convict persons under Section 420 of IPC, the prosecution has to establish dishonest intentions on the part of the issuer of the cheque from the inception of the cheque. And, just because the cheque is dishonoured, the crime of cheating is not established.

However, under Section 138 of the NI Act, if a cheque is dishonoured for insufficient funds, it constitutes an offence, notwithstanding the intention of the person issuing the cheque.

But the large number of pending cases defeats the very purpose of making cheque returns a criminal offence, and the credibility of the system is seriously affected.

The existing legal provisions contain sufficient safeguards like issuing of notice of dishonour by the beneficiary within 30 days, 15 days’ time for the issuer to make the payment and one month for the beneficiary to file a complaint.

Have we learnt from the past?

In 1993, Debt Recovery Tribunals (DRTs) were started to facilitate debt recovery involving banks and other financial institutions. These were established as the regular courts were taking a long time to resolve these cases and the recovery by banks was affected.

But what do we witness now? The DRTs had over 161,000 cases pending for adjudication as on February 28, 2022, the Finance Ministry informed the Lok Sabha, highlighting the backlog. Hence, establishing special courts may not solve the problem of pending cheque bounce cases.

Way forward

Long ago, when Section 138 of the NI Act was introduced, there was a need for such a provision, as issuing a cheque was the predominant mode of payment through banks. But, over the years, technology has enabled us to transfer funds by various means like NEFT, RTGS and IMPS, and there is no compulsion to issue cheques.

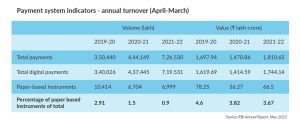

The following table reveals how we are moving away from paper-based payment systems.

It is now time to restrict the usage of cheques. Only for large payments (say ₹1-5 lakh or so), cheques can be permitted and all other payments can be restricted to online transfers. This will straightaway bring down the cheque bounce cases. There can also be substantial fees for the issue of cheques to restrict their usage.

When 20 of the 27 EU member states have effectively eliminated cheques with usage down to two cheques per capita per annum or less, with mobile phone and internet penetration, it should be possible for India to move to paperless bank transactions and that should be the best way to reduce cheque bounce cases.

We may also consider removing the penal provision of Section 138 of the NI Act, as it will be redundant with the wider adoption of online funds transfer.

(The writer is a retired banker.)