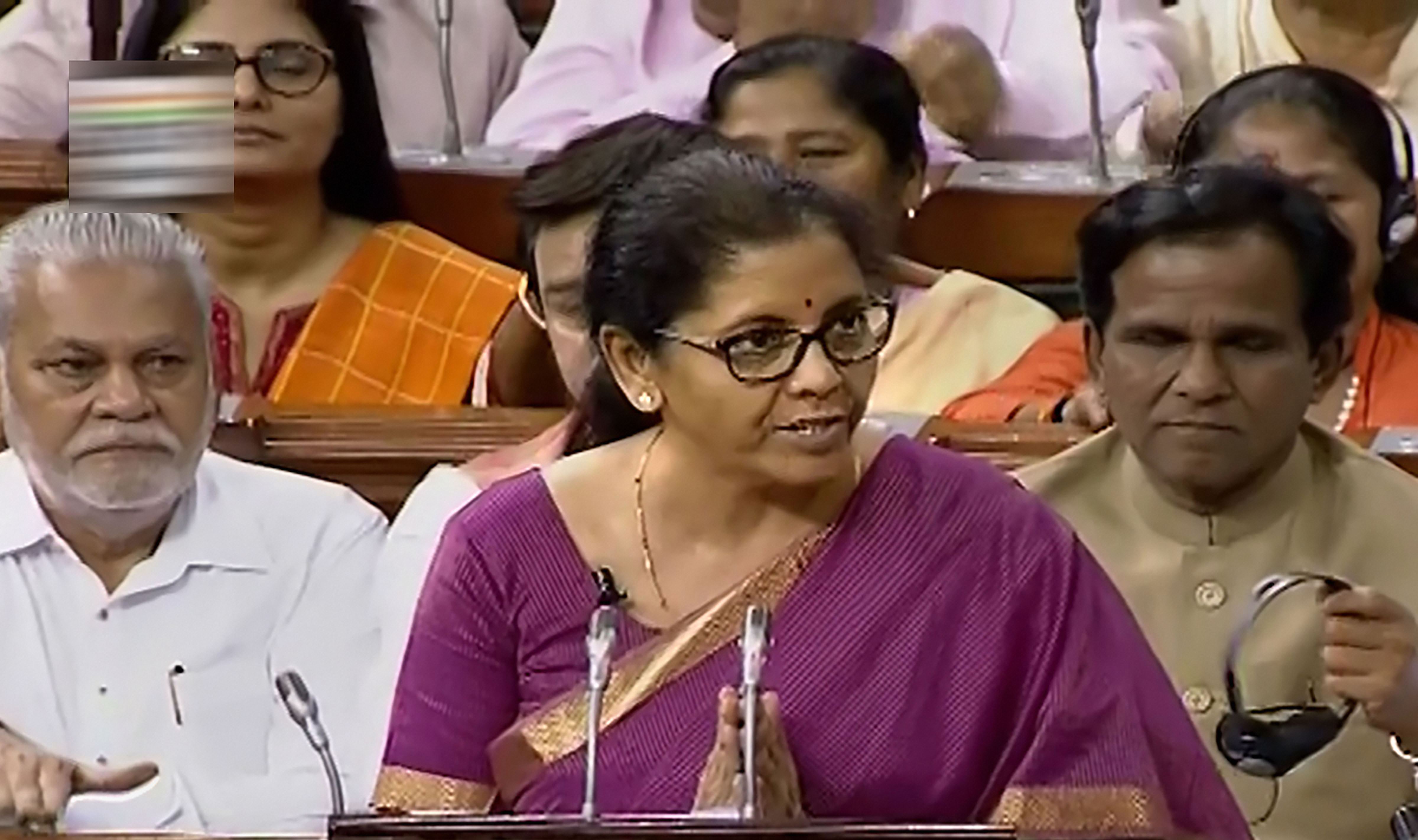

Union Budget: Nirmala flirts with inflation to deliver growth

The first Union Budget of Modi 2.0 on Friday (July 5) opted to embrace inflation in an attempt to deliver much needed growth to the stagnant Indian economy.

Coming at the back of a historical verdict, the Bharatiya Janata Party-led National Democratic Alliance government stood firm in its bid to give stimulus to growth and catalyse employment, it decided to increase cess on diesel and petrol by ₹2. The move is likely to trigger a ripple effect, which could hurt the middle class the most.

Sitharaman, in her 127 minutes speech – studded with quotes in Urdu, Hindi and Tamil – however, spared the middle class from new taxes and announced an additional income tax deduction of ₹1.5 lakh to the existing ₹2 lakh on interest paid on home loans. As a result, she said the buyer will benefit up to ₹7 lakh over the period of the loan. This benefit will be available for “affordable” homes till March 2020. In other words, it will be applicable for a home loan value up to ₹45 lakh. This is a limited benefit for a section of people while the cess on petrol and diesel is for all. In other words, the overall increase in inflation may dent whatever benefit accrues to the buyer of an affordable home.

The finance minister looked to balance the nominal dole for the middle class by increasing surcharge on income tax on the super-rich earning over ₹2 crore. The surcharge on income tax for those earning between ₹2 crore and ₹5 crore has been raised to 3 per cent and that for those earning more than ₹5 crore has been raised to 7 per cent.

But in another blow for the middle class, the Modi-led government proposed to increase import duty on gold and precious metal to 12.5 per cent. The move will make the yellow metal and jewellery more expensive in the domestic market. “It is proposed to increase customs duty on gold and other precious metals from 10 per cent to 12.5 per cent,” Nirmala Sitharaman said. The decision comes at a time when the domestic jewellery industry has been demanding a cut in import duty. The commerce ministry, too, had in the past recommended reduction in the duty. The country’s gold imports dipped about three per cent in value terms to $32.8 billion during 2018-19.

Dip in the imports of gold is expected to keep a lid on the current account deficit. Total imports of the precious metal in 2017-18 had stood at $33.7 billion as against $27.5 billion in 2016-17 and $31.8 billion in 2015-16.