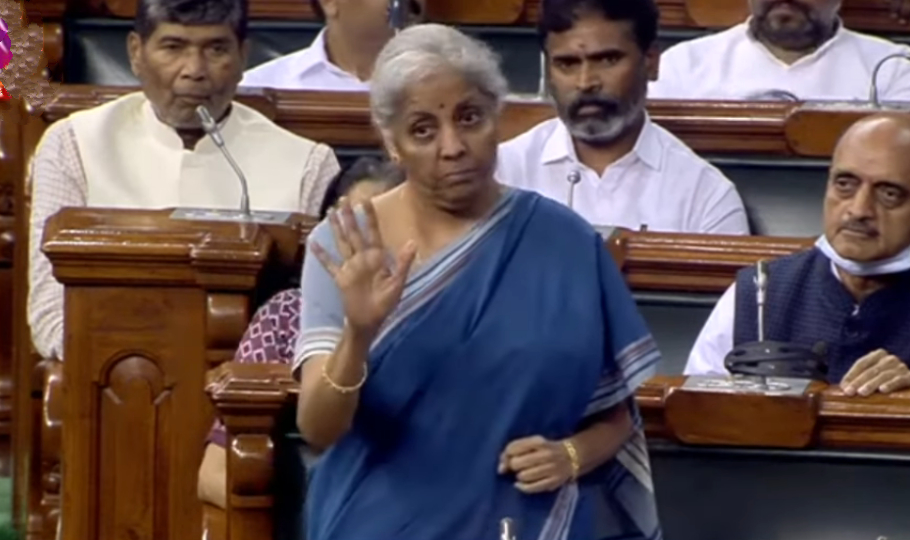

No new GST on items consumed by poor, says Finance Minister

Finance Minister Nirmala Sitharaman on Tuesday said GST Council had not imposed any new levy on essential items consumed by the poor, though such products were taxed in one form or the other by almost all states in the pre-GST era.

The minister, replying to a short-duration discussion on price rise in the Rajya Sabha, also said GST had not increased the burden on families.

She also said the government contained prices of tomato, onion, and potato, while comparing rates with those prevailing in November 2013. Almost every state, including West Bengal, Jharkhand, Maharashtra and Kerala, imposed levies on items like pulses, flour, curd, paneer, and buttermilk before the GST regime kicked in on July 1, 2017.

The GST Council has not imposed any new tax on essential items, the minister said while replying to a short-duration debate on price rise in the Rajya Sabha.

Also Read: July GST revenue up 28% at Rs 1.49 lakh-crore; second highest ever

“…every state had one or the other tax on all these items,” she said and cited taxes on items like pulses, flour, buttermilk, and paneer.

The ongoing monsoon session of Parliament has witnessed several disruptions by the opposition after GST was imposed on several pre-packed and labelled essential items.

The minister said all states at the last GST Council meeting held at Chandigarh had agreed to the proposal to levy 5 per cent GST on pre-packed, labelled food items.

Not one person (state minister) spoke against the GST during the meeting, she added.

Sitharaman stressed that taxes had not been levied on food items consumed by the poor, as the GST has not been imposed on items that are sold loose.

While the minister was referring to a tax on a food item in West Bengal in the pre-GST era, TMC party leader Derek OBrien tried to raise a point of order and later his party staged a walkout. Sitharaman also clarified there is no GST on crematoriums, but the tax is only on the construction of a new crematorium.

Also, there is no GST on hospital beds or ICUs, but only on rent of Rs 5,000 per day in a hospital.

(With Agency inputs)