States fume as no decision yet on extending GST compensation

Even as Centre drags its feet on the issue, states have demanded that either the revenue sharing formula under GST regime should be changed or compensation period should be extended by five years

The GST Council on Wednesday (June 29) failed to arrive at a decision on the all-important issue of extending the compensation paid to states for revenue lost from the implementation of GST, beyond this month. The states want an extension for another five years or a change in the formula of equally splitting revenues from the GST between the Centre and states.

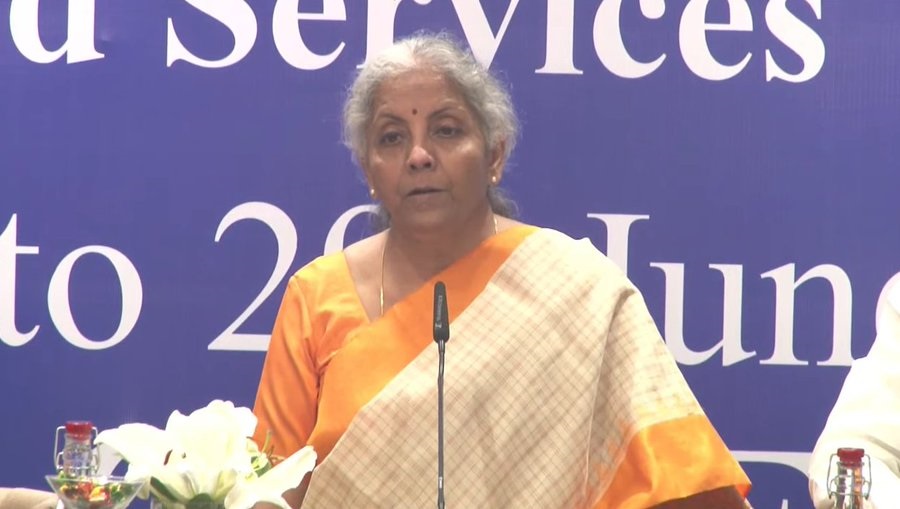

The Council – the highest decision-making body of the indirect tax regime, which is headed by Union finance minister Nirmala Sitharaman and comprises representatives of all states and UTs – discussed the issue at a two-day meeting underway at Chandigarh from June 28 but failed to take a decision.

A final decision is likely to be taken at the next meeting of the council in August.

After the Goods and Services Tax (GST) was introduced on July 1, 2017 and subsumed 17 central and state levies, states were assured of compensation for the revenue loss for five years – until June 2022. With two years being lost in the pandemic, states have sought an extension of this compensation mechanism.

States demand an extension

Puducherry Finance Minister K Lakshminarayanan said all states sought an extension of the compensation mechanism, but no decision has been taken.

States ruled by Opposition parties, however, have demanded that either the revenue sharing formula under the GST regime should be changed or the compensation period should be extended by five years, amid concerns over revenue losses.

Also read: GST rates revised: Know every day items that will cost more

Chhattisgarh Minister of Commercial Taxes, TS Singh Deo, in a letter addressed to the FM Sitharaman said the present formula for equally splitting revenues from the GST between the Centre and states should be changed, with a larger share of 70-80 per cent being given to states.

Kerala Finance Minister KN Balagopal too said the GST compensation mechanism for states should be extended to make good the revenue loss. “Almost all states are asking for an extension of the compensation period,” Balagopal said.

In his letter to Sitharaman, who is chairing the GST Council meeting, Deo said his state has suffered a huge revenue loss under the GST regime, mainly because mining and manufacturing states have suffered the most under GST, which is a consumption-based tax.

Chhattisgarh has suffered a revenue loss of ₹4,127 crore in the last fiscal, ₹3,620 crore in 2020-21, ₹3,176 crore in 2019-20 and ₹2,786 crore in 2018-19. The most pertinent issue being brought to her notice is the ending of the provision of 14 per cent protected revenue due on June 30.

