Budget: How much sense does zero capital allocation for banks make?

When significant credit growth is anticipated, it is essential to equip banks with adequate capital and adequate resources to meet such credit demand

While presenting the Union Budget for the FY 2023-24, Finance Minister Nirmala Sitharaman has not indicated any allocation towards capital infusion for public sector banks. Why this is so is not clear as the Economic Survey, presented in Parliament a day before on January 31, had anticipated good credit growth by banks.

Also read: Budget offers bounty, but with subtly placed caveats

The Economic Survey 2022-23 had said the following regarding the banking sector:

- Credit growth is likely to be brisk for the micro, small and medium enterprises (MSMEs) in FY2023-24, provided inflation remains benign and cost of credit is low.

- The MSME sector witnessed a credit growth of about 31 per cent in January-November 2022.

- Banking sector in India has responded in equal measure to the demand for credit as the year-on-year growth in credit since the January-March quarter of 2022 has moved into double digits and is rising across most sectors.

- The finances of public sector banks (PSBs) have seen a significant turnaround with profit being booked at regular intervals and non-performing assets being fast-tracked for quicker resolution/liquidation by the Insolvency and Bankruptcy Board of India (IBBI).

- The government has been providing adequate budgetary support for keeping the PSBs well capitalized, ensuring that their capital risk-weighted adjusted ratio (CRAR) remains comfortably above the threshold levels of adequacy.

- Growth is expected to be brisk in FY24 as a vigorous credit disbursal and capital investment cycle is expected to unfold in India with the strengthening of the balance sheets of the corporate and banking sectors.

Need to equip banks

When significant credit growth is anticipated, it is essential to equip banks with adequate capital and adequate resources to meet such credit demand. Only by timely meeting credit demand of industries can accelerate growth.

Also read: Budget 2023-24: Pro-growth and forward-looking, says India Inc

Banks need to mobilise necessary deposits to lend and as the government is a big borrower in the system, the extent of liquidity left in the system is important for such mobilisation. The central bank may monitor and provide adequate liquidity in the system.

However, as banks’ lending capacity is based on Capital Adequacy Ratio (CAR) also, it is necessary that banks should be provided with necessary capital. In the case of public sector banks, the government has to ensure that.

CAR is the ratio of a bank’s capital in relation to its risk weighted assets and current liabilities. It is decided by the central bank and bank regulators to prevent commercial banks from taking excess leverage and becoming insolvent in the process. It is also known as the Capital to Risk (Weighted) Assets Ratio (CRAR).

Present level of CRAR

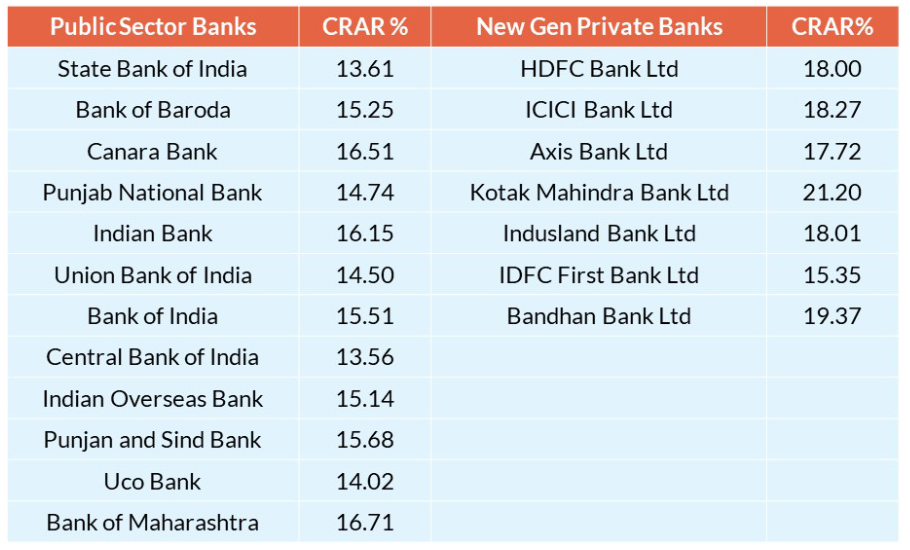

The following table provides CRAR of public sector banks and some selected new generation private sector banks as on September 2022.

When we look at these figures, we can understand that generally the private sector banks are well equipped with higher CRAR which will enable them to meet credit demands.

Recapitalising banks

The government adopts a unique way of providing capital to the banks. It is like having the cake and eating it too — the banks are provided with necessary capital on the one hand and then they are asked to buy government bonds for the equal amount. These are called recapitalisation bonds. Hence, the bank’s capital will increase and investment in government bond will also increase for the same amount. Promoters of private banks do not have this luxury of financing their banks through such accounting gimmicks.

As per the statement of Minister of State for Finance Bhagwat Karad to Parliament, the government has infused Rs 3,10,997 crore to recapitalise banks during the last five financial years i.e., from 2016-17 to 2020-21. Out of which, Rs 34,997 crore were sourced through budgetary allocation and Rs 2,76,000 crore through issuance of recapitalisation bonds to these banks.

The government last provided capital support to banks in 2021-22. It had earmarked Rs 20,000 crore for recapitalisation of PSBs through supplementary demands for grants.

In earlier years, weak balance sheets of public sector banks warranted infusion of equity capital by the government and when the recapitalisation is done through this bond route, it is liquidity neutral for the government. The government has to pay only the coupon on the bonds issued.

Also read: Budget 2023-24: Thrust on Ease of Doing Business, MSMEs; PAN common identifier

Recently, the government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the bank Rs 5,500-crore worth Special Zero Coupon Recapitalisation Bonds. In this case, the coupon rate is kept as zero and there is no outflow even as interest from the government. These bonds are not tradable or transferable.

Conclusion

When the economic survey anticipates good credit growth by banks, which may be possible only with comfortable CAR, it is not clear why no budgetary allocation has been done to shore up capital of public sector banks. As this is being done only through recapitalised bond route, funds’ constraint cannot be a reason. The finance minister must at least elaborate the roadmap for meeting credit demand from banks.