PNB reports fraud of ₹2,060 crore in NPA account of IL&FS TN Power Co

Provisions of ₹824 crore have already been made under prudential norms, Punjab National Bank says in regulatory filing

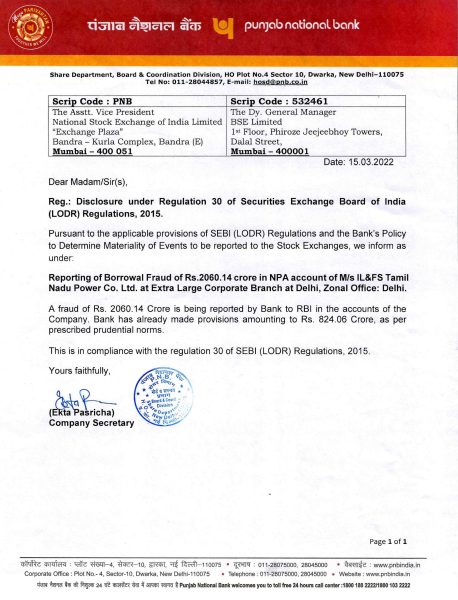

Public sector bank Punjab National Bank (PNB) has reported a fraud of ₹2,060 crore in the NPA (non-performing asset) account of IL&FS Tamil Nadu Power Company Limited (ITPCL).

In a disclosure to the Bombay Stock Exchange (BSE) on Tuesday, the publicly listed bank said it has already made provisions amounting to ₹824.1 crore as per the prescribed prudential norms.

In February, Punjab & Sind Bank had declared ITPCL as a fraud account with outstanding dues of ₹148 crore.

“It is informed that an NPA account, viz IL&FS Tamil Nadu Power Company Ltd with outstanding dues of ₹148.86 crore, has been declared as fraud and reported to RBI today, as per regulatory requirement,” Punjab & Sind Bank had said in a regulatory filing.

Restructuring plan

ITPCL was set up as a special purpose vehicle (SPV) by the debt-laden Infrastructure Leasing & Financial Services Ltd (IL&FS), under its energy platform IEDCL, for the implementation of thermal power projects at Cuddalore in Tamil Nadu. The entity owed over ₹6,700 crore to its lenders and around ₹900 crore to IL&FS Group entities as of April 2020, according to an affidavit submitted by IL&FS before the National Company Law Appellate Tribunal (NCLAT).

IL&FS had earlier initiated the restructuring of ITPCL, which also included selling its stake to the Tamil Nadu government and other stakeholders, but it was unsuccessful.