As energy hub, Russia’s nuclear power goes well beyond oil, gas lines

Sanctions by US and Europe don’t appear to be hurting Russia's Ukraine invasion much, and one key factor for this is Europe’s continuing dependency on Russia’s nuclear energy.

Sanctions by US and Europe don’t appear to be hurting Russia’s Ukraine invasion much, and one key factor for this is Europe’s continuing dependency on Russia’s nuclear energy.

Besides oil and gas, Russia supplies a significant amount of nuclear fuel and technology to a number of European countries, the US and other countries in other parts of the world.

US, China, Australia, Canada and other countries are also significant suppliers in the nuclear energy market.

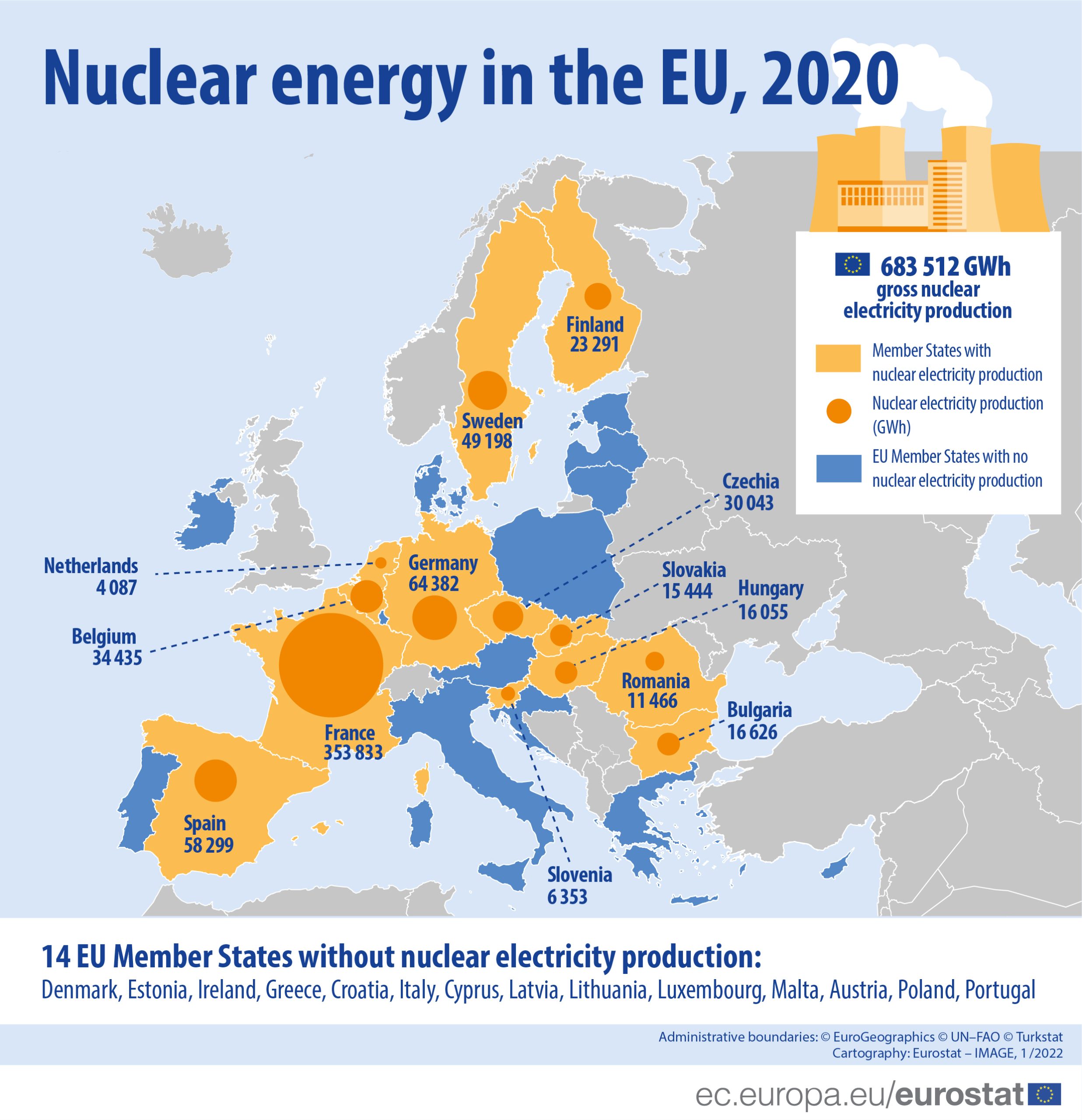

Over the decades, several countries in Europe like France, Ukraine, Hungary, Finland, Sweden have moved to nuclear energy to reduce dependency on imported fossil fuels and carbon emissions.

As of 2020, Europe imported almost 60% of its energy requirements from Russia, having not been able to produce enough energy to meet its demands.

The process of mining uranium to making it usable to building a nuclear reactor and ensuring it runs is quite complex and this makes it simply very difficult to shift or dismantle a project as compared to fossil fuel production.

Russia has only about 5% of world’s uranium reserves, but it controls Kazakhstan’s (40%) rich reserves. Also, Russia has one-third of the technology to convert mined uranium to uranium hexafluoride, which is to be used in reactors. Russia also has 43% of the global enrichment capacity, followed by Europe (about 33%), China (16%) and the U.S. (7%). Russia is also planning to move fast neutron power reactors, with substantial recycle of fuel.

Already, Russia has exported over 25,000 MWe of nuclear reactors and energy technology to countries across the world, including Belarus, Bangladesh, China, India, Turkey, Finland, Hungary, Egypt and Iran, and more is planned. Overall, the value of its nuclear exports were estimated to be $133 billion in late 2017.

Since 2011 Fukushima nuclear disaster in Japan, uranium prices have been traded at around $25 per pound. But since 2021, the prices have soared to $60 per pound following market speculation and protests in Kazakhstan.

Uranium spot prices surge to the highest level since the 2011 Fukushima nuclear disaster on concern potential sanctions aimed at Russia are poised to roil an already tight market https://t.co/gNmgSQNvn7 pic.twitter.com/7tB1VTsRHx

— Bloomberg (@business) March 11, 2022

As energy prices increase globally, Europe finds itself in a precarious situation, having committed a dependency to Russia.

Over the decades, Russia’s state-owned nuclear energy corporation, Rosatom, has become the world’s leading supplier of nuclear reactors using flexible business models, attractive financial packages and diplomatic tools that make the crucial for electricity supply and strategic in geo-politics.

Even though concerns are being raised over Russia’s use of nuclear energy for expanding its sphere of influence in geopolitics across the world and efforts are being made to move away from Russian dependency, a sudden cutting of supply lines could spell long-term and disastrous effects for the world, economically, politically and energy-wise.