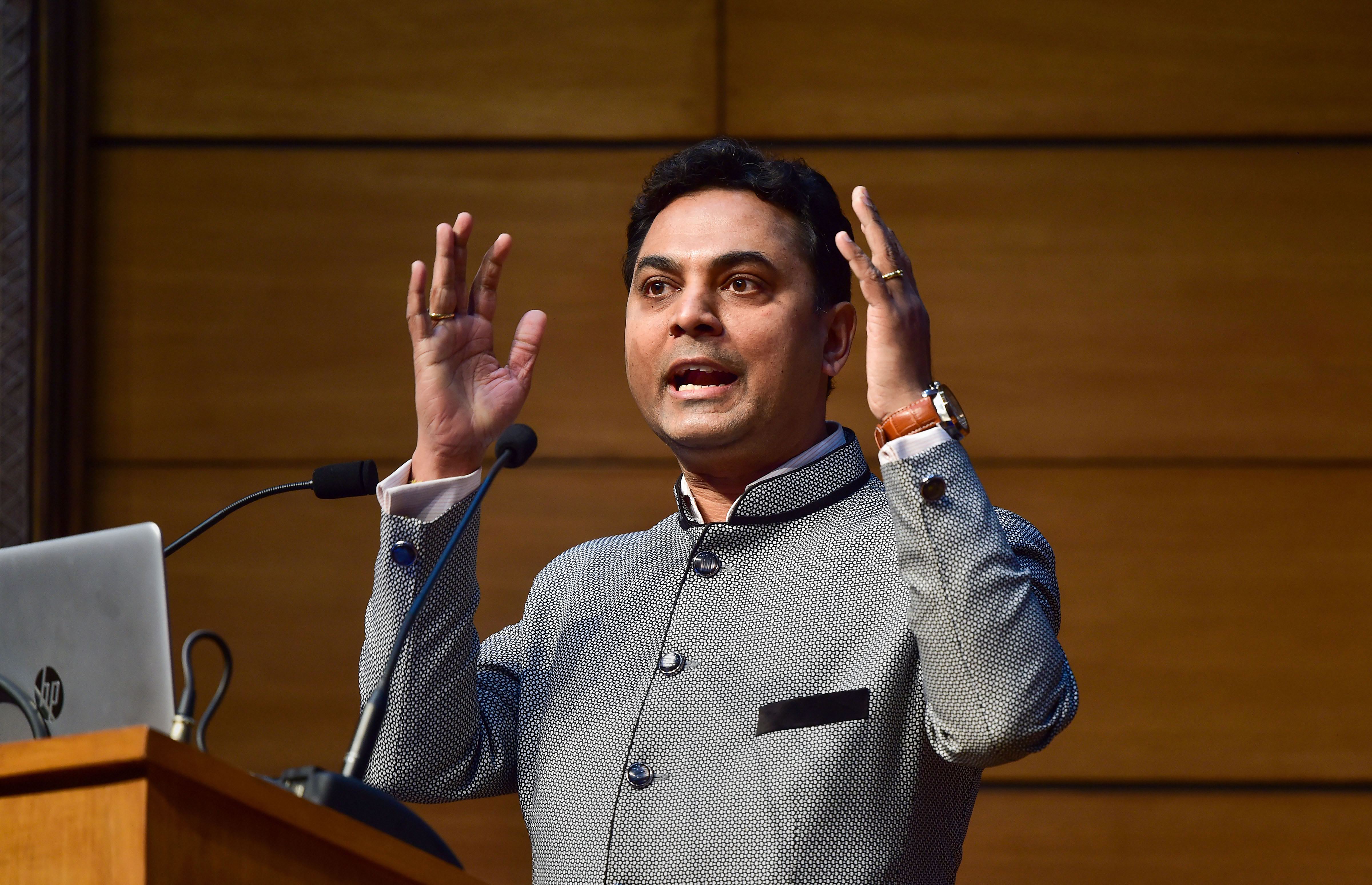

GST structure will be revamped into 3 slabs ‘soon’: CEA Subramanian

GST, which just turned 4, will shortly undergo a structure rationalisation into three slabs from the current four, said Krishnamurthy Subramanian, CEA

The goods and services tax (GST), introduced in July 2017, will shortly undergo a structure rationalisation into three slabs from the current four, according to Krishnamurthy Subramanian, Chief Economic Advisor (CEA). This will be done by merging two existing slabs.

“It’s something that is definitely going to happen,” Subramanian said at an event. The three-rate structure is definitely important. Even the inverted duty structure that is there is equally important to actually fix. The government is definitely seized of the matter. You should hopefully see traction on that soon.”

Also read: Should India cut import duty on EVs? India Inc responds to Tesla call

The CEA was speaking at Assocham’s 2nd National E-conclave on Productive Use of Financial Resources, ‘Roadmap for Economic Rebound’.

Perfect vs excellent

Initially, the plan had been to introduce a three-rate structure of GST, he said. “However, what we have to be very cognizant about is that often, with policymaking, you don’t want perfect to become the enemy of excellent,” a Mint report quoted him as saying. “GST, the way it got created with five rates, was basically an excellent move because now we are seeing the amounts that are coming in. The policymakers must be given credit for being practical enough to say, ‘let’s get it going first’.”

The report further noted that at present there are four GST rates — 5%, 12%, 18% and 28%. Apart from this, there is a cess on luxury and ‘sin’ goods such as automobiles, tobacco and aerated soft drinks. Plus, there is an additional levy on precious stones and metals, of 0.25% and 3%, respectively.

If the Centre consolidates the GST rates, it is likely the 12% and 18% slabs will be merged. The GST Council will be taking a decision on the subject. Mint noted that if the slabs are merged, the items in the current 12% slab — such as ghee, butter, cheese and spectacles — may become costlier. Those in the current 18% slab — such as expensive soap, kitchenware and apparel — may get cheaper.

‘Choices driven by hope’

Further, an Assocham press release quoted Subramanian as saying the government’s choices are “driven by hope”, while that of its opponents are driven by “excessive fear”.

“If you see the reforms and seminal reforms that have been done over the last year and a half, you will see clear signals that the policy reforms that the government has taken are clearly driven by hope, even as a lot of commentary seems to be driven by excessive fear,” he remarked.

The CEA said he had suggested a V-shaped recovery after the first quarter numbers that showed a roughly 24% decline. “We are very glad to note a V-shaped recovery in economic growth. As a matter of fact, India is the only country among large countries, which have had two consecutive quarters of growth,” he added.