Budget 2020: Know the new tax regime unveiled by FM Sitharaman

In the Union Budget, personal income tax is probably the largest aspect that garners public attention as it bears a direct impact on the household income of the citizens. In the budget 2020, Finance Minister Nirmala Sitharaman announced major tax reforms and brought in a five-slab tax.

A tax payer will get the benefit of the new proposals only if he forgoes all deductions and exemptions on home loans, insurance premiums, school fees, post office savings and the like, reports said.

Also read | Quantum computing to gene mapping: New tech to the fore in budget

The Finance Minister said the old and new regimes would run parallel and it was for the individuals to see what fits them best. “The shift to the new tax regime is optional,” she said.

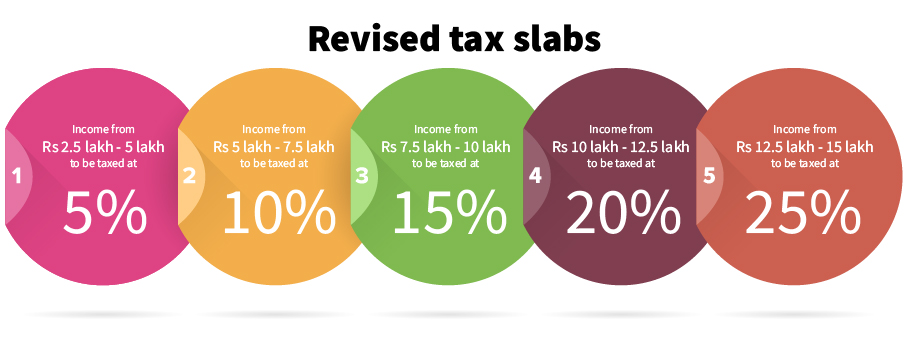

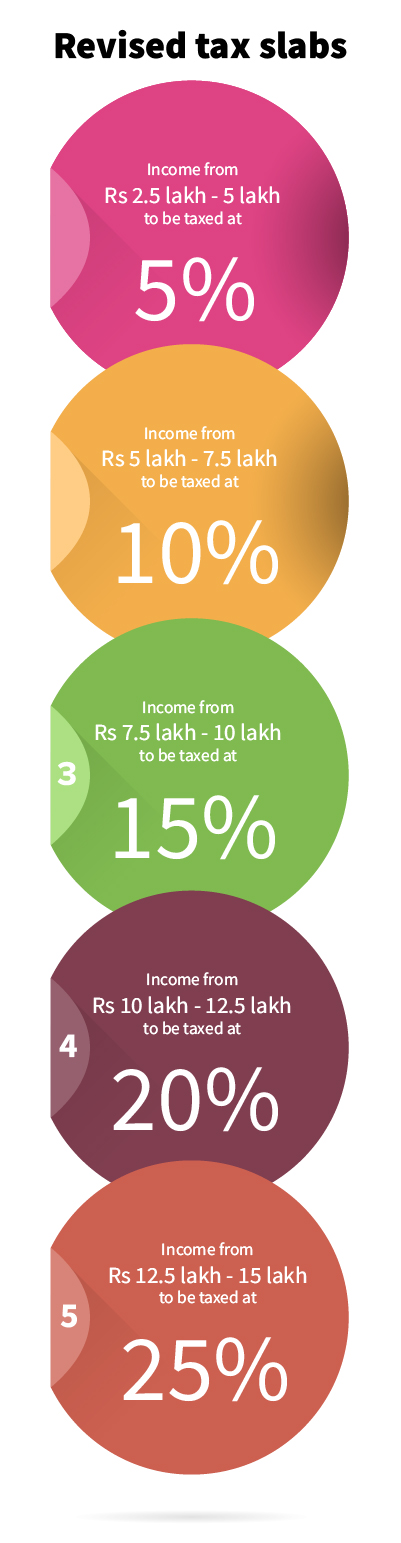

The new slabs

The new slabs, to be effective from Aril 1, are as follows: ₹5-7.5 lakh: 10%, ₹7.5 lakh to ₹10 lakh: 15%, ₹10 lakh-12.5 lakh: 20%, ₹12.5 lakh-15 lakh: 25%. For those earning above ₹15 lakh, 30%.

In the present regime, incomes between ₹5 lakh and 10 lakh are taxed at 20% but the taxpayer can avail of deductions and exemptions. There will be no changes in tax for annual incomes above ₹15 lakh. The Finance Minister was silent on the surcharge on annual incomes above ₹50 lakh.

Also read | India to tax global income of drifter citizens, changes non-residents’ norms

Experts say the new tax regime will create a bit of confusion in the system, both at the individual and individual levels. Now, the government tax establishment will have to deal with a multitude of requests — to switch to the new regime. Also, the Finance Minister said the systems would be made simpler so that individuals may not need the help of professionals to fill in the tax forms and file returns.

The tax relief would boost middle-class consumption, thereby activating the sagging economy.

Break-up

Out of the total taxpayer base of 5.87 crore in the country, 48% fall in the ₹2.5 lakh – ₹.5 lakh slab. The exchequer anticipates a revenue fall of ₹40,000 crore (approx.) on account of this slab revision.

The FM said the benefits would accrue to a taxpayer dependent on the exemptions and deductions claimed. “For example, a person earning ₹15 lakh a year and not availing any deductions will pay only ₹1.95 lakh as compared to ₹2.73 lakh in the old regime. Thus, the tax burden shall be reduced by ₹78,000 in the new regime,” the minister said.

The taxpayer would stand to gain more if he opted to get the deduction of ₹1.5 lakh under various sections of Chapter VI-A of the Income Tax Act under the old regime.

Also read | Nothing in Union Budget 2020 assures revival of growth: Chidambaram

The FM said, “an individual who currently got more deductions and exemptions under the Income Tax Act may choose to avail them and continue to pay tax in the old regime,” she said.

Making it amply clear that the change to the new regime was optional, she said the onus was on the individual to see which regime suited him best.

The FM was quick to state that the deductions and exemptions would be further rationalized to optimize the tax regimen.

Over a hundred deductions and exemptions were in place at present and the FM said she had taken into account most of it incorporated in the law over the years. “I have removed around 70 of them in the new simplified regime. We will review and rationalise the remaining exemptions and deductions in the coming years with a view to further simplifying the tax system and lowering the tax rate,” she said.

Also read | Govt intends to remove all income tax exemptions in long run: FinMin