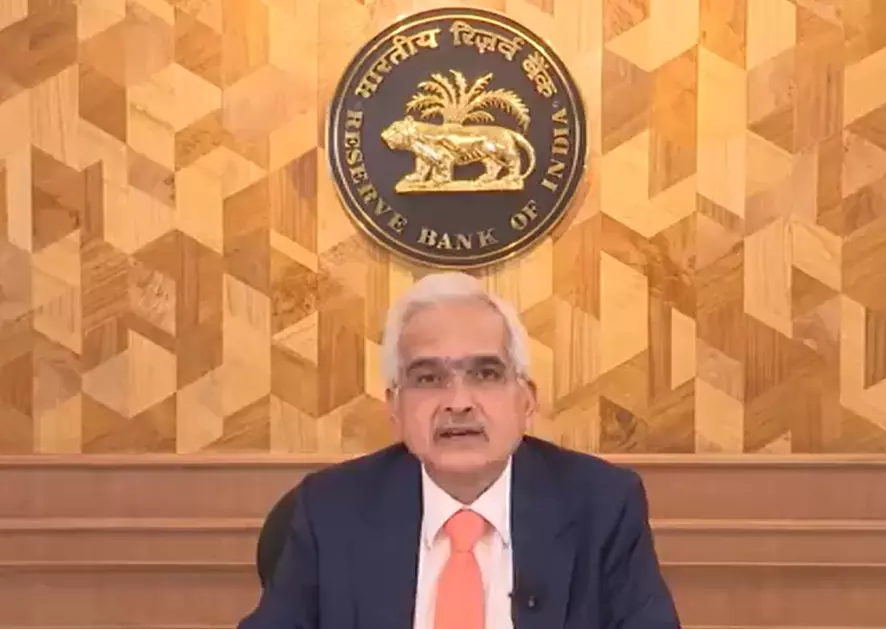

RBI’s Monetary Policy Committee maintained its repo rate at 6.5 per cent. Its governor Shaktikanta Das said the ‘primary objective is to achieve durable alignment of inflation with the target while supporting growth’. Photo: X screengrab

RBI breaks away from global rate cuts, balances inflation control with growth

As global counterparts adopt a more dovish approach, the RBI’s cautious position may set India apart, potentially affecting capital flows and the currency

The Reserve Bank of India's Monetary Policy Committee (MPC) maintained its repo rate at 6.5 per cent in a largely-expected move.

This was the 10th successive RBI meeting in which the key policy rate remained unchanged - steady but cautious action in the light of rising domestic inflation and global economic uncertainty. The MPC switched its policy stance from "withdrawal of accommodation" to "neutral," which is a more subtle move in policy focus with a decisive 5:1 majority.

The governor, Shaktikanta Das, said the "primary objective is to achieve durable alignment of inflation with the target while supporting growth". This is in sharp contrast to the dovish shifts evident in recent times at some other central banks, especially in the United States and the Eurozone, and it highlights the unique combination of challenges and priorities that India faces.

Policy implications

This shift from a "withdrawal of accommodation" to a "neutral" stance reflects the softening stance of the RBI vis-à-vis rate decisions for future periods. That means the RBI is not in a tearing hurry to hike rates or to cut them. The committee remains focussed on delivering a 4 per cent inflation target, with a leeway of 2 per cent on either side.

Governor Das's analogy about "the inflation horse being brought to the stable but needing to be cautious about opening the gate" vividly illustrates the tender see-saw under which the central bank must live. Rushing into a monetary easing of policy can undo attempts at containing inflationary pressures, not least with food prices having proven as errant as they have been and, as Das has noted, a more significant risk factor for the fiscal year ahead.

Also Read: RBI keeps repo rate unchanged at 6.5% for 10th time in a row

The central bank maintained its FY25 GDP growth forecast at 7.2 per cent, displaying no crack in its confidence in India's macro fundamentals. The RBI also kept inflation at 4.5 per cent for the same period, striking the right chord of prudent optimism. However, it warned that such a cheerful glow might be upset by external shocks, including commodity prices globally and weather events.

Global perspective

Das said optimism about inflation is susceptible to shock from weather conditions. This highlights how the central bank is looking for trends that might affect food inflation, a highly-sensitive component of India's inflation basket.

After its last half-point cut, the US Federal Reserve indicated that more such rate reductions may follow, subject to the ongoing economic scenario. The ECB recently cut its rates as Eurozone inflation dipped below 2 per cent for the first time in over two years.

Also Read: To undo the deadly noose of loan apps, RBI’s occasional warnings won’t do

These developments prompt reflection on the RBI’s unwavering commitment. As its global counterparts adopt a more dovish approach, the RBI’s cautious position may set India apart, potentially affecting capital flows and the currency.

Impacts on key sectors

The RBI’s decision has been welcomed as a promising one for the real estate sector.

Ashwin Chadha, CEO of India Sotheby's International Realty, says it would be good for homebuyers since buyers are more likely to purchase when interest rates are stable, especially around the festive season.

Going further on similar lines, Vimal Nadar, Head of Research, Colliers India, said: "The policy dynamics from 'withdrawal of accommodation' to 'neutral' opens the gates for a rate cut later on, something which would infuse much life into the residential real estate market, apart from stable borrowing costs along with judicial support recently received -including an extension of ITC - which would further enhance the commercial segment developers.".

A balanced approach

Anshuman Magazine, Chairman and CEO - India, South-East Asia, Middle East & Africa, CBRE, said the RBI's decision to hold the repo rate steady reflects a balanced approach to achieving economic growth and managing inflation levels.

Also Read: S&P retains India's growth forecast at 6.8%, expects RBI to cut rates in Oct

“As we approach the festive season, the decision will likely support the sector's ongoing momentum. The strong performance in the first half of 2024 across most real estate segments, coupled with a seasonal peak in activity, indicates that the real estate sector is well-positioned for continued growth during this period,” he said.

However, the RBI's concerns that some NBFCs are aggressively expanding hint at possible regulatory tightening ahead. The central bank said that some NBFCs had channelled their energies toward unchecked retail targets rather than sound underwriting practices, warning of the possibility of systemic risks.

Liquidity and financial stability

Governor Das said the way forward would be for the NBFCs to take self-corrective measures, although RBI will maintain close supervision and will not blink an eyelid if necessary.

This upgrade of the digital-payments infrastructure is part of the RBI's vision for financial stability. Regarding the development steps, the transaction limit through UPI 123Pay has been increased to ₹10,000 from ₹5,000, and the wallet in UPI Lite has been increased to ₹5,000. This should give an impetus to digital payments in rural and semi-urban locations.