With tech taking over, bank clerks set to disappear from workforce

Reserve Bank of India’s latest segregated bank employment data showed that the share of clerical jobs in India’s banking system had dropped from over 50 per cent in the early 1990s to 22 per cent in 2020-21

Experts have been predicting that digital technology and artificial intelligence will lead to the disappearance of certain jobs in the banking sector. This is now happening in India.

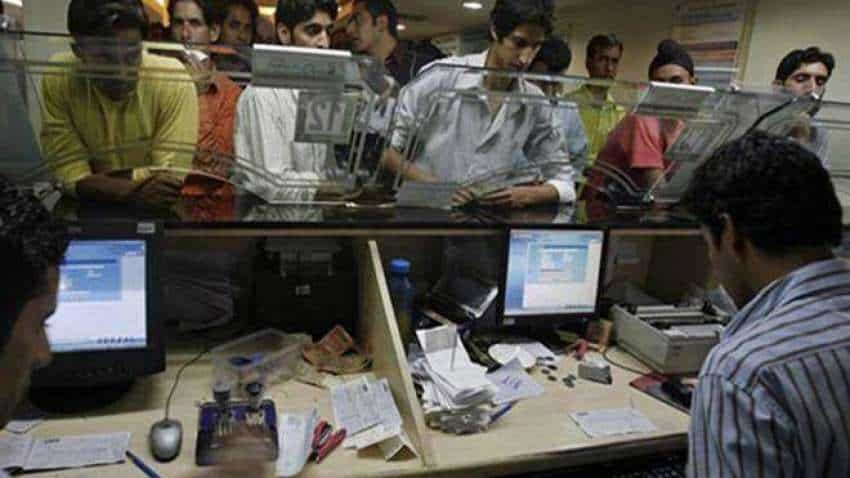

As technology is able to solve simple tasks like moving files and as customers, especially in urban areas, turn to online transactions rather than visit banks, the ubiquitous ‘clerk’ in banks seems to be getting redundant.

According to a news report in Mint, banks are gradually cutting down on recruiting clerks. The report quoted the Reserve Bank of India’s latest segregated bank employment data, which showed that the share of clerical jobs in India’s banking system had dropped over the past years from over 50 per cent in the early 90s to 22 per cent as of FY21.

Also read: Tamilnad Mercantile Bank shares debut nearly 3 pc lower on NSE

Clerks, who interface with the bank customers, also do the work of tellers, cashiers and act as assistants to managers. Since traditional jobs such as passbook updating, cash deposit, verification of know-your-customer details, salary uploads are increasingly going digital, this is leading to job redundancies.

Robot-staff

The likes of Axis Bank, ICICI Bank and HDFC Bank are pushing the boundaries of technology by implementing robotics to centralise operations and for quicker turnarounds in things like loan processing and selling financial products to customers. This is reducing the need for a manual worker.

The advent of third party vendors has also made it easier to manage mundane tasks.

According to an expert, technology and automation have played a major role in changing the workforce distribution at banks and even at public sector banks. Less paperwork and lesser people manning bank branches as customers are busy doing transactions online, has drastically reduced the role of the clerk. And, so clerical roles are not as central to bank operations as earlier.

Khandelwal panel report

The report in Mint also flagged the suggestions made by a committee, headed by Anil K. Khandelwal, the former Bank of Baroda chairman and managing director in 2010. The committee was studying human resources issues at state-owned banks.

Also read: Ujjivan Small Finance Bank launches QIP at floor price of Rs 21.93

The report had urged banks to look into the continued requirement of clerical jobs in a post-CBS (core banking solution) environment. And that they must “seriously deliberate” on the future requirement of clerical staff.

Clerks should not be recruited any longer on the basis of replacing retired staff, or due to branch expansion and a spike in business. This creates a long-term financial burden and will affect productivity, pointed out the the Khandelwal report. Recruitment experts have also said that the changes in the focus areas for banks have impacted these jobs.

Bank unions, however, are against this move of pushing clerks into oblivion and want to make such roles more relevant. They are mulling the possibility of demanding for upgrading the power of the frontline clerical staff. This demand will ostensibly be put forward at the bipartite settlement between the union and the Indian Banks’ Association (IBA).

According to the spokesperson of the bank employees association clerks are actually less expensive and are a useful resource. They will work better to maintain a better cost-to-income ratio as clerks can be recruited at a starting salary of ₹30,000, while officers will have to be paid a salary of ₹70,000.

Vanishing positions

According to a Wells Fargo report late last year, about 100,000 positions could vanish over the next five years, as large US banks invest more in digital banking and other technologies. Roles slated to disappear include branch managers, call centre employees and tellers. It will be AI, cloud computing and robots that will play a larger role in daily banking functions like taking payments, approving loans and detecting fraud.