FDI 2021: India in top 10 despite fall in investment, reveals Unctad report

Large projects in India include the construction of a steel and cement plant for $13.5 billion by ArcelorMittal Nippon Steel and a new car manufacturing facility by Suzuki Motor for $2.4 billion

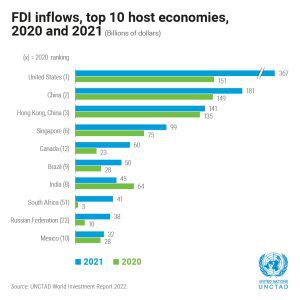

Foreign direct investment (FDI) inflows to India declined by $19 billion to $45 billion in 2021, but the country still remained among the top 10 global economies for FDI last year, according to the United Nations.

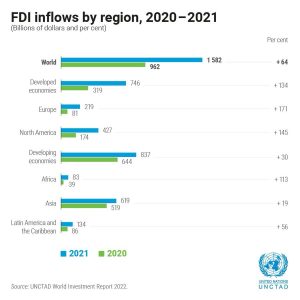

According to the United Nations Conference on Trade and Development (Unctad) World Investment Report, flows of FDI recovered to pre-pandemic levels last year, hitting nearly $1.6 trillion. However, the prospects for this year are grimmer as global FDI in 2022 and beyond will be affected by the security and humanitarian crises caused by the Ukraine war, by macroeconomic shocks set off by the conflict, by energy and food price hikes, and by increased investor uncertainty.

Also read: 5G allocation to bulk users would be coal scam redux

India ahead of South Africa, Russia

India, which had received $64 billion in FDI in 2020, recorded a decline in FDI inflows in 2021 at $45 billion. But it was still among the top 10 economies for FDI inflows in 2021, ranking 7th after the US, China, Hong Kong, Singapore, Canada and Brazil, said the Unctad report. South Africa, Russia and Mexico rounded up the top 10 economies for FDI inflows in 2021.

Flows to India declined to $45 billion. However, a flurry of new international project finance deals were announced in the country — 108 projects, compared with 20 projects on average for the last 10 years — the report said, adding that the largest number of 23 projects was in renewables.

Large projects include the construction of a steel and cement plant in India for $13.5 billion by ArcelorMittal Nippon Steel (Japan) and the construction of a new car manufacturing facility by Suzuki Motor (Japan) for $2.4 billion.

Outward FDI from South Asia, mainly from India, rose by 43 per cent to $16 billion.

Ukraine war’s global impact

The report noted that the war in Ukraine will have far-reaching consequences for international investment in economic development and the Sustainable Development Goals (SDGs) in all countries. It comes as a fragile world economy was just beginning an uneven recovery from the effects of the pandemic.

Also read: Consumer confidence improving but still in pessimistic zone: RBI survey

The report said the direct effects of the war on investment flows to and from Russia and Ukraine include the halting of existing investment projects and the cancellation of announced projects, an exodus of multinational enterprises (MNEs) from Russia, widespread loss of asset values and sanctions virtually precluding outflows.

It added that to date, MNEs from China and India account for a negligible share of FDI stock in Russia (less than 1 per cent), although their share in ongoing projects is larger.

Resilience of Asia

The report said despite successive waves of COVID, FDI in developing Asia rose for the third consecutive year to an all-time high of $619 billion, underscoring the resilience of the region. It is the largest recipient region of FDI in the world, accounting for 40 per cent of global inflows.

The 2021 upward trend was widely shared in the region, with South Asia the only exception, where FDI inflows declined by 26 per cent to $52 billion in 2021 from $71 billion in 2020 as the large M&As (mergers and acquisitions) registered in 2020 were not repeated.

Inflows remain highly concentrated and six economies (China, Hong Kong, Singapore, India, the UAE and Indonesia, in that order) accounted for more than 80 per cent of FDI to the region.

The report noted that international project finance announcements in industrial real estate have also grown continuously for several years, with no let-up during the pandemic. In 2021, deal numbers tripled to 152 projects with a value of $135 billion. Large projects include the construction of a steel and cement manufacturing plant in India for $14 billion and the construction of a 960-hectare pharmaceutical park in Vietnam for $10 billion.

Giant share of R&D investment

Further, it said that more than 60 per cent of greenfield investments are in developed economies, especially in Europe (45 per cent). Of the research and development (R&D) investment in developing economies, India captures almost half of all projects.

In developing economies, American MNEs targeted India in 8 per cent of the deals, mostly buying minority stakes to gain access to the market and to local innovative solutions.

For example, eBay (US) jointly with Microsoft (US) and Tencent (China), acquired an undisclosed minority stake in online retailer Flipkart (India), for $1.4 billion in 2017. Similarly, Paypal (US) acquired undisclosed minority stakes in a range of Indian companies across several industries, including software providers, online brokerage systems, professional services and electronic payments (Moshpit Technologies, Speckle Internet Solutions, Scalend Technologies, Freecharge Payment Technologies).

It added that four Chinese companies accounted for 11 per cent of the deals and invested a relatively higher share in developing-economy MNEs (34 per cent) than their developed counterparts did. They invested especially in Asia, with shares divided equally between India and South-East Asia, it said.

Investment facilitation measures

The report noted that investment facilitation measures undertaken by nations accounted for almost 40 per cent of all measures more favourable to investment. Many new measures concerned the simplification of administrative procedures for investment.

For example, India launched the National Single-Window System, which will become a one- stop shop for approvals and clearances needed by investors, entrepreneurs and businesses.

With agency inputs