COVID forces fall in oil demand as lockdown restricts movement

Strict lockdown is hampering the people’s movement, resulting in lowering fuel sales and curbing crude processing by refineries to manage its rising stockpiles. The consequence is India’s oil demand has slackened further in the first half of May.

Around 300,000 daily COVID infections are reported since April 22, straining the health system and overwhelming crematoriums and hospitals, and forcing most of Indian states to stay in lockdown.

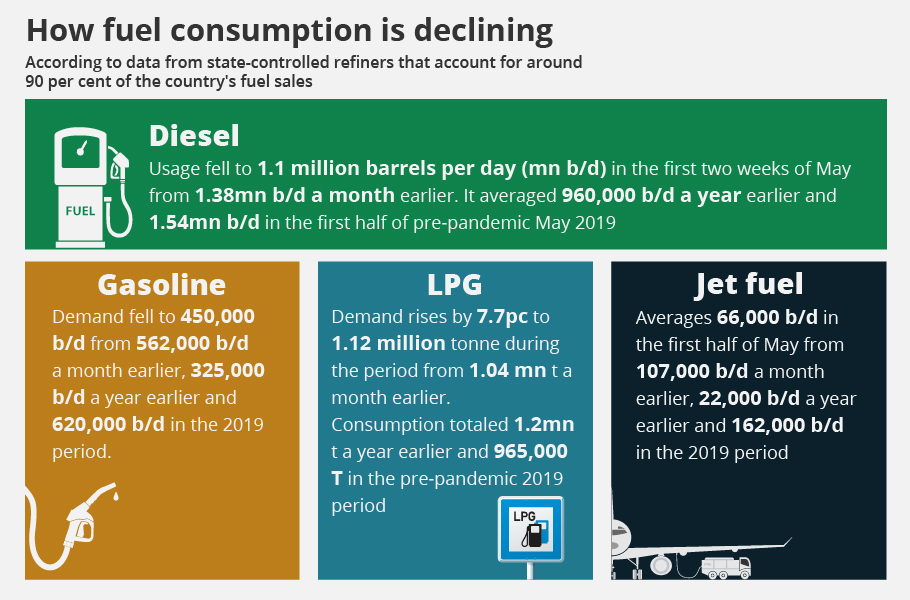

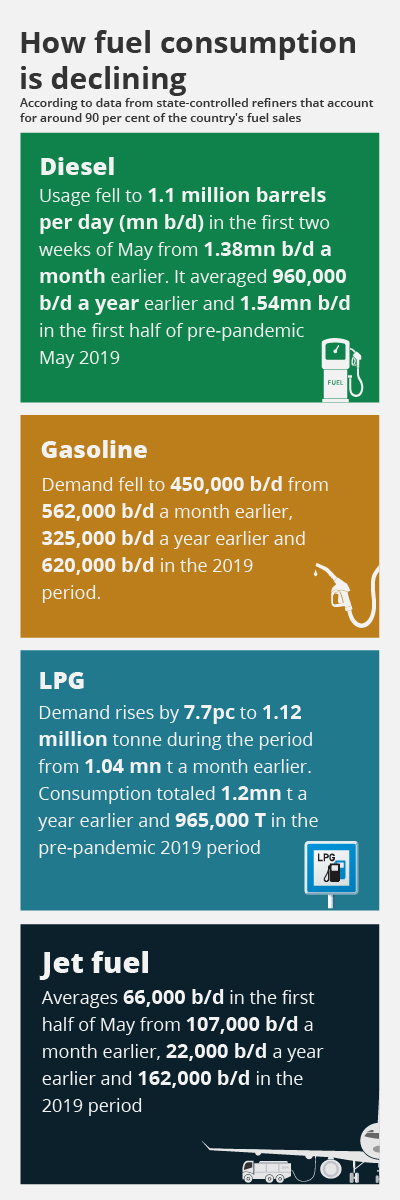

Media reports quoting sources said that preliminary data from the country’s three biggest retailers suggested that sales of road transport fuels during May 1-15 dropped by a fifth from the previous month and about 28 per cent from the same period in 2019.

Also read: Record GST mop-up in April may be no indicator of economic health

Average daily sales of petrol fell to about 53,300 tons, the lowest in a year. Sale of diesel dropped to a seven-month low of 147,300 tons a day during May 1-15, Bloomberg reported.

A steep fall in consumption at the world’s third-biggest crude consumer is likely to affect sentiment on oil prices and lower expectations of a rebound for a strong global demand in the summer. The International Energy Agency has lowered its 2021 global oil demand forecast from the impact of the raging virus outbreak in India, while OPEC and its allies are already taking a cautious view.

Also read: WPI inflation hits double digit as crude oil prices soar

Indian refiners have enough storage capacity to absorb the lower demand. But driving activity, a key indicator of fuel demand use, slumped in April, mobility data from US technology firm Apple showed. Driving activity across India was 29 per cent above a 13 January 2020 baseline on April 1, but 36 per cent below the same baseline as of April 24, the data showed.

The low demand is expected to continue in June with refineries trimming runs to 80 per cent or perhaps lower from around 95 per cent in April, market participants said, with overflowing storage and postponement of maintenance shutdowns forcing run costs.