Buy Now, Pay Later schemes can be costly; here's why

While buyers view BNPL as a deferred payment option, the service provider treats it as a short-term loan; that comes with attached costs

Buy Now Pay Later (BNPL) is a new financing option available to buyers of products or services. It allows consumers to buy products or avail themselves of services instantly and pay for the same at a later date, as a lump sum or in instalments. Though it is not explicitly stated as a loan product, clearly, it is a short-term loan product.

Generally, the buyers are allowed to pay for the purchase in 15-30 days and, apparently, no interest is charged for this period. However, as the saying goes, there are no free lunches anywhere and if no interest is charged for the deferred payment, it then means that the interest is indirectly loaded into the sale price of the product.

It is reported that the market for BNPL is booming in India. As per RazorPay’s The Covid Era of Rising Fintech report, the BNPL market has grown 569 per cent in 2020 and 637 per cent in 2021. Further, as per Indian consultancy Redseer, the BNPL market is likely to grow from $3-3.5 billion currently to $45-50 billion by 2026.

There are pure-play BNPL firms such as Simpl, ZestMoney, LazyPay, Flexmoney, ePayLater, Paytm Postpaid, Amazon Pay Later, Flipkart Pay Later etc., and they are not connected with any banks. Traditional banks, too, have also forayed into the segment in addition to e-commerce giants and payments companies. This includes HDFC Bank’s FlexiPay and ICICI Bank’s ICICI PayLater offerings.

Need to regulate

A working group on digital lending, which included lending through online platforms and mobile apps, set up by the Reserve Bank of India (RBI) on January 13, 2021 submitted its report on November 18, 2021.

The committee has underlined the importance of regulating lending through online platforms like the BNPL schemes on the following lines: “Technological innovations have led to marked improvements in efficiency, productivity, quality, inclusion and competitiveness in extension of financial services, especially in the area of digital lending. However, there have been unintended consequences on account of greater reliance on third-party lending service providers mis-selling to the unsuspecting customers, concerns over breach of data privacy, unethical business conduct and illegitimate operations”.

“While the current share of digital lending in the overall credit pie of the financial sector is not significant enough for it to affect financial stability, the growth momentum has compelling stability implications. It is believed that ease of accessing digital financial services, technological innovations and cost-efficient business models will eventually lead to a meteoric rise in the share of digital lending in the overall credit,” it added.

Also read: Digital currency to come out from RBI itself this year: Finance Minister

The working group has recommended in the near term (within one year) to set up a nodal agency, which will primarily verify the technological credentials of digital lending applications (DLAs) of the balance sheet lenders and lending service providers (LSPs) operating in the digital lending ecosystem, and also to establish a self-regulatory organisation. There are various other recommendations to be implemented in the near term as well as in the medium term and one expects that the RBI will implement them in the course of time.

Attached costs

Meanwhile, when it is not well regulated, there are some misrepresentations and misunderstandings about the schemes on offer. The buyers of a product think the deferred payment option is only a payment option, whereas the app operator or service provider treats it as short-term finance. When it is a short-term finance, there is a cost attached to it and this is indirectly loaded into the product price.

Also, when it is a loan, the default reduces a consumer’s credit score. Many consumers are surprised when their CIBIL score is affected after availing themselves of a BNPL option and there is a default. This is because they never saw it as a loan product in the first place.

There are reports as well that persons who are using this facility risk a drop in their credit scores. There are many incidents in which people have said their credit scores have reduced after using the BNPL feature. It appears that the entities who offer this feature raise loans in the name of the buyers and the buyers are not able to recognise such loans. It is when they find out that the loan matches the BNPL amount, they realise they are loans, which are reported to credit rating agencies and ultimately affect their credit score.

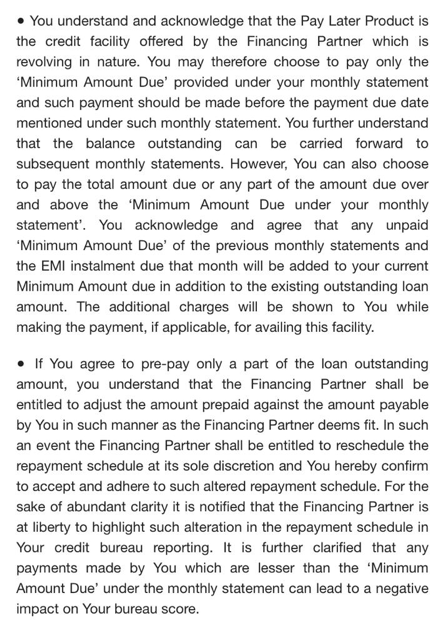

While availing the BNPL facility, as a matter of routine, people sign up, accepting various terms and conditions in small print. The consumer does not try to understand the terms and the service provider also does not bother to explain the terms. A typical fine print is on the following lines

It is time the RBI implemented the recommendations soon and ensured orderly conduct of BNPL schemes within the framework of regulated activities. This will enable consumers to make informed decisions while accepting finance under BNPL.

(The writer is a retired banker)