Mutual funds: Why growth plans are a better option for investors

When an MF pays dividend, the net asset value of the fund comes down correspondingly and hence the outstanding investment of the investor also comes down

While making some investments under a mutual fund scheme, Ashok opts for a dividend plan. He thinks if he opts for a growth plan, he may not get periodical payments that he prefers to manage his funds requirements.

He also prefers to select MF schemes which declare periodical dividends. Mentally, he equates the dividend plan with banks’ fixed deposit schemes where interest is paid periodically. Is it the right approach? What should be the basis to opt for a dividend plan or a growth plan?

Personal Finance: Zerodha’s Nithin Kamath gives 5 tips to avoid ‘retirement crisis’

Generally, MF distributors encourage growth schemes “if one does not need regular cash flows”. Even some fund houses suggest this. But that may not be the right approach.

Growth vs dividend option

In the growth option, profits made by the scheme are reinvested in the scheme instead of being paid out to investors. Since profits are reinvested in the scheme, the investor can earn profits on profits and thereby benefit from compounding. Under the dividend option, profits booked by the fund manager are distributed to the investor.

Dividend distribution by an MF is not similar to one by a company (to its stockholders). Dividend distribution by a company is out of the profit earned by it. It indicates the company’s profitability and also how much it distributes out of its profit.

When an MF pays dividend, the net asset value of the fund comes down correspondingly and hence the outstanding investment of the investor also comes down.

Personal Finance: Post-retirement nest eggs for those who value safety, regularity

Instead of opting for a dividend plan, one can opt for a growth plan and use the redemption facility for any periodical requirements. There are even systematic withdrawal plans available.

Taxation is different

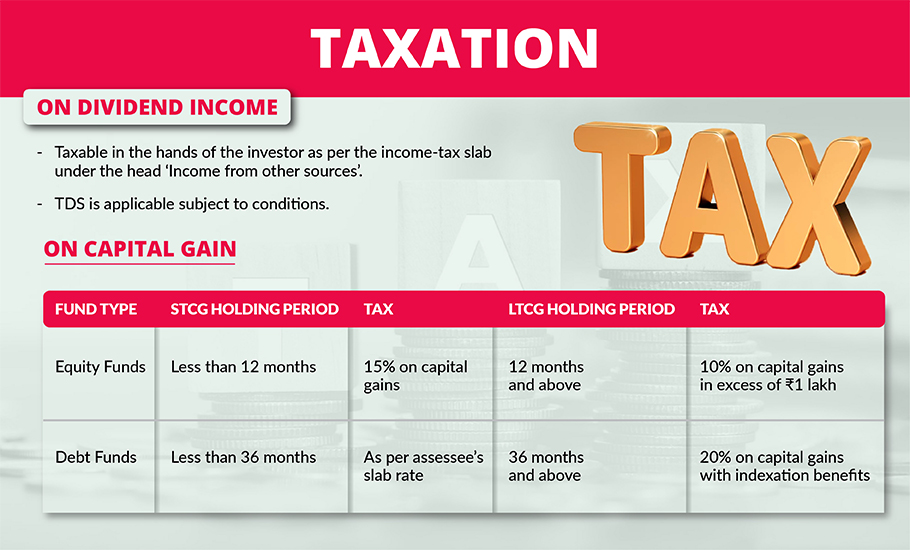

Taxes on dividend and redemption are different. After the abolition of the Dividend Distribution Tax in 2020, the entire dividend income is taxable per the income-tax slab under the head, ‘Income from other sources’.

TDS (tax deducted at source) is also applicable to the dividend distributed by the MF scheme. Under the new rules, when an MF distributes dividend to its investors, it must deduct 10 per cent TDS under Section 194K if the total dividend paid to an investor exceeds ₹5,000 during a financial year. This can be claimed when the tax return is filed.

For redemption, there is a tax on capital gains. This depends on the type of MF and also the duration of investment. For equity funds, the short-term capital gains (STCG) holding period is less than 12 months and for debt funds, it is less than 36 months. Beyond this period, it is treated as long-term capital gains (LTCG).

Personal Finance: Choosing PMS over MF? Do it only if you’re rich and well-informed

STCG on the sale of units of equity-oriented MF schemes is charged at 15 per cent. On debt schemes, it is charged per the assessee’s tax slab.

LTCG tax on MFs (equity-oriented schemes) is charged at the rate of 10 per cent on capital gains in excess of ₹1 lakh. On debt-oriented schemes, it is charged at 20 per cent with indexation benefits.

Takeaway

It is clear that one can save tax by opting for a growth scheme and use the redemption facility instead of opting for the dividend plan. In the dividend plan, the entire dividend receipt is taxable, apart from the TDS provision, whereas the tax on capital gains may be favourable.

Moreover, redemption can be exercised by the individual investor independently, whereas dividend is decided by the mutual fund house.

The exception

Equity-linked savings schemes come with a lock-in period of three years. So, one cannot redeem units during that period. If one opts for the dividend plan in this case, and if the fund also declares dividends during the lock-in period, it may be useful to the investor as it increases the cash flow. In all other cases, there is no need to opt for a dividend plan.

(The writer is a retired banker. The views expressed here are those of the writer, and do not constitute investment advice.)