Jet likely to get fresh funds to stay afloat

The cash-strapped Jet Airways seemed to be in deep trouble with over a 1000 pilots and engineers deciding to go on a strike from midnight Sunday (April 14). But the sky turned clear as the pilots deferred their strike plan late in the night. Also, there were reports of a quick and emergency financial infusion by the consortium of banks led by the SBI. This is likely to happen on Monday. However, there is a lack of consensus among the banks and the Jet management needs to submit a utilisation plan for the money till May 7.

In this context, The Federal re-publishes a detailed scenario analysis for the benefit of our discerning readers:

Perhaps for the first time in the Indian domestic airline industry, an owner of an airline has been forced to step down and that is good news for the sector.

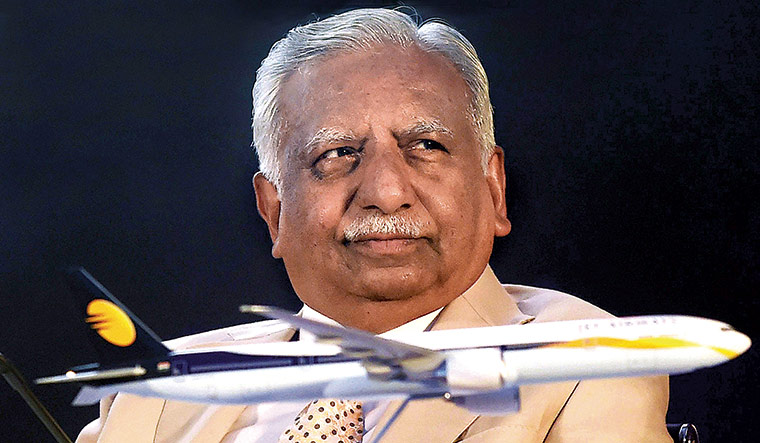

Naresh Goyal on March 25 afternoon quit as chairman along with his wife, Anita, a pre-condition set by the lenders for pumping in additional funds. With joint venture partner Etihad’ stake decreasing to 12% from 24% and that of Goyal and family at 25% from the previous 51%, the stage is set for a new investor to step in.

Bank intervention

The lenders should be applauded for their intervention at the right time and learning lessons from Kingfisher Airlines’ fiasco. If they had allowed the airline to run its course, it might have just folded up rendering over 16,000 direct employees jobless, a few thousand others connected with the airline ending up on the streets and hundreds of vendors left with unpaid bills. …and the lenders failing yet again to recover the monies they invested in the airline.

The lead lender, State Bank of India chairman Rajneesh Kumar has said that a new investor will be on board before May 31 which means his bank has already initiated talks with a few and perhaps this is the right time for Tata Sons, which earlier had held talks with Goyal to buy a stake in the airline, to renew talks. It will be much easier to do so as the Tatas can hope to buy a higher stake in the airline to control its management. However, it will not be that easy either. Talks can go either way and lenders will need to show commitment to getting the right investor to onboard the airline without which Jet might be forced to close down as there are not many around who would willingly take the risk of running an operation in the turbulent world of aviation.

The unfolding of the crisis at Jet Airways holds a mirror to the state of affairs of most of the corporates in the country.

Distressed assets

Be it an Essar Steel or a Bhushan or even Anil Ambani’s Reliance Communications — the number of companies reporting sick at the National Company Law Tribunal is growing every month. What is distressing to note is that among the several ones who are waiting for a suitable suitor to rescue them, quite a few are $1 billion companies or even more.

The argument that the private sector brings efficiency while the public sector brings scale to the industry is turning out to be a myth. The problems at Jet Airways shows that it tried to marry the two — efficiency and size — to disastrous results.

Not that it was an impossible dream to chase. Some of the largest airlines in the world are only growing bigger adding hundreds of aircraft to their fleet and increasing their domestic and international network rapidly.

Jet, which has been around for the last 26 years, never managed to replicate the model of its international peers in spite of a joint venture with Etihad Airways, an international airline based out of Abu Dhabi. What is more significant to note is that while during the 2000s, the airline grew fast, others like Kingfisher Airlines, NEPC, Sahara and East West Airlines kept going down precisely for the reasons which Jet finds itself in today.