“Requested an extension of five years on this to protect the states from severe revenue loss and let them function as an effective federal unit of India,” Deo tweeted.

“We are presenting the proposal in the GST Council to continue with the 14 per cent protected revenue provision. If the protective revenue provision is not continued then the 50 per cent formula for CGST and SGST should be changed to SGST 80-70 per cent and CGST 20-30 per cent,” said Deo, who is unable to attend the meeting due to COVID-19 infection.

Also read: GST Council clears proposal to remove tax exemptions on select goods

Otherwise, the present compensation mechanism, he said, should continue for another five years.

Currently, revenue collected from the GST is shared equally between the Centre and states. The collection from cess levied on luxury, demerit and sin goods is used entirely to compensate the states for revenue loss due to GST implementation.

Though states protected revenue has been growing at 14 per cent compounded growth, the cess collection did not increase at the same proportion, and COVID-19 further increased the gap between protected revenue and the actual revenue receipt, including a reduction in cess collection.

In order to meet the resource gap of the states due to the short release of compensation, the Centre borrowed ₹1.1 lakh crore in 2020-21 and ₹1.59 lakh crore in 2021-22 as back-to-back loans to meet a part of the shortfall in cess collection.

As per data on revenue growth collated for the Council meeting, only five out of 31 states/UTs Arunachal Pradesh, Manipur, Mizoram, Nagaland, and Sikkim registered a revenue growth higher than the protected revenue rate for states under the GST in the financial year 2021-22.

Puducherry, Punjab, Uttarakhand and Himachal Pradesh have recorded the highest revenue gap between the protected revenue and post-settlement gross state GST revenue in 2021-22.

Also read: GST Council meet: States’ compensation, slab and rate tweaks on cards

States cite Supreme Court ruling – decisions to be taken in consensus

The states have also cited a recent Supreme Court ruling that decisions made by the Council are not binding on states and they need not stick to them.

The ruling by the court has been seen by some as states having powers to determine taxation.

Recalling the recent Supreme Court judgement regarding the power of the GST Council, Deo said: Unless we in the GST Council, as its members unilaterally ensure the financial stability through rational revenue realisation for each and every state and Union Territory in India then the very concept for which the GST Council was put in place may appear to be untenable.

Separately, Amit Mitra, principal chief advisor to West Bengal Chief Minister Mamata Banerjee, said in light of the recent Supreme Court judgement all decisions of the Council should be taken by consensus.

“Post decision of the honourable apex court, it has become imperative for the GST council to take every decision by consensus and to leave aside any shade of majoritarianism not only for the future credibility of the GST Council but also the uphold the rich tradition of this august body,” wrote Mitra, former WB finance minister.

The Supreme Court, in the Mohit Minerals Ocean Freight case, had ruled that the recommendations of the GST Council are not binding and only have persuasive value. It held that parliament and state legislatures can equally legislate on GST.

Deferred decision on levying tax on casinos, online gaming, horse racing

Meanwhile, a group of ministers (GoM) has been asked to further deliberate on the tax rate and the method of valuation of taxing online gaming, casinos and horse racing.

According to FM Sitharaman, the GST Council postponed a decision on levying a 28 per cent tax on casinos, online gaming, horse racing and lottery pending more consultations with stakeholders.

She told reporters that a group of ministers headed by Meghalaya CM Conrad Sangma has been asked to consider submissions of stakeholders again on the valuation mechanism and submit its report by July 15.

The council will meet again in the first week of August to decide on the issue, she said.

A two-day meeting of the panel considered a report of the GoM but did not take a decision since Goa and some others wanted to make more submissions.

The GoM had recommended that online gaming should be taxed at the full value of the consideration, including the contest entry fee paid by the player on participating in the game.

In the case of race courses, it had suggested that GST be levied on the full value of bets pooled in the totalisators and placed with the bookmakers. It also recommended that no distinction should be made on grounds of game of skill or game of chance for the purpose of the levy of GST and should be taxed at the highest rate of 28 per cent.