Dividing assets and doing it well, the Mukesh Ambani way

Distribution of business assets to avoid acrimony is a given; the inheritors must learn the ropes as leaders, and not just as brilliant performers in a division of labour within the family; Akash’s elevation represents that

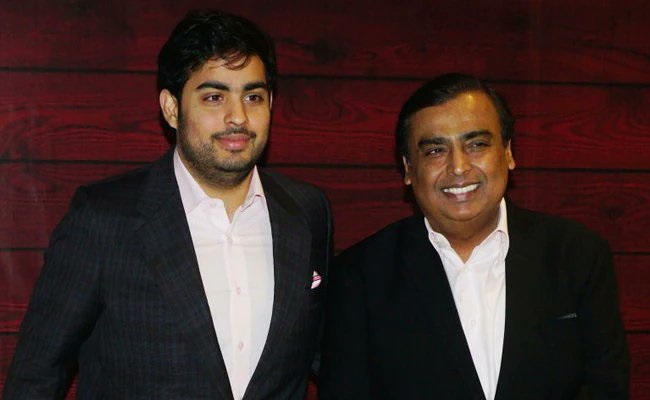

The sky doesn’t quite fall on Jio Infocomm with Mukesh Ambani, the man whose vision, ambition and ruthless pursuit of that ambition have made the company the main driver of India’s digital revolution, stepping down. Akash, literally the sky, is going up as chairman of the telecom giant, to replace his father.

Mukesh will remain chairman of Jio Platforms, which wholly owns Jio Infocomm. Reliance Industries Ltd (RIL), in turn, owns 67 per cent of Jio Platforms. Mukesh continues to chair the board of RIL. The net result of the leadership change at Jio Infocomm is to hand over controls to the Ambani scion while Papa is still at hand to offer guidance and support, if these are needed, rather than any drastic change in the corporate culture, strategy or fortunes at India’s largest telco.

Also read: Cryptos going the way they were meant to go — south

Clearly, Mukesh Ambani is determined to not repeat the mistake his father had made. Dhirubhai Ambani died without leaving a will, and left both his sons discharging different functions at the self-same company, Reliance Industries. This led to a succession battle, division of assets and the eventual decline of younger brother Anil Ambani’s business empire. Decline would, in all honesty, be a euphemism. At one point, Mukesh had to pony up the funds needed to pay off an Anil Ambani group debt, to keep his brother out of jail.

Hard-learnt lesson

The lesson Mukesh has learnt is not just that the distribution of assets among his children must be carried out in an orderly fashion while he is still alive, to avoid acrimony and attrition. That much is pretty obvious. What he also seems to have learnt is that inheritors of business assets must learn the ropes as leaders, and not just as brilliant performers of assigned functions in a division of labour within the family.

Even as Dhirubhai looked on in approval, Mukesh concentrated on project execution, while Anil focused on finance, liaison with the government and the media. Both were pretty good at their jobs. Reliance used global consultants and contractors to set up their first refinery. When it came to setting up a much larger facility, the company did the job with its in-house team, based on the diligent learning undertaken during the implementation of the initial phase.

Also read: Vodafone-Idea – Three big stakeholders, with none to love

The refinery, one of the most complex ones of the world, capable of refining any grade of crude, sources crude from across the world, identifying the crude that would give the company the highest refining margins by the time it completes the transaction chain of being shipped to Jamnagar, refined and being exported as the price-optimising mix of diesel, petrol and other fuels.

RIL performed India’s first equity issuance abroad, via global depository receipts, as soon as regulation permitted it. It employed the finest finance professionals to raise capital at the best possible rates from around the world. It never suffered from adverse government policy, as policy refashioned itself to suit its requirements. The media played a supportive role. The two sons shone in their respective roles.

Diverse skill-sets

But when the empire broke up and was divided up among Dhirubhai’s two sons, each lacked the skills the other had specialised in. Mukesh got his act together soon enough and, in any case, success in execution speaks for itself and wins respect, sooner or later.

Executing projects involves a great deal of delegation of carefully identified responsibility and trusting those entrusted with the task to perform it, without second-guessing them all the time. This came naturally to Mukesh, even as Anil struggled with it. Reliance Capital became the last place where competent professionals stayed on at the top.

When the time came for him to groom his successors in their corporate roles, Mukesh would seem keen to avoid the premature specialisation in disparate functions that he and his sibling had undergone. By appointing Akash as the chairman of Jio Infocomm, he is giving him the opportunity to lead all functions, bar none.

Mukesh does have four businesses to divide up among his children: refinery and petrochemicals, telecom and digital businesses, retail and new energy. While refinery & petrochemical is the cash cow of the group, its future in a climate-change-wary world is clouded.

Telecom and digital businesses represent the pasture where unicorns frolic as young foals, and grow into giant, potentially global businesses. As the internet mutates into the metaverse or Internet 3.0 and blockchains snag everything from healthcare to property records, apart from financial transactions, those who manage the ecosystem stand to gain immensely.

Also read: Stop beating down on central bankers

Power of retail

Organised retail can only grow. India is just about one-third urban, about half as much as China. As India grows fast, so would the proportion of the population living in towns. New towns would come up. It is estimated that of the total number of buildings that would host humanity by 2060, about half are yet to be built. The proportion of the population living in towns would go up dramatically, and so would the share of organised retail in the overall retail industry.

Right now, Reliance Retail might claim its impressive gross merchandise value (GVA) based on, to a large extent, its diamond and jewellery business, but it is only a matter of time before it picks up sizable volumes, along with other players in the sector. Whichever of the children ends up with the retail business – it could be the daughter, by present indications – they would have a major business selling stuff to more than 1.4 Indians.

Mukesh announced, at the latest annual general meeting of RIL, his goal to supply green hydrogen at $1 a kg. He made this bold announcement at a time when US President Joe Biden’s ultimately doomed infrastructure bill was touting a $5 subsidy per kg of green hydrogen. Subsequently, fellow billionaire heavyweight from Gujarat, Gautam Adani, also joined the quest to batter down the price of green hydrogen, with large investments in the sector.

Promise of green hydrogen

Green hydrogen is the preferred solution to renewable energy’s intermittency problem. When the wind does not blow and the sun does not shine, where is one to find carbon-free energy? Use the power from wind turbines and solar farms to split water into hydrogen and oxygen, use that hydrogen, made entirely from renewable power, as a clean fuel.

Hydrogen can be stored, transported by pipe and tanker, used as the heat source in cement and steel industries, used as fuel in trucks and ships, and even burned in gas turbines to produce clean power. Green hydrogen will be a major global business – unless nuclear fusion becomes viable and becomes the principal source of clean energy.

For those of us who have only a peripheral interest in the affairs of the Ambani family, on the lines of watching a television serial called Papa kehte hai bada kaam karega, the pre-emption of confrontational division of one of Asia’s biggest business empires represents loss of excitement in the spectacle. For investors and other stakeholders in Reliance, the elevation of Akash to corporate leadership is a happy augury of no dark surprises in the future.

(TK Arun is a senior journalist based in Delhi)

(The Federal seeks to present views and opinions from all sides of the spectrum. The information, ideas or opinions in the articles are of the author and do not necessarily reflect the views of The Federal)