IT returns' deadline extended; process made faster with pre-filled forms

The Central Board of Direct Taxes (CBDT) has extended the deadline for filing Income Tax Returns (ITR) for certain categories of taxpayers to August 31, 2019. The move will bring relief to the taxpayers who were facing problems in filing returns by July 31.

The move comes after chartered accounts and taxpayers requested the government to extend the deadline so that they can file the ITR properly.

To ease the process, the income tax department has introduced pre-filled forms that will allow individuals to file their returns faster.

The pre-filled forms already contain details of employer, allowances, deductions, dividend, and interest income and so on. You can download these pre-filled forms from the income tax website (www.incometaxindiaefiling.gov.in) as XML file and upload into the excel utility of the relevant ITR form. Taxpayers can also edit these pre-filled columns.

Depending on the income and residential status, an individual can file income tax returns under either of the four categories — ITR-1, ITR-2, ITR-3 and ITR-4.

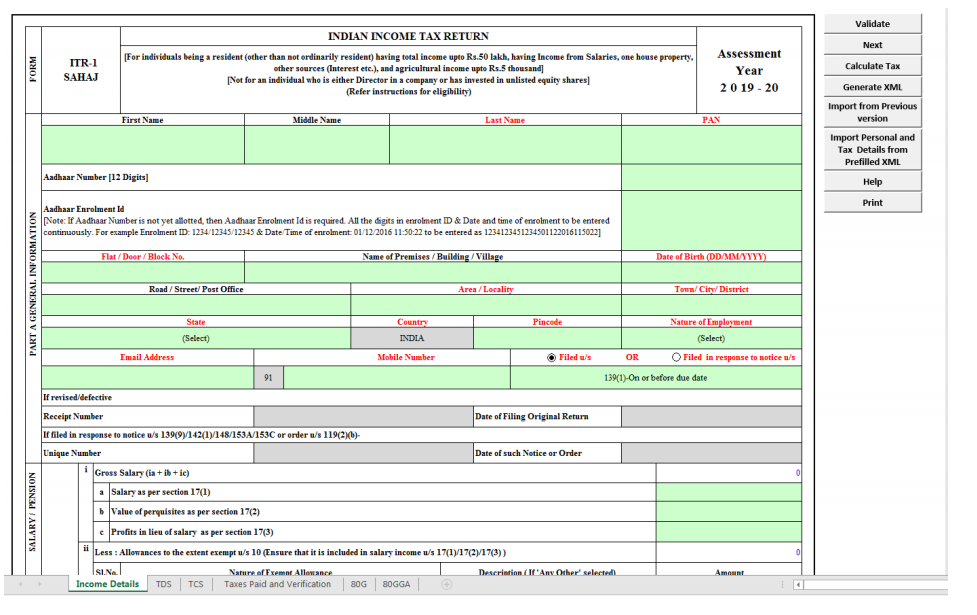

The ITR-1 can be filed by resident individuals having a total income of up to ₹50 lakh, from salaries, one house property, other sources (interest), and agricultural income up to ₹5,000; excluding those who are directors or have invested in unlisted companies.

Also read: Govt to suo motu allot PAN to those furnishing Aadhaar for I-T returns

Further, ITR-2 is meant for individuals and ‘Hindu Undivided Families (HUFs)’ not having income from profits and gains of business or profession, and ITR-3 is for individuals and HUFs having income from profits and gains of business or profession.

Sugam or ITR-4 is filed by individuals, HUFs and firms with a total income of up to ₹50 lakh under the presumptive income scheme from business and profession, provided the assessee is neither a director nor have invested in any unlisted company.

Around 1.46 crore income tax returns is said to have been filed so far. Earlier, income tax officials told PTI that the higher return filing is because of convenience due to pre-filled return forms which have been made available from this year.

Here’s how you can use pre-filled ITR forms to file returns faster:

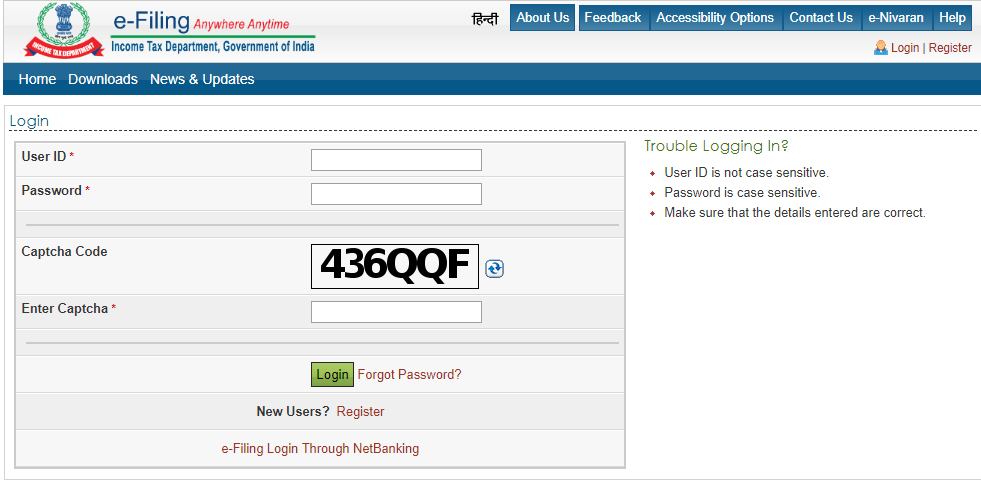

Step 1: Go to income tax e-filing portal (www.incometaxindiaefiling.gov.in).