Smarter management would have taken measures to ring-fence itself from such eventualities. However, what one now finds is that the airline managed to stay afloat only because those which closed down made more and more significant mistakes than Jet Airways.

Dropping numbers

One can argue that the current crisis has to more to do with the domestic airline industry itself which is facing its worst nightmare with over a million seats disappearing in March alone. However, the fact is that the crisis has only accentuated the problems at Jet.

As per regulator, DGCA’s website Jet’s market share has seen a decline year after year. Five years ago, Jet Airways’ market share (not including its low-cost subsidiary, JetLite’s share) was 18.7% (December 2014) and since then it has been slowly eroding: to 18.2% in 2015 to 15.3% in 2016 to 14.6% in 2017 to 12.7% in 2018 to a mere 10% in February this year. The market share is set to go down further as the airline has grounded as much as 84 aircraft out of the 116 it has in its fleet at present.

What could have gone wrong with an airline which was once known for getting the bureaucracy as well as the cabinet ministers rooting for it from the sidelines?

One apparent reason is the rapid rise of low-cost airlines. Low-cost IndiGo’s market share at the end of 2018 was a robust 43.2% while that of JetLite, the low-cost airline of Jet, was a disappointing 1.7%. Five years ago, IndiGo’s share stood at 36% and that of Jet Lite at 4.6%.

JetLite, formerly Sahara Airlines, never lived up to the expectations of its parent even though it was meant to be a flanking brand to keep the likes of IndiGo away from eating into the market share of Jet. Instead, the reverse happened. However, the problem with managing low-cost airlines is not that of Jet alone. Lufthansa’s Eurowings has been struggling since its launch and so has Nok Air of Thai Airways though Qantas’ Jetstar Airways is more of an exception.

Qantas managed to turn JetStar profitable because it kept the low-cost airline completely independent of itself. It does not share any services or aircraft with Jetstar, unlike the others. Jet Airways didn’t have to look far to fix the issues with Jet Lite. The failure of Kingfisher Airlines has more to do with acquiring low-cost Air Deccan and being unable to manage the two brands efficiently. Today, Qantas is more of an upmarket brand with its own set of loyal passengers. Could Jet Airlines do the same? It didn’t. Jet Lite has a total of seven aircraft compared with 116 of its parent which goes to show that Jet Airlines could never manage to redefine its service once the low-cost airlines took over the Indian skies.

International choices

Another problem which spelt trouble was the poor network and aircraft acquisition planning. Whether it should deploy Boeing Dreamliners or the Airbus A330s and Boeing 777-300ERs (extra range) for international routes was always an issue for Jet Airlines. Dreamlines would have been a better fit for starters as they can fly long distance in routes which have low demand. A 330s and B777s would have needed a more extensive network and volumes which Jet couldn’t manage. To offset the losses, these were leased out to foreign airlines which clearly shows that there was little clarity of thought while buying them. Instead of flying to US cities, Jet could have focused more on neighbouring countries just as Air India Express has managed to do successfully. However, by onboarding Etihad, it shot itself in the foot as increasing network in routes where Etihad ran its operations quite well was always going to be a contentious issue between the two airlines.

Third and perhaps the most important one was its association with Etihad. The 24 per cent partnership which Etihad has with Jet was never going to be easy as the Abu Dhabi airline was quite clear that it wanted the Indian partner to act more like an extended arm on which it could fly its international routes. One doesn’t know what the contours of the agreement of the two were when the deal was signed, but the fact that Jet managed to snatch Etihad just when it was about to enter into a relationship with Kingfisher Airlines shows that rules of the game were drawn much after the Abu Dhabi came on board.

It must be hurting Goyal, whose head Etihad wants, if it is to continue its partnership with the airline. However, Etihad knows better than anyone else that alliances are formed from the relationship with the promoters. With the exit of the promoters, it will have to deal with hard-nosed bankers (in this case State Bank of India) whose only aim is to make a quick exit after turning around the airline. Perhaps that is one of the reasons, Etihad wants to check out and offload its stake to SBI.

Which begs the question of how will the lenders run an airline offloading both the promoter as well as the partner of Jet Airways. It is a conundrum which the SBI top executives must be trying to wrap their heads around to find a solution to a problem they never created in the first place. If they do find one, it will become a template for every other airline in the industry.