SEBI may change mutual fund TER rates: What is TER, how does it affect investors?

The Securities and Exchange Board of India (SEBI) is contemplating introducing a uniform total expense ratio (TER) for mutual fund scheme categories such as equity and debt and has released a consultation paper on this. The aim seems to be to curb mis-selling of funds and reduce investors’ costs.

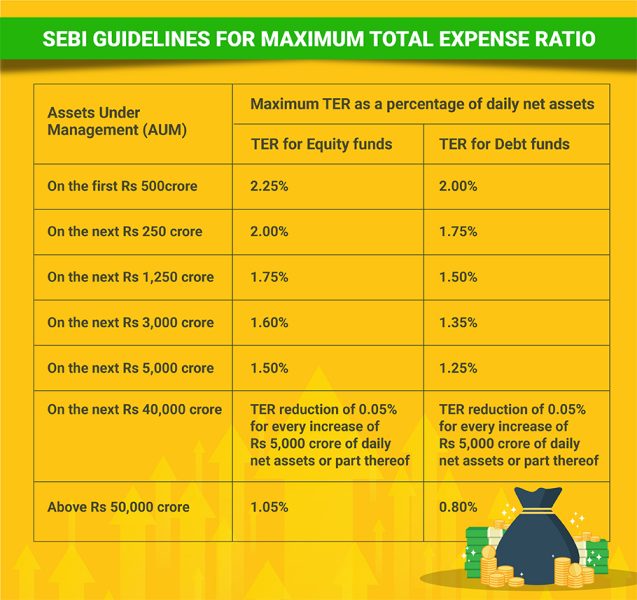

There are already certain guidelines in place on the TER that can be charged (table provided below). But some bad practices result in the diversion of funds from existing schemes (with a lower TER) to new schemes (with a higher TER) due to mis-selling by mutual fund advisers. The proposals in the consultation paper are provided separately below.

To understand the implications of this change, we must wait for the new guidelines. However, investors must first understand the implications of the TER charged by mutual funds. While the new guidelines may change the methodology, the investors must ultimately pay the charge. Hence, it is important to understand the concept.

What is total expense ratio?

The TER is the all-inclusive cost that is debited daily to the Net Asset Value (NAV) of a scheme, and it is a cost to the investor. Over longer periods, the TER makes a difference.

The TER is the sum of all costs, such as fund management costs, registry costs, administration costs, market and publicity costs, etc. The costs are added up and debited to the NAV proportionately every day so that no investor has an undue advantage due to the timing of entering or exiting the fund.

The following are the SEBI’s guidelines for the maximum expense ratio that can be charged.

The expense ratio is fungible, i.e., there is no limit on any particular type of expense as long as the total expense ratio is within the prescribed limit. The regulatory limits of TER that can be incurred/charged to the fund by a Mutual Fund AMC have been specified under Regulation 52 of SEBI Mutual Fund Regulations.

How does it matter?

Even a small difference in the expense ratio can cost you a lot of money in the long run. Suppose you invested Rs 10,000 in a fund with a 2.5% expense ratio. Assuming an average annualized gain of 10%, the value of your fund would be Rs 51,524 after 20 years.

But, had you invested the same amount in a similar-performing fund with a 0.5% expense ratio, the value of your fund would be Rs 64,122 after two decades. This is a 24% improvement over the more expensive fund.

Fund expenses can make a significant difference to an investor’s profit. If a fund realizes an overall annual return of 5% but charges expenses that total 2%, then 40% of the fund’s return is eaten up by fees. Even if the fund does not make a positive return, the expenses will be charged and that will be a double whammy for the investors.

Also read: Govt to scrap long-term tax benefit for debt mutual funds investing less than 35% assets in equity

Factors to consider

Active and passive funds: Since Exchange Traded Funds are passively managed, their expense ratio is less. The assets held in them are selected to mirror an index, and changes to the selection rarely need to be made. When a mutual fund is actively managed, the assets have to be constantly monitored and the assets may have to be changed to maximize return.

Fund with larger AUM: You can see from the table that when the Assets Under Management (AUM) grow, the percentage of total expenses permitted comes down. But there is a lower percentage only for the incremental AUM. However, it can be better to identify a fund with a larger AUM for a lower expense ratio. In the same way, one can select a fund that is growing in AUM, as the TER may come down in future.

TER is not all: In addition to TER, mutual funds have been allowed to charge up to 30 bps (basis points) more if the new inflows from retail investors from beyond the top 30 (B30) cities are at least (a) 30% of gross new inflows in the scheme or (b) 15% of the average AUM (year to date) of the scheme, whichever is higher. This is essentially to encourage inflows into mutual funds from tier 2 and tier 3 cities.

SEBI initiative: Last year, the SEBI initiated a detailed study of the fees and expenses charged by mutual funds and had said the study would seek to provide data as input for policy formulation. “The policies, as always, would seek to balance the need for facilitating financial inclusion, encouraging new participants, leveraging economies of scale, encouraging adoption of technology, discouraging cross-subsidization across schemes, closing arbitrage opportunities, and curbing malpractices,” the SEBI had said.

One expects the new guideline to discourage mis-selling. At present, investors are charged irrespective of fund performance. If SEBI initiates steps to link performance and fees, it may encourage better performance, which will be to the advantage of investors.

Proposals in the consultation paper

The consultation paper advocates the following changes in the scheme of things: 1. Introduction of performance-based fees for AMCs, 2. TER should be levied at the AMC-level and not at the scheme-level like at present, 3. The slabs should be bifurcated as equity and non-equity-based AUM, and 4. A maximum TER of 2.55% — for AMCs having an AUM up to Rs 2,500 crore (the first slab).

(The writer is a retired banker. The views expressed here are his own, and do not constitute investment advice.)