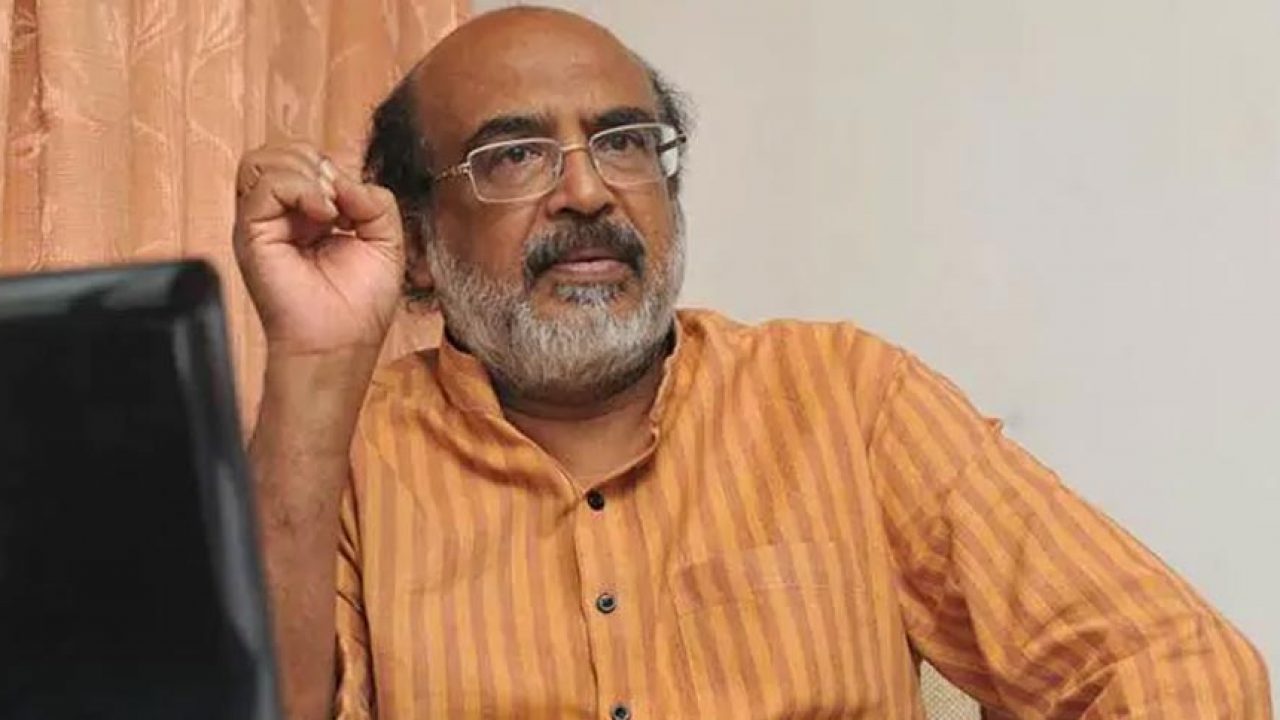

Gold smuggling: Kerala FM Isaac points to loophole in Centre's e-way bill system

Kerala Finance Minister Thomas Isaac has slammed the BJP government at the Centre for leaving a loophole in the e-way bill system that enabled gold smuggling. “Any product that values over ₹50,000 requires e-way bill to be transported within the country. But gold and other precious stones are exempted. Once the customs clearance at entry points is done, anyone can carry any amount of unbilled Gold anywhere in India,” he said.

Dr. Isaac told The Federal that Kerala had consistently been demanding the inclusion of gold in the list of goods that require e-way bill. “This has been in discussion since the introduction of GST. But BJP-ruled states had strongly opposed Kerala’s demand to make e-way bill mandatory for gold,” he said.

“If smuggled gold is used to finance terrorist activities, the Centre must take actions to expand the tax net of gold. Otherwise, it is to be understood that BJP government is only facilitating the illegal transaction of gold,” said Dr. Isaac, blaming the Centre for the flow of ‘dirty gold.’

Though the Centre had formed a committee of ministers from various states to look into these issues, a consensus could not be made, said Issac. “We have even asked (the Centre) to make e-way bill compulsory for the transportation of gold at least in Kerala, if BJP-ruled states are not willing.”

Movement of gold/precious metals and stones is exempted from the e-way bill under 138(14)(a) of CGST Rule, 2017.

During a meeting of ministers in New Delhi on January 18 to examine the feasibility of the implementation of e-way bill system, Kerala had unambiguously sought the inclusion of gold in it.

Related News: NIA takes Swapna Suresh, Sandeep Nair into custody in gold smuggling case

According to the meeting minutes, a copy of which was obtained by The Federal, Gujarat had opposed the proposal on the grounds that any information on the movement of gold or precious metal/stone may pose a serious security risk. The joint secretary of the revenue department had also expressed reservations upon the practical difficulties in it.

The GST Council had also expressed apprehension that the introduction of the e-way bill system might not help in resolving the problem. In a meeting convened on March 3, 2020, the issue was discussed further, but no decision was made.

According to sources, an average of 250-ton gold is being smuggled to India every year. Tax authorities in the state have no role in scrutinising the flow of gold through seaports and airports. “Customs is the only authority to have a check on the entry point of gold. Once it enters the country, free flow is possible because of the provisions in the GST Act,” said Dr. Isaac.

The sources added that the tax authorities in the state had seized 110 kg of gold during vehicle checks in 2019-20. However, the department has to release the seized gold, if the tax is paid along with the fine.

“When we examine last year’s scenario, we could see that the state had received only 2.8 crore in tax from the seizure of gold, which is a meagre amount for smugglers. On the other hand, Customs has larger powers so as to confiscate the entire amount of gold. Dr. Isaac said that, so far, not even a single case of seizure by the central tax department was known.

Related News: NIA takes up probe in Kerala gold smuggling case, lodges FIR

Section 130 of the CGST Act empowers state governments to confiscate unaccounted goods, whereas Section 129 enables the release of the seized goods if one pays the fine and the same amount of tax.

A recent judgment passed by the Kerala High Court stipulates that Section 130 can be invoked only after the provisions of Section 129 are exhausted. In other words, if the carrier is willing to pay tax and fine for the seized gold, authorities cannot confiscate the same.

However, during the VAT (value-added tax) regime in Kerala, major gold dealers had opted for compounding scheme and the tax was fixed based on the previous year’s turnover. There was no input tax credit for those dealers and this also had contributed to high revenue from the gold market.

When GST was introduced, the tax on gold was reduced to 3 per cent and, in effect, the state’s share became 1.5 per cent — that too with input tax credit. This fall from 5 per cent to 1.5 per cent is the major reason for the fall in revenue from the gold industry.

Considering the increase in the price of gold and also its demand in the state, there should have been a growth in the sector. However, the industry is not showing any growth under the GST regime.

On the other hand, there is a rigorous flow of smuggled gold which is much higher than estimated. In lure of big profits through tax avoidance, smugglers have come up with numerous innovative ways to transport gold clandestinely into the State.