Step 2: Log into your account.

Also read: File tax returns if you have foreign trips, steep electricity bills

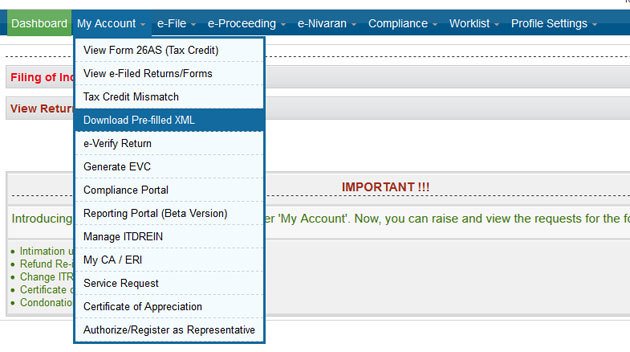

Step 3: Click on ‘My Account’ tab and select ‘Download Pre-fill XML’ option.

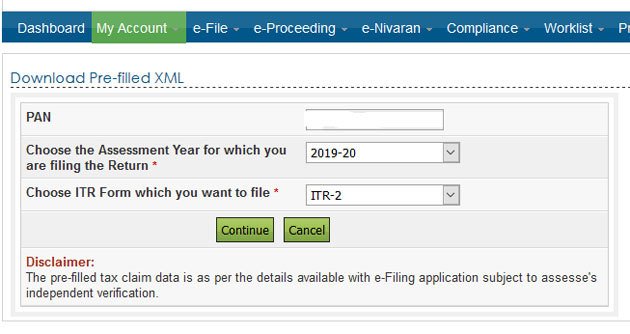

Step 4: In the ‘Download Pre-filled XML’ page, the PAN will be auto populated, choose the

assessment year (2019-20) for which you are filing the return and the ITR Form which you want to file from the dropdown. Click ‘Continue’ button.

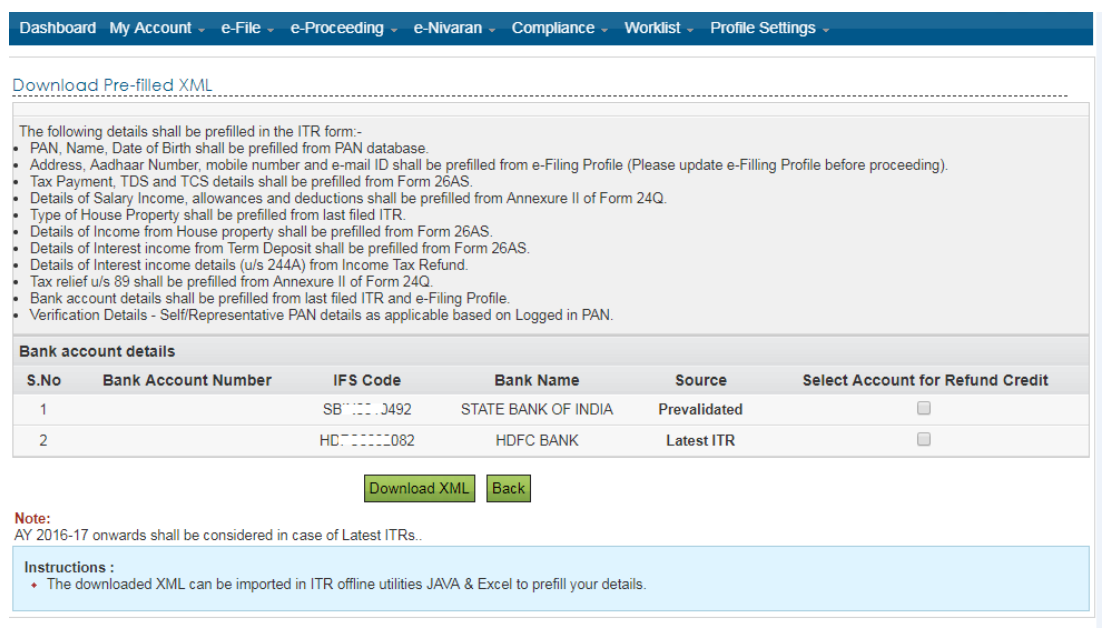

Step 5: Select the bank account/s that you want to be pre-filled in the ITR form and a pre-validated bank account in which you wish to receive the tax-refund, if any. Earlier, the tax department stated that it will issue e-refunds to bank accounts that are linked to PAN are pre-validated on the e-filing website. You can pre-validate your bank account by selecting the ‘Pre-validate Your Bank Account’ option under ‘Profile Settings’.

Also read: PAN, Aadhaar interchangeable for filing of IT returns: FM

Step 6: Click on ‘Download XML’.

Step 7: Right click on the downloaded zip file and click on ‘Extract All’.

Step 8: Open the ITR excel utility and click ‘Import Personal and Tax Details from Prefilled XML’ button from the right side panel.

Step 9: Browse and select the downloaded pre-fill XML file and click on ‘Open’ button. All the personal and tax details available with e-filing portal will be prefilled into the ITR excel utility. It’s better to cross-check the income details once it is imported into the ITR form